Span-America Holding (SPAN) has been part of the ValueUncovered portfolio for over a year, my longest holding.

Despite lots of volatility throughout the year (touching almost $20/shr), the stock’s is only slightly up, primarily helped by consistent dividend payouts (including a large special dividend earlier this year).

I am catching up on past SEC filings, and SPAN’s 2010 report came out a few weeks ago.

Financial Review

Total revenues in 2010 declined 6% to $52.4m compared to the prior fiscal year, with declines reported in both operating segments.

SPAN’s therapeutic support surfaces (the largest part of the medical product segment at 62% of sales), are considered a capital expenditure. Although the outlook has improved, the product line continues to face weakness in the company’s main markets.

The acute care market continues to be the bright spot, with several new product lines experiencing double digit YoY growth. Overall, medical sales were down 6% to $35.6m compared to $37.8m in 2009.

In the custom products segment, sales decreased 7% to $16.8m compared to $18.1m last year.

Last year’s numbers were helped by a one-time test program which was not repeated in 2010.

This is the 3rd year in a row of annual revenue decreases.

More worrisome, the company has slowly shifted its product mix towards consumer products and away from therapeutic support surfaces, which command much higher margins – support surfaces are down from 54% of total sales in 2007 to 43% in this latest fiscal year.

Despite the lower top-line, the company remains solidly profitable and continues to throw off generous amounts of free cash flow.

Net income was $4.5m – down slightly from the year before – but the company still managed to produce $5.3m in FCF. Using these figures and the current market cap of 41m equals a solid FCF yield of 13%.

The company paid out $3.9m in dividends, or 86% of net income, a solid way to return cash to shareholders.

The balance sheet remains strong, with a current ratio of 3.39, no debt, and cash and marketable securities of $4.4m

Industry Outlook

While the company continues to be solidly profitable, it is facing headwinds on a number of different fronts:

Increased Foreign Competition – There is no doubt that the company will face increased pressure from foreign competitors in the future, especially China.

This shift will put even greater pressure on margins, and slowly erode the high returns on capital that the company has experienced. Some product segments, such as consumer bedding, have little differentiation aside from price:

“During the last two years, we have experienced increased competition in our medical and custom products segments from low-cost foreign imports. In the medical segment, the number of low-cost, imported mattress products has increased in the last two years, but it has not yet had a significant impact on our medical business. We believe that we have potentially greater exposure to low-cost imports in our consumer bedding product lines because those products have more commodity-like characteristics than our medical products.”

Uncertainty around Medicare – As a medical company, a number of SPAN’s products are eligible for reimbursement from Medicare. There has been a ton of proposed regulation and controversy over the recent healthcare laws.

While the fallout is still undetermined, it will create additional fear and hesitation on the part of consumers when purchasing new medical products, potentially cutting into SPAN’s sales.

Continued Economic Weakness – While the stock market has enjoyed a record run, the economy and job market are definitely not back to full speed. SPAN has benefited tremendously over the past five years by an increase in its therapeutic support surfaces – in 2010, they made up 42% of total sales.

The sale of these products significantly boosted SPAN’s FCF rate, up to the current levels of $5-$6m per year. It is unclear whether the company can continue aggressive growth in this area.

Conclusion

I recently came across another post regarding the author’s equity investing philosophy. In addition to laying out a solid set of ground rules, it also included this quote from Warren Buffett’s 1977 annual letter:

“One of the lessons your management has learned – and, unfortunately, sometimes re-learned – is the importance of being in businesses where tailwinds prevail rather than headwinds.”

I think that this valuable lesson applies to SPAN.

While the balance sheet remains strong and the company continues to throw off lots of cash, the overall trend is headed in the wrong direction.

While there still appears to be a gap between the stock’s intrinsic value and the current market price, I’m afraid that the value may fall to meet the price instead of the other way around.

The stock is releasing earnings in the next few weeks. As a general rule, I try to avoid holding stocks through an earnings release unless I plan to hold for long-term.

In addition, I’ve been growingly increasingly nervous of the broader market and therefore actively trimming my positions in order to raise more cash.

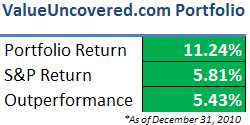

With that in mind, I’m closing out my position in SPAN at today’s closing price of $15.55, a gain of 10.06% vs 16.74% for the S&P.

Disclosure

No positions.