On the heels of the failed going private transaction in Emmis Communications, another recent special situations investment paid off in the last few weeks.

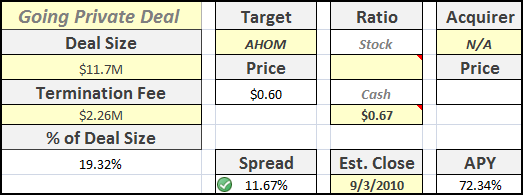

As I originally wrote back in June, American HomePatient, Inc. (AHOM) was going private in a transaction valued at $0.67.

Steps to Closure

On the surface, the transaction seemed to be complicated, as the company needed to go through multiple steps to close the transaction including reincorporation in a new state, the tender of more than 90% of votes, followed by a tender offer and debt restructuring.

On July 30, company shareholders voted to approve the reincorporation (an expected result, since Highland Capital, the acquirer, owned approx. 48% of shares outstanding).

The tender offer statement was officially filed on July 7, with an original end date of August 4.

On August 5, the company issued a revised offer statement and updated shareholder count – only 87% of shares had been validly tendered, slightly short of the required amount. The company extended the tender offer until Wednesday, August 25.

On the new closing date, the tender offer was extended again, with a key condition changed: the minimum tender condition would now be set at 80% vs the original 90% figure.

Since 87% of shares were still validly tendered, this modification allowed the transaction to proceed as planned.

On Sept 2, AHOM announced that 6,917,314 shares, or 87%, of the company’s outstanding stock were validly tendered at $0.67/shr.

I received the money in my account on Sept 3.

Return

Although the transaction took a month longer than I expected, it was a very profitable transaction on both an absolute and annualized return basis.

Conclusion

Looking back at these going private transactions, it is clear that investors must be conscious of the fact that tender offers do not always go as planned.

Although the deals were similar in many ways (i.e. each acquirer had a dominant ownership position in the company), there was one key difference:

the acquirer was not relying on outside financing for the transaction.

With no third party in the mix, Highland Capital was able to extend and modify the offer statement as required to complete the transaction without worrying about an outside investor pulling support at the last minute.

Disclosure

No current positions.