AMCON Distributing, Inc. (DIT) possess a market cap of only $40m, yet just passed the $1B mark in total revenues for fiscal 2010, a significant achievement.

After reporting full year results, the company has significantly improved its financial position and is poised for another solid year in 2011.

2010 Year in Review

DIT hit several key milestones during fiscal 2010:

- Acquired Discount Distributors, a wholesale distributor based out of Arkansas with annual sales of $59.6m. The acquisition occurred in November 2009, so most of this annual run rate is included in 2010 results.

- Opened a new retail food store in Tulsa, Oklahoma. The company is expanding cautiously, and this new store brings the total count to 14.

- Reduced total borrowings under the credit facility by more than $4m, even after the opening of a new store and a decent-sized acquisition.

- Grew net sales, operating profits, earnings per share, and dividends to the highest on company record.

Financial Information

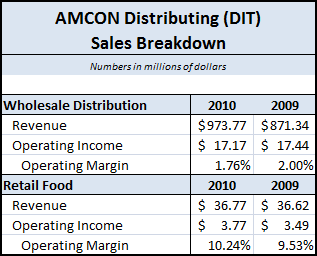

The company operates in two reporting segments, wholesale distribution and retail foods. For the year, total sales increased 11.3% to $1.01B.

Wholesale distribution saw a significant jump in revenues, largely driven by the new acquisition and higher cigarette prices that were passed along to AMCON’s customers – overall cigarette carton sales were down.

Retail foods revenues were basically flat, but gross margins increased from 41.8% in 2009 to 43.8% this year.

As a whole, the higher revenues and lower margins managed to cancel each other out, and operating income remained relatively flat at $15.4M.

However, income from continuing operations increased 5.6% to $9M, due to the lower interest expense (as the company continues to pay down its long-term debt) and tax burden.

On an unadjusted basis, diluted EPS was $11.99 compared to $16.61 last year – however, last year’s numbers were boosted significantly by the sale of AMCON’s water business, a sale classified under discontinued operations.

After normalizing for this one-time event, earnings per share actually rose 10% from the prior year.

Balance Sheet and Efficiency

AMCON continues to generate solid cash flow from operations, and has put the cash to good use – smart acquisitions, cautious store expansion, and debt repayment.

Debt to equity has fallen to 181%, down from a high of 1590% (!) back in 2007. The company’s current ratio now sits at a respectable 2.5.

CROIC is a very solid 16.9%.

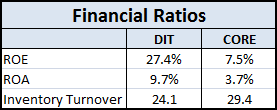

Compare these other efficiency ratios to DIT’s key competitor: Core-Mark Holding Company (CORE)

Valuation

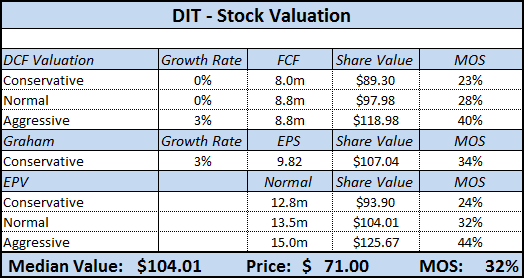

The stock has appreciated more than 20% since my original article on this turnaround story, but remains undervalued at current levels.

EV/EBITDA is 4.42 – applying a normal multiple of 6 would translate into a share price of $102.

Conclusion

Management has done a great job of turning around the company over the last several years.

AMCON runs a very lean operation, so net margins probably won’t rise much above 1% overall as long as the majority of the business is driven from the distribution side.

Management has already taken the obvious improvement steps, so growth will be largely from smart acquisitions and well-designed expansion on the retail side.

Last year, the Series C preferred stock was converted into common shares and retired – the majority of the remaining preferred shares are owned by current management so the risk of dilution is small.

Although unglamorous, AMCON’s business is unlikely to go away:

“With over 144,000 locations at the end of the 2009 calendar year, convenience stores outnumbered all other competing sales channels (supermarkets, drug stores, tobacco outlets, and mass merchant/dollar stores) combined, and have become a destination of choice for time-starved customers. Additionally, because convenience stores dominate a number of product categories, they have become an unavoidable part of day-to-day life for many Americans”

Business remains steady throughout the business cycle, in good times and bad:

“our businesses have remained more resilient than many other distribution and retail formats and have performed comparatively well given the challenging operating environment.

While the stock isn’t as cheap as before, it has plenty of upside left.

Disclosure

Long DIT