As I had mentioned in my previous posts on the evolution of my value investment philosophy, I’ve recently been focusing more on microcap stocks trading on the OTCBB and Pink Sheets.

While many stock screeners aggregate data for most stocks on the OTCBB, Pink Sheets are not required by law to file periodic financial statements, making a screener less useful.

Despite this, many Pink Sheets continue to file audited financial statements and press releases.

Since many investors are unwilling to purchase these types of securities, this dynamic presents a great opportunity for the willing investor, as many of the securities are significantly mis-priced.

Buffett’s Approach

At the 2001 Berkshire shareholder meeting, Buffett talked about his approach to investment research:

When I started, I went through the manuals page by page. I went through 20,000 pages in the Moody’s industrial, transportation, banks and finance manuals — twice. I actually looked at every business — although I didn’t look very hard at some.

Since the opportunities in the broader market are drying up (at least for the fundamentally cheap stocks I’m looking for), I used this as inspiration to start my own research project into all of the businesses trading on the Pink Sheets.

I would look at every possible stock and decide whether it was worth further research.

As Buffett said, I wouldn’t look very hard at the majority of the available stocks, but I was hopeful that I would find a few gems.

On the OTCMarkets website – the go-to source for Pink Sheets securities – I started with the Symbol Information File for the entire company directory.

A recent check shows 20,730 individual securities, a staggering number.

Research Methodology

A significant number of these securities consist of stocks trading on the Grey Market – a security that “is not listed, traded or quoted on any U.S. stock exchange or the OTC Markets” and has no market maker – and therefore can be avoided.

Check out the list of OTC Market tiers to better understand the various levels of disclosure.

I also removed international stocks, setting them aside for further review later. (Right now, I continue to trade through Zecco, which does not provide exposure to international markets)

For the initial stage of this project, the focus was on U.S. common stocks.

Once the list was cut down, I started going through the list one-by-one.

I’d open up each stock quote page on OTCMarket and check out the latest price quote, stock chart, and company information. I’d look at the financials, and open up the latest 10-Q and 10-K.

I could usually tell within a minute or two whether the stock warranted further analysis.

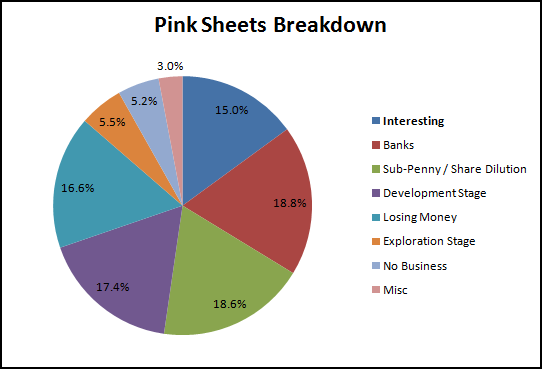

Many stocks are labeled as development or exploration companies, outside of my circle of competence and likely not generating revenues.

A large portion were banks and other financial institutions, an immediate pass for me.

Others were shell companies, continuing their public disclosure in the hopes of merging with an entity in the future.

And numerous others had no identifiable business model or updated financial information.

Consistently negative profits, tons of debt, recent or repeated share dilution (a favorite among the penny stocks) are all reasons to cross the name off of the list.

The ugliest had literally billions of shares outstanding yet traded for only fractions of a penny.

While some investors might find value in these types of securities, I decided to just pass instead of looking at them very hard.

At the same time, many of the stocks were growing, profitable businesses with long histories, but ones that had decided that the costs and compliance of Sarbanes-Oxley and full SEC reporting were not in the best interest of the company or shareholders.

If the stock passed the initial once-over, I’d usually spend time reading the full annual report, the last few quarterly filings, as well as the proxy statement and any recent press releases or insider filings.

Only then, satisfied that it was a legitimate, worthwhile business, would I add it to the watch list for full due diligence at a later date.

By the Numbers – 3698 Stocks Later

Final Tally: 3,698 stocks

Roughly 15% of the stocks passed my initial 2 minute due diligence check.

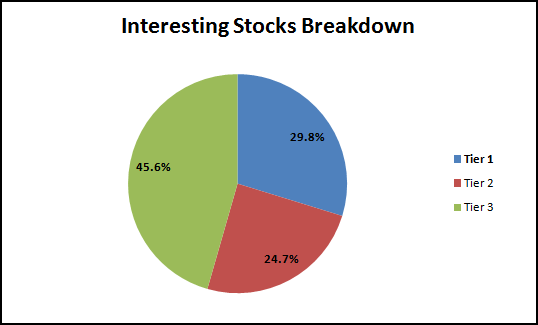

Of the stocks requiring further due diligence, I broke them out into subjective tiers based on their overall business model, cheapness, insider holdings, etc.

All Tier 1 stocks required additional due diligence and number crunching to identify actual investment candidates.

To date, maybe 20-30 companies made it as candidates on my immediate watch (or buy) list.

30 out of 3698

.8%

Conclusions

There is no doubt that there are still incredible bargains out there for investors who are willing to put in the effort to comb through the undiscovered corners of the market.

A few examples:

- A business with 50 years of history trading at 1.5x EV/EBIT & less than working capital

- A sub $50m stock that grew revenues through 2008/2009 with an average FCF yield of 27%

- A $300m in sales company selling for 0.65x book value, with positive net income for 9 out of 10 years

It was an incredible exercise, and definitely helped my confidence in evaluating companies through their financial statements alone.

In these stocks, the simple things matter – profits, cash flow, positive equity – and I’ve found that I prefer it that way.

It took me almost 2 months to complete this initial review, but it is a quest that never ends. I need to go back through the Tier 2 & 3 stocks for a second pass.

Final Thoughts

In a 1993 interview, Buffett talked again about his recommendation for investors who are starting out with small sums of capital and searching for undervalued opportunities.

Adam Smith: If a younger Warren Buffett were coming into the investment field today, what areas would you tell him to point himself in?

Warren Buffett: Well, if he were doing – if he were coming in and working with small sums of capital I’d tell him to do exactly what I did 40-odd years ago, which is to learn about every company in the United States that has publicly traded securities and that bank of knowledge will do him or her terrific good over time.

Smith: But there’s 27,000 public companies.

Buffett: Well, start with the A’s.

3,698 stocks later.

From A – Z.

Mad Props, Dude. Hope the hard work pays off, it certainly was an excellent read.

Wow Adam! I am so impressed with your Pink Sheet review project. I think Warren would be impressed as well.

Thanks! Now the hard part of figuring out which ones to actually buy 🙂

Great inspiration! I think you mean .8% not .008% though, and 1 out of 100 is actually not a bad hit rate.

Good catch. My brain was a little fuzzy after slogging through all of the information and trying to categorize the data.

Plenty of work left to do!

[…] This post was mentioned on Twitter by Adam Sues, Ian Cassel. Ian Cassel said: RT @asues: New Post – A Journey through the Pink Sheets. 3,698 Stocks Later http://bit.ly/evz4xr […]

Good Work Adam! I’ve recently been doing something similar- I’ve built a database that has just about every public US company. My goal was to basically recreate the old Moody’s manuals and then “start with the A’s”. I’m a couple of hundred stocks in and my brain is very fuzzy.

very awesome. any good net nets?

Great stuff Adam. Can’t wait to see some articles discussing some specific findings!

Awesome, this is exactly what I was looking for. I didn’t realize you could focus your companies by issue or country on the otcmarket site.

That’s easier than the excel spreadsheet with 20000 names on it.

Thank you

Paul – You’re welcome, 20,000 names is a bit daunting but the spreadsheet makes it decently easy to focus on the particular region, tier, or security class that you want to focus on.

Whopper – As you might be able to tell, I’m WAY behind on the articles and suffering a bit from information overload. Even after breaking it down, I still have dozens of Tier 1 companies that require additional due diligence. Picking between several comparable businesses is going to be key.

btw – You’ve already beaten me to many of these companies with your own research! 🙂

Floris – I guess it depends on how you define net-net? In any case, it’s probably not as many as you think.

Many companies are trading right around their NCAV value but very few would meet the tough criteria of requiring a 33% discount to this number. As the stock market has risen, it has carried many of these volatile/illiquid stocks up as well. I can’t tell you how many times I was kicking myself for not starting this project in November.

Margin of Safety Investor – I’m curious how you pulled the database together and what exchanges does it cover? While I have my hands full with my current data set, I’m always on the lookout for new hunting grounds. Drop me a line.

Thanks to all for the comments and emails! Now I just need to go make some money!

Been following here and Whopper for a while now. Your blog looks great Margin of Safety Investor.

I’ve got the otc’s, Amex, Nasdaq and NYSE all downloaded on excel. Far from a database, but it’s a start.

I’d love to hear about your database also Margin of Safety, maybe a post on your blog in the future?

I’m also wondering the difference between common and ordinary shares valueuncovered? I noticed when I downloaded the xls. file, there were quite a few that were ordinary shares.

Paul,

I don’t think there is really much of a difference between common and ordinary shares. I treated them the same when I was cutting down my list.

Would love to hear input from others though if there is a difference I should be aware of.

As far as I know, they are the same and the difference is just a matter of semantics. In India or in the UK, what we call ‘common stock’ or ‘stock’ is referred to as “ordinary shares” or “shares” for short.

If you want a higher hit ratio, try the same exercise for Japanese stocks. You wont believe what you will find..

Cog,

I think there is huge potential outside of the U.S. and would like to start broadening my scope eventually. Greenbackd had a good article on Japanese net-net’s:

http://greenbackd.com/2010/02/09/performance-of-japanese-sub-liquidation-value-stocks-the-results/

(If people have suggestions for determining what countries are relatively cheap, I’m open to suggestions – sounds like Japan is one)

However, I’ve found that many brokers aren’t very conducive or friendly to buying penny stocks.

What broker would you recommend for international exposure to microcap / penny stocks?

Al

Congrats and Great Work VU! Btw, I was wondering how you are planning on allocating capital once you have narrowed down your search for companies to buy.

OTC stocks are generally more risky( where I define risk as a combination of a number of factors like ease of market manipulation, lack of complete information, illiquidity, fraudulent financial information -even when audited, etc, etc), so how do plan to reduce the risk to your portfolio?

Btw, I am curious, given that you have done a remarkable job in narrowing your search to such a small subset of OTC stocks, how much confidence do you place on the publicly available financial information in the 10-Ks and 10-Qs of the companies you have shortlisted.

I agree that OTC stocks are one of the best places to look for mispriced securities, but I am always afraid of pulling the trigger due to the high chance of fraud ( not that NYSE/NASDAQ are immune to fraudulent companies, but I feel the chances are lower for companies listed on those exchanges). Maybe I am mistaken in my assumption, however, I am curious to learn about your thoughts on this matter.

Ranajit,

I’m finding that allocating capital among the new list is much harder than generating the list in the first place. I have a wealth of ideas, all trading for ridiculously low prices, but now am trying to figure out whether to go with Company A or Company B.

It is a tough decision.

I would have to disagree with parts of your ‘risk’ definition. There are many high flying companies on the broader exchanges that are extremely risky.

There have also been some high-profile examples of fraud recently (especially in some of the Chinese names) and the classic examples of Tyco, Worldcom, Enron, etc. – but I don’t think many could argue that these were traditional value investments at the height of the mania.

After looking through thousands of companies, I can tell you there is a ridiculous amount of paper-thin, fly-by-night businesses trading on the PinkSheets that are around for no other reason than financial engineering. They usually end up with billions of shares and are constantly undergoing capital raises, stock splits, etc.

Most of the companies that made my short list are businesses that have been around for decades. They are often family-owned, sometimes through several generations, with insiders holding a large portion of the stock. They generally have rock-solid balance sheets with tons of cash, little debt, and stable shares outstanding, so I try to keep the downside minimal (unless it’s an outright sham).

Is there a possibility that all of the numbers are made up?

I guess there is always a chance, but the SEC disclosure requirements, Sarbanes-Oxley, and plethora of financial information available on the internet makes it an order of magnitude easier to perform due diligence. A thorough Google search gives so much more information than Buffett’s old Moody’s manuals.

Just think, back in Graham’s day, many companies didn’t even publish a balance sheet and actually went to court to refuse publishing their sales figures and other financial information to investors on a timely basis!

I hold a diversified portfolio of these stocks, but am actually looking to go the opposite direction – to concentrate more on the very best ideas.

But I also came from a poker background, so I probably have a much higher risk tolerance than most investors. At least in stocks, you don’t normally lose 100% of your principal with a single card! 🙂

Thanks for the response. I agree that I may have been mistaken in my assumptions about OTC stocks and the risks they entail.

I think that this misperception may be founded on the experience that I haven’t come across many investors who have consistently made money investing in OTC stocks.

Again, this maybe totally a case of biased and incorrect sampling of data, but being a conservative investor who follows the 2 Golden rules of investing – “Don’t lose money” and “Don’t forget rule #1”, I have been somewhat apprehensive.

Btw, I am also curious, given your experience and knowledge in OTC stocks, what sort of catalysts do you see playing out in these markets when it comes to value creation? What are the most common types of catalysts that create value in the OTC markets?

As an aside, I totally understand what you are talking about when you draw parallels with poker.

Even though I haven’t played poker at your level of expertise or your stakes, there was a time when I used to spend almost all my non-work hours grinding the microstakes cash games and HU games on Full Tilt and reading books and strategy posts on 2plus2 forums to get better at the game ( I played NL and PL holdem only though and I would be lying if I said, playing full-time poker did not ever cross my mind 🙂 )

I have had enough bad beats and have seen enough volatility to understand very well what you mean ;-).

It was quite a learning experience, especially from a risk mitigation and bankroll management perspective, but then I got hooked to value investing and have only played very little since( I realized that the return on time and effort invested was better in the stock market than in poker..not to mention the avoidance of wild swings in fortune and mood within very short periods of time). The effort and research needed doesn’t leave time for much, especially when 8-10 hours gets eaten up by your day job.

Was wondering how you got hooked to value investing and whether you still play poker.

For many of these companies, I think being acquired by larger companies are usually the most likely exit strategies (see AMLJ as a recent example).

I imagine that the same characteristics that I look for in my investments – consistent profits, solid balance sheet, large cash position – are attractive features for potential acquirers. Even more so, the companies are trading at comparably low multiples which means they can ‘pay up’ but still get a decent deal.

In the same position, businesses that have large insider ownership are good candidates for management-led going private transactions, thereby reducing the costs of compliance and dealing with outside shareholders. Usually this must occur at a premium to the current price.

Some of these businesses have been around for decades and are still controlled by their founders – but they are getting older, and must pass along their legacy to the next generation, who could theoretically be hungrier and want to grow the business aggressively.

And for some, the ability to make the leap to the broader exchanges is a significant source of potential liquidity and investor interest.

I spent 5-6 years playing poker while going to school – often 50,000 hands per month. I was a regular reader on 2+2. I don’t play anymore, as the games have gotten significantly tougher but will likely pick it back up again once it is legalized/regulated (which I think will happen soon).

Despite my poker playing, I’m extremely frugal – I don’t like to lose money. As long as I keep putting myself in +EV situations (like buying undervalued small companies), I think the results will turn out well in the long-run.

Good work Adam, really good. I’m about to start a process of going just through the bank stocks on the pinks one by one. It seems nobody pays attention to them, and they are highly regulated which takes away the regulatory risk that many gray and pink sheet stocks have. Apparently there are over 1500 publicly traded banks with under a billion in assets, so I have my work cut out.

A question, did you record the 695 (18.8% of 3698) bank stocks that you came across or just make a mark when you came across one for recording purposes? If you did write the names down I would be very interested in seeing that list.

-Hester

Hester,

As a matter of fact, I did separate out the list of banking stocks. They are outside of my traditional circle of competence, but an area I would like to learn more about – especially after reading some of Buffett’s old letters where he describes the outstanding results of his investment in Illinois National Bank.

I can imagine that there are quite a few bank bargains stuck on the Pink Sheets. I’ll reach out to you privately and see if we can come up with something.

Hester – was thinking the same about bank stocks, now im disappointed that my thoughts weren’t as original as i thought haha

Adam – you avoided ‘a security that “is not listed, traded or quoted on any U.S. stock exchange or the OTC Markets” and has no market maker” — this was WEB’s sweet spot when he was a young gun, maybe this warrants a second look?

i think important with pinks is mgmt / industry player convos, scuttlebutt, etc. – have you been incorporating this into your research yet or have plans to?

cool blog, keep up the good work

This is impressive work.

I’ve started this same project several times, but life keeps getting in the way.

Could you please e-mail me directly?

You’ve done a lot of legwork, and I have a decent list of OTC/Pink sheet tickers that look like they meet your watchlist requirements – perhaps we can work out something of mutual benefit.

Thanks in advance, and also thanks for blogging 🙂

Hey, i saw this post.

Ive done some work on it. If you need to discuss, let me know. Just a word, unless you are Paul Sonkin, take out those with no updated info. That will probably kill a third of the list or 2/5 at least.

MT,

Yes, I got rid of most of the stocks that were showing ‘No Information’ according to the Pink Sheets tier system. All reporting companies and ‘Limited Information’ stocks were included.

Amazing job, congrats to you. The pie chart was an extraordinary touch.

I wonder about the bid/ask spreads that you found for the decent companies you found… I imagine many have very wide spreads.

Paul,

Thanks for the comment and glad you enjoyed the pie chart! I usually find that presenting the data in graphical form is the easiest way to visualize the numbers (I spend way too much time staring at spreadsheets full of numbers…)

You are correct that the bid/ask spreads are huge for many of these tiny illiquid names. Investing in these types of stocks requires a ton of patience, and the willingness to avoid jumping onto the current ask price just to start a position.

For example, my recent position in IBAL took several weeks to pick up my desired number of shares, and I have a handful of other stocks that I’ve been trying to buy for the past 2 months without any success at all.

So there are certainly challenges, but I think the potential rewards can make up for it though..

Adam,

Do you have anything to say about a company named

Medefile International, Inc. (MDFI.PK)? I have been evaluating them for awhile and even though I feel like it is risky I still see value in the stock.

Ken,

What’s your thesis behind the stock? I have been known to buy some equities under $1 per share, but I do tend to avoid those that are less than $1c…the company has several billion shares outstanding, is consistently unprofitable (large accumulated deficit), and isnt producing any cash flow…

I would avoid under most any circumstances but certainly open to hearing your thoughts.

Hi Asues, I just came across this awesome article you wrote,

I’ve been meaning to do something similar myself, and it gives me some encouragement that someone before me did (and survived!) haha.

I was actually just curious, you had mentioned:

A business with 50 years of history trading at 1.5x EV/EBIT & less than working capital

A sub $50m stock that grew revenues through 2008/2009 with an average FCF yield of 27%

A $300m in sales company selling for 0.65x book value, with positive net income for 9 out of 10 years

Would you mind sharing with me the ticker symbols for those 3 companies? Did you happen to buy into those also? I’ve never used this site before, so if you do get this message, could you email me at calcsmart-at-yahoo.com

I look forward to hearing back from you.

Thanks!

– John

John,

Thanks for the reply. It’s a lot of work, but I would encourage you to take on the project – some of the companies are amazing.

The first company was IBAL – you can see my post on the company here:

http://www.valueuncovered.com/international-baler-ibal-ob-profitable-net-net-investment

As you might imagine, the other companies are extremely illiquid. Although I don’t have a position, I’m keeping them both on my watch list and therefore unnamed for now.

Question for you… When looking at these companies, if you come across one with unaudited financial statements, do you still research the company? If so, how do you evaluated the reliability of the information your getting? Do you just try to incorporate it at the macro level as a whole or are there specific metrics, disclosures, you discount heavily?

I’d look at the company regardless, but I don’t think I’ve actually invested in a company that didn’t provide any audited financial statements at all…many do not provide them quarterly, but often provide an audited annual update.

I think it depends on what sort of thesis you are considering:

– Is it purely an asset play where a significant portion of the margin of safety is tied up in inventory (that potentially could be obsolete or not even there..).

– Is it a start-up company that is growing extremely quickly and could be fudging the earnings?

– Or is it a family business that has been around for 50+ years doing the same boring thing, but just doesn’t provide public audited statements to shareholders anymore in order to save on costs?

I’d be interested in the 3rd case but would probably just avoid in the others. For specific metrics, I’d take a look at the accruals ratio and M score (oddballstocks.com and oldschoolvalue.com have posts on each of them respectively) as other examples to try to root out funky accounting.

And finally, I’d just ask management for audited financials and see how they respond.

Not sure there is a clear-cut answer but hopefully that helps.

-Adam

That helps, thanks!

As long as the foreign stocks trade as ADR’s, there is no need to exclude them from your list.

True – but many of the small & illiquid names on the pinksheets don’t have ADRs available. In any case, I have switched to Interactive Brokers, and now have access to many foreign exchanges, although the majority of my investing is still in the U.S.

[…] company and stumbled upon a really great blog called Value Uncovered. His most popular post is “A Journey Through the Pink Sheets – 3,698 Stocks Later” Adam (from Value Uncovered) went through OTCBB and Pink Sheet stocks to try find a few potential […]

Nice post. It seems to me that such a search (literally “starting with the A’s”) would be extremely inefficient in terms of time. Back then, WB used the Moody’s Manual, which meant that all the data was already combed through and presented to readers and they would just have to flip through pages. Someone could go through the whole book (hundreds or thousands of companies) in a relatively few hours. Do you know of any such books or resources for the pink sheets today? I’ve been unable to find any.

I used Amazon Mechanical Turk and Odesk to help optimize the process. Once I had my list narrowed down, it basically WAS like flipping through the Moody’s Manual – just type in the ticket symbol on otcmarkets.com and go through several of the tabs + financials for a quick snapshot of the company. If you prefer a hard copy, I believe Mergent Manuals are very similar and are updated every year. I haven’t looked myself, but they are available in my school library.

[…] followed a very similar methodology to that Adam over at Value Uncovered posted in 2011: http://www.valueuncovered.com/a-journey-through-the-pink-sheets-3698-stocks-later. (Actually, we started this in the middle of 2012, long after reading Adam’s post. It was now […]

[…] A to Z– Buffet talks about going through a list of companies from start to finish. Walter Schloss used to flip through copies of Value Line cover to cover. Value Uncovered has an impressive post going through pink sheets. […]