iParty Corp. (IPT) operates 51 retail stores spread throughout New England and Florida. The company stocks over 20,000 products ranging from paper party goods and Halloween costumes to greeting cards and balloons.

The business is heavily dependent on holiday and party events like anniversaries and graduations, along with major holidays like Easter, Christmas, and Halloween.

Although the business is highly cyclical in nature during a given year, the company has been profitable for four out of the last 5 years (with the only hiccup being a loss in 2008 during the depths of the recession).

A string of recent insider buying and the upcoming Halloween season should help drive record profitability and free cash flow for this nano-cap stock.

Financials

Revenues have remained flat since 2006, falling into a range of $78-82M. Revenue increases are primarily driven from opening new stores – new store growth has slowed in the past few years as the company cut back during the recession.

5-yr median CROIC (11.4%) and ROE (5.1%) are unspectacular, but have risen substantially over the past several years. 2009 CROIC was 28.8% and it looks like 2010 will be in the same territory as well.

Debt to equity is high, at 148.4% in the most recent quarter – this number should come down after fourth quarter results. 2009’s debt to equity was 123.5%, down significantly from 243.9% in 2005.

IPT’s assets are tied up in inventory rather than cash or other liquid assets, and the company’s credit line is backed by this inventory. Hence, the quick ratio is very low, and the company’s Z-score could be improved.

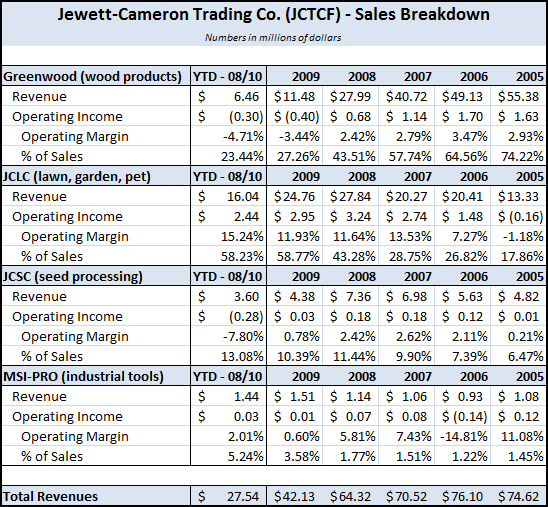

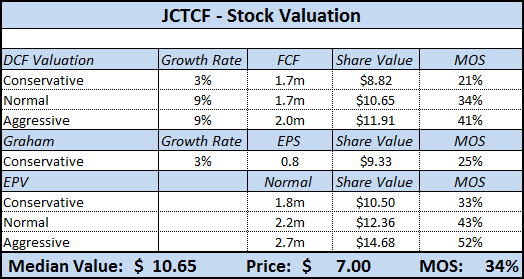

While the balance sheet doesn’t compare to other stocks recently featured (JCTCF and APT for example), the company does have quite a bit of room left in its credit line, and has produced solid free cash flow each year since 2006.

On the income statement, management has done a great job of cutting costs so far in 2010 despite the flat sales. SGA expenses as a percentage of revenue was 36% in the second quarter of 2010, compared to an average of 45-50% in prior years.

Positives

Insider Buying

Five different insiders have been purchasing shares over the past year at prices ranging from $0.26-$0.30. In total, 346k shares were purchased, almost 1.5% of shares outstanding.

Several recent purchases in August and September should be a positive sign for the upcoming earnings release.

Increase in Comp Store Sales

After seven consecutive negative quarters for comp store sales, the company returned to growth for both the first (+1.3%) and second quarter (+1.4%) of 2010.

As a key metric for most retail businesses, this is a good sign going into IPT’s busiest time of the year, especially since 2009 was the best year in company history from both a net income and cash flow perspective.

Store Footprint

IPT opened its first city-based store in downtown Boston in December 2009. The company expects to open another store in a prime urban location before the 2010 Halloween season.

If management is correct, both should help drive increased exposure and sales for the fourth quarter.

In addition, the company has also increased its focus on temporary Halloween stores. It opened 4 temporary stores in 2009 compared to only 2 in 2008.

These temporary stores provide some flexibility to react to market trends, as the company can control its costs to some degree depending on the sales environment.

Negatives

Risk of Dilution

IPT currently has 5 different series of preferred shares, in addition to outstanding warrants for its common stock.

Combined, the preferred shares can be converted into approx. 15M shares of common stock, a significant number that could potentially lead to dilution for existing common shareholders.

The bulk of the warrants resulted from a 2006 financing agreement with Highbridge Capital – they carry an exercise price of $0.48/shr and currently expire in September 2011.

Cyclical Sales

IPT traditionally has reported a loss in its fiscal 1st quarter and 3rd quarter. The vast majority of profits come in the fourth quarter, with both the Halloween and Christmas holidays.

Other major events (such as the New England Patriots making it to the Super Bowl) can also have a dramatic effect on the company’s revenues. These fluctuations must be carefully managed and sometimes make investors nervous.

Although the company has done a great job in controlling SGA expenses, sales have stagnated around $78-80M.

There are only so many costs that can be wrung out of an organization, so top-line growth will have to come from somewhere (the urban-store expansion?) in order to propel the business further.

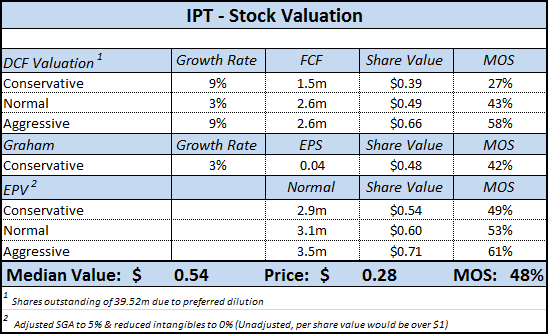

Valuation

Assuming the company ends the year with $0.05 EPS, that translates into a P/E ratio of 5.6 at current prices. Applying a normal P/E multiple of 10 leads to a price of $0.50, in line with the other valuation methods.

Conclusion

This year is shaping up to a stellar year and insiders have been extremely bullish going into historically the best quarter for the company.

Management has done a good job of controlling costs throughout the economic downturn and has resumed their store expansion strategy which should help drive sales growth (while keeping some flexibility with the temporary store locations).

The company is backed by top venture capital firms.

Robert H. Lessin, now the Vice Chairman of Jefferies & Co, owns approx 35% of the company and appears to be a rockstar in the angel industry on the East Coast, providing seed investments to Overture and Register.com.

Other current holdings by Roccia Partners, Highbridge International, Boston Millenia Partners, and Patriot Capital all provide positive reinforcement that the industry believes in the company.

Finally, another catalyst happens to occur in October 2010 – this month has five full weekends (5 Fridays, 5 Saturdays, & 5 Sundays).

The last time this occurred in October was 2004. It won’t happen again until 2021, but for a company like iParty that depends on Halloween, it should provide opportunity for shoppers to hit the stores, translating into a nice sales boost!

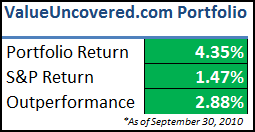

I’m adding IPT to the Value Uncovered portfolio at yesterday’s closing price of $0.28.

Disclosure

Long IPT