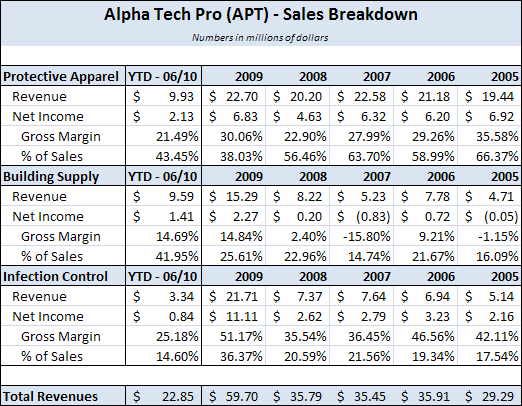

Alpha Pro Tech LTD (APT) is a Canadian micro-cap company offering products in three different operating segments: Protective Apparel, Building Supply, and Infection Control.

The stock is down almost 70% from a high of over $7 back in October 2009. APT saw significant increase in sales due to the outbreak and threat of the H1N1 flu virus, as it increased demand substantially for the company’s protective gear.

In 2010, comparable numbers are off significantly as the H1N1 threat has abated – the market has punished the stock despite a solid balance sheet and continuing profitability.

This is a great example of the market overreacting, providing an opportunity for savvy investors to pick up shares on the cheap.

Segment Breakdown

The company sells a variety of disposable protective items including shoecovers, caps, gowns, masks and eye shields, along with house wrap and synthetic roof underlayerments on the building materials side.

2009 was an incredible year for the company, with sales increasing 66.8% compared to 2008, driven by strong results in the Infection Control group. Infection Control sales almost tripled, as customers stocked up on protective gear to combat the H1N1 flu strain.

Despite the sharp drop in protective gear sales from the 2009 high-water mark, the company has managed to hold revenue numbers fairly steady in 2010, primarily due to growth in the Building Supply segment.

Building Supplies now make up over 41% of total revenues, almost double the segment average over the past five years.

Financial Information

Revenue has grown at 12.7% per year over the past five years on a solid gross margin of 46.4%. Both operating and net margins have remained stable as well, at 12.1% and 7.6% respectively.

Margins will fall as the company increases its focus on the lower margin Building Supply business, but the growth prospects should help to make up the difference.

5-yr CROIC (11.9%) and ROE (12.3%) are respectable although not outstanding.

On the balance sheet side, book value has increased at a steady rate of 16.6% per year and currently sits at $1.56/shr.

Last quarter, APT made significant inventory purchases across all product lines in order to strengthen marketplace position and ready for future sales. The company expects to generate and stockpile cash in the second half of the year as it works through inventory.

Loss of Key Distributor

In 2009, 28.7% of company sales were to VWR International, the company’s largest distributor. However, on March 29 2010, VWR decided to stop carrying Alpha Pro Tech’s product line and launch its own competitive line of products.

Although the company has slowly been transitioning away from VWR (the distributor made up 45.7% of sales in 2007), this will still have an adverse effect on financial performance as the company moves to a broader distributor network.

So far in 2010, Protective Apparel sales are off 26% – although the other business segments have picked up the slack, it remains to be seen whether the company will be able to stabilize sales through a broader distribution network.

Catalysts

Share Buybacks

In April 2009, the company announced a $2m stock repurchase program. The plan was expanded to another $2m in February 2010. While repurchases have slowed in 2010, the company has managed to retire over 6.1M in shares for an average price of $1.24 since the program was originally announced.

I’d imagine the company will begin repurchasing shares again once sales stabilize and the cash balance improves.

Business Supply Growth

Despite the troubles in housing and construction markets, APT’s Business Supply segment continues to churn out impressive results. The company has managed to operate the segment profitably, growing both top and bottom line results, and has hired additional sales staff to handle expected growth.

The company has also announced a new product offering in the third quarter which should increase market share as well.

Flu Season

In the U.S., flu season is usually marked by the October through May time period. While it is very difficult to predict the severity of the 2010-2011 season, there certainly remains the potential for another significant outbreak.

If so, APT’s products are well positioned to capitalize and provide protection where required.

The buildup in inventory will ensure the company can meet demand without costly production issues if an outbreak requires immediate supply.

Valuation

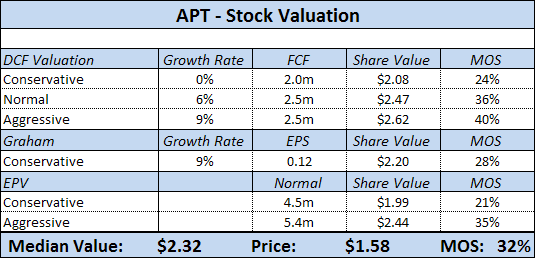

Assuming the company can deliver 2010 EPS of $0.12, the stock is currently trading at a forward P/E level of approx 13, compared to the stock’s long-term P/E average of 19.23.

Assigning the average multiple and the per-share value would be $2.31, right around my estimate.

The stock is currently trading at book value, despite a historical book value multiple closer to 2.5.

NCAV of $1.30 provides a measure of protection on the downside.

Conclusion

With Alpha Pro Tech, the market seems to be keying on the comparable YoY numbers between 2009 and 2010 rather than focusing on a business that has maintained profitability through the ups and downs in its business cycle.

The company’s Building Supply segments has shown exciting growth prospects, and while the loss of VWR’s business is detrimental to sales in the short-term, it might even offer an opportunity for APT to increase its sales network through broader distribution channels.

While $7 is too high for the stock based on current financial performance, conservative estimates peg APT’s value at north of $2.

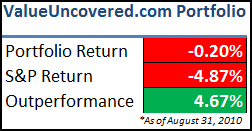

I’m adding APT to Value Uncovered’s Model Portfolio at $1.58.

Disclosure

No positions in my personal portfolio at the time of this writing.