After 3 years and over $35m in losses, Sparton Corp (SPA) took a giant leap forward in 2010, evidence of a strong turnaround by the new management team.

SPA struggled through several bad years due to a variety of causes: underutilized and unused manufacturing facilities, lax management, inflexible long-term contracts and overall recessionary pressure.

Despite these difficulties, the underlying business had potential, and based on latest results, the stock remains undervalued with strong potential for future growth.

Background

Sparton operated at only 25% of operating capacity for period of time after management decided to move business to an inefficient facility in Jackson, MI (where the company HQ’s and management were located), instead of keeping it at a modern facility in New Mexico.

In addition, quality concerns led to substantial losses within the DSS segment as Sparton was forced to eat the losses on fixed price contracts.

Finally, in mid-2008, the company’s largest shareholder, Lawndale Capital Management, initiated a proxy fight citing concerns regarding Sparton’s corporate governance and board composition – new directors were nominated, along with a recommendation for hiring an experienced turnaround management team to shakeup the long-entrenched and underperforming management group.

Soon after, a rockstar turnaround team was put into place, starting with the hiring of a new CEO, Cary Wood, in November 2008.

The new team instituted a number of initiatives for controlling costs during a tough business climate and setting the strategic vision for the company’s future, including:

- Cutting staff by 6% during the course of 2009

- Freezing pension plan accruals and 401(k) matching contributions

- Closing several plant facilities and consolidating others

- Initiating lean manufacturing principles throughout the company’s locations

- Eliminating unprofitable long-term contracts

- Setting long-term growth strategy, including identifying core business segments

These changes were necessary and significant step in the right direction.

Business Segments

Management also consolidated and organized the business into three segments:

Medical Device Operations – contract design and development for complex electromechanical devices for medical device customers

Electronic Manufacturing Services (EMS) – contract manufacturing and prototyping for industrial customers seeking quality-assured products such as flight control systems, security systems, lighting, and defense

Defense & Security Systems (DSS) – design and production of defense programs, focused on sonobuoys, an anti-submarine warfare (“ASW”) device used by the U.S. Navy and foreign governments. Note: Sonobuoys are consumable devices with a life of less than 8 hours and the Navy requires a constant supply – Sparton is one out of only two companies capable of manufacturing these products.

Financials

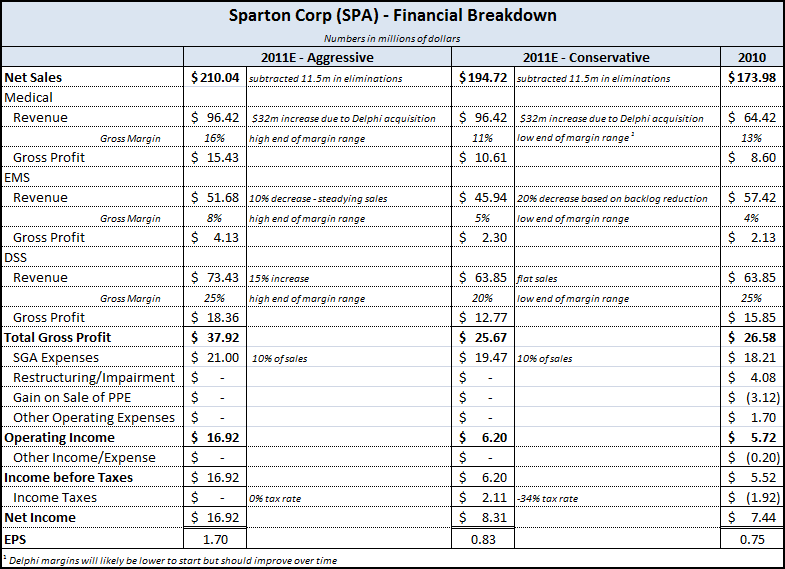

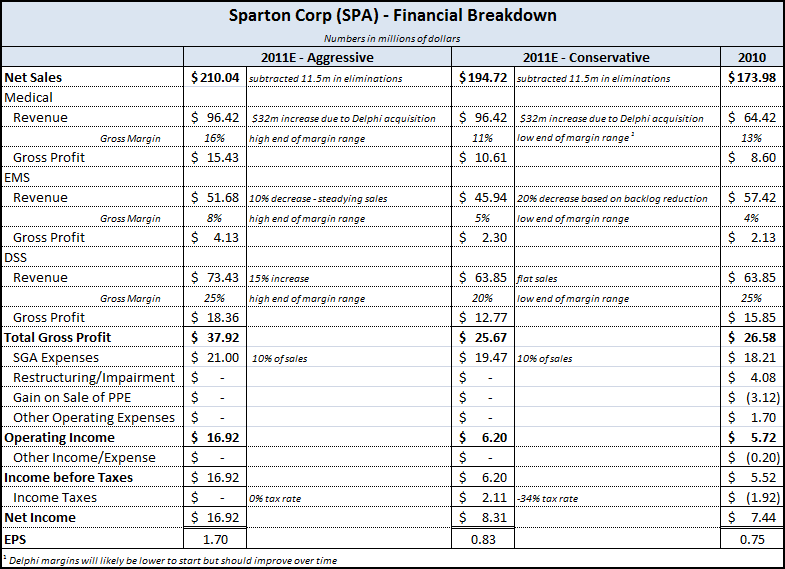

For fiscal 2010, total sales were down 22% to $173.98m, as the company walked away from unprofitable contracts with several major customers, primarily within the EMS segment.

Despite the sales decrease, the company blew out its income targets, turning in four straight profitable quarters after reporting pre-tax losses for the previous twelve. Overall, net income jumped to $7.44m compared to a loss of $15.75m in 2009.

These results were more than double management’s incentive goals, as the business returned to profitability significantly ahead of schedule.

Further, these results were accomplished despite continued restructuring expenses in 2010 ($4.1m compared to $7m in 2009). The good news is that all restructuring activities appear to have been completed as of June 2010.

Gross margins averaged 15.9% in 2010 with encouraging improvements in all three business segments. Operating margins are tight (3.3%) but should continue to rise.

In fact, the company’s EMS segment reported an operating loss in 2010, with a terrible fourth quarter. However, management raised its margin guidance for this segment going into 2011, a positive sign for the segment’s prospects.

CROIC (14.8%) and ROE (11.6%) are both solid and should increase as well.

As part of the turnaround plan, Sparton aggressively paid down debt, reducing it from $22.96m in June 2009 to only $1.92m a year later.

In addition to producing solid free cash flow ($7.9m), the company also has an unused $20m credit facility, and over $30m in cash on the balance sheet (with another $3.2m in restricted cash about to be released).

Once the restricted cash is released, the company will be have almost $33m in net cash, giving the stock an EV of under $40m.

Catalysts

Uninhibited Growth

Even with the stellar results, the company still has room for improvement – an easy change will be the reporting of clean operating results going forward in 2011.

Restructuring/impairment charges and other operating expenses (related to carrying costs for facilities – now sold) added up to $5.78m, offset by $3.12m in gains from the disposition of these assets.

Removing these expenses will add almost $0.27 per share to 2011 results.

In addition, SPA announced the resumption in marketing programs, an area neglected for several years:

“in the near term, a new marketing initiative will center around identifying our brand and brand position, developing new selling collateral materials, enhancing our trade show image and presence, and modernizing Sparton’s website architecture and technology – all done with a level of professionalism that will fully support and improve the selling effort.”

Finally, Sparton is also recommitting itself to R&D activities around creating proprietary product lines within the DSS segment, a potential (and high margin) boost to future profits.

Smart Acquisitions

In August, Sparton announced the acquisition of the contract manufacturing business of Delphi Medical Systems for $8m.

The acquisition is expected to add $32m in additional revenue. Delphi has two manufacturing facilities that could eventually be consolidated, and management believes that margins could be improved a similar range to corporate (13-15%).

Since the purchase also covers Delphi’s inventory, the acquisition is a steal, and will allow SPA to broaden its reach into the Western U.S.

Investor Roadshow

Despite the turnaround, many investors are still unaware of this micro-cap stock.

Management appears to be attacking this situation by going on the road – with investor presentations scheduled in Minneapolis (Oct), Dallas (Nov), Connecticut & Baltimore (Dec), along with stops in California, New York, and Philadelphia.

Sparton’s corporate presentation presents a compelling story, and the market should react favorably to the stock’s potential.

2011 Estimates

Using the average of these two estimates, and my forecasted EPS for 2011 comes in at $1.27/shr.

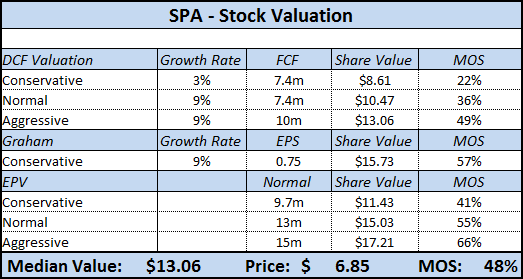

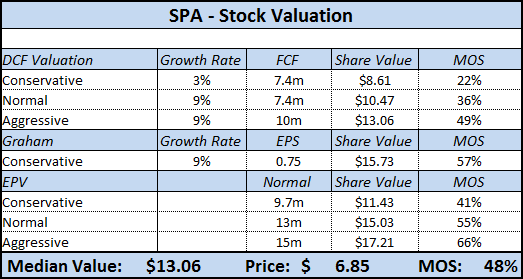

Valuation

The current EV/EBIT ratio is 6.5 – very cheap for a profitable and growing company.

SPA’s current P/E ratio is 9.18. While it is hard to find a close competitor, SPA’s industry has an average P/E ratio of 16.

Applying this P/E multiple to the current share price and EPS numbers yields a target value of $12.

Using this same multiple but a 2011 estimated EPS of $1.27 would imply a per share price of $20.

Conclusion

Cary Wood and the rest of the management team have done an incredible job of focusing the company and recovering from a string of bad years – it is a true turnaround story with plenty of opportunity going forward.

The Delphi acquisition should be immediately accretive, and Sparton will continue to drive profitability by improving margins across the business units.

Conservatively, the stock should return 50%+ over the next year or two.

Building on 111 years of history, Sparton Corp has big plans:

“Sparton will become a $500 million enterprise by fiscal 2015 by attaining key market positions in our primary lines of business and through complementary and compatible acquisitions; and will consistently rank in the top half of our peer group in return on shareholder equity and return on assets.”

It’s an audacious goal, but one that will richly reward shareholders who are along for the ride.

I’m adding SPA to the Value Uncovered portfolio at today’s closing price of $6.85.

Disclosure

Long SPA