A great year for the overall market, the S&P finished up 14.6% on the year after a sustained rally after the July lows.

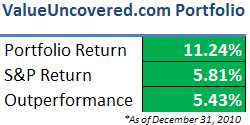

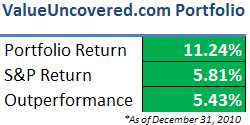

2010 also concluded the first calendar year-end for Value Uncovered. Just having launched the site back in May, I’m pleased with the first half-year performance.

Stock Positions

Check out the Holdings page for a list of my current stock holdings, with 16 positions overall. 15 out of 16 ended the year with positive returns since my original analysis/writeup.

Lowlights

NOOF was the only laggard, still down 15.76% since my entry point of $2.03. Since my original writeup, the balance sheet has continued to remain strong but earnings improvements have been slow to materialize – the stock remains extremely cheap.

I think NOOF’s new lease agreement will provide substantial cost savings going forward.

The stock continues to be held by a large number of institutional investors and insiders were buying back shares near the yearly low. I remain bullish on the name going forward.

While the rest of my positions showed positive gains, 5 trailed the S&P: SPAN, SVT, ACU, APNC, and IPT.

It is interesting to note that the first three stocks (SPAN, SVT, ACU) were some of my original picks and have shown the least results. I believe I have made strong improvements in my valuation analysis and overall investment philosophy.

The one item of note from these stocks was that SPAN paid a nice special dividend of $1.00 per share, adding almost 6% to the position’s total return.

I find that closing out positions is often the hardest part of my decision-making process. Several of these stocks (ACU, SVT, ELST), neared the low-end of my intrinsic value estimates during the course of the year.

When this occurs, it is a great time to sell and recycle money into more attractive opportunities. From now on, I will be keeping a close eye on these positions as they near the bottom of my intrinsic value estimates.

Highlights

I closed out a position in CHBU for a gain of 80%, my largest return to date. I originally entered the position when the company is selling at a large discount to their net cash. Despite the positive overall result, I managed to exit the CHBU position one week too early, missing out on ~100-150% in gains.

Other large winners included TPCS, ADVC, and DIT, all returning more than 30% since my original analysis.

ADVC benefited from paying out the announced special cash dividends, providing the 10% yield I talked a in my original writeup.

DIT continued its march upwards on the back of the new management team, posting over $1B in sales for the first time in company history.

TPCS was the best performer, and management seemed extremely bullish on the latest conference call. The new investor presentation does a great job of laying out the potential for the company going forward.

APNC announced that they were pursuing a broad range of strategic alternatives to unlock shareholder value, so I’ll be keeping a close eye on any news.

Special Situations

2010 was also the first year that I started investing in special situations or workouts.

I completed several investments, including my first merger arbitrage play with the UBET/CHDN merger, a successful going private transaction with AHOM, and easy money with tender offers for FIS and VR.

I remain on the lookout for other special situations but have found relatively few opportunities with the proper risk/reward characteristics.

Biggest Mistake

Despite the successes in my event-driven investments, my biggest mistake also occurred there – EMMS – my largest loser at -25.76%.

It was a great lesson around the dangers of getting hooked on a particular situation even when the dynamics of the situation radically changed.

The goal of these workouts is to supplement other opportunities with small absolute gains on a short time horizon, leading to a nice annualized figure with little risk.

With EMMS, I learned that chasing the last 5% is not worth the risk, especially when the downside is 50% or more.

Lesson learned.

Future Strategy

Ideally, I’m planning on holding somewhere between 10-20 positions at one time. Today, I’m near the high end of my target portfolio makeup, and have several positions that I’ll be cutting back when the opportunity presents itself.

In the broader market, I’m not finding very much that I like – most solid names seem fairly valued and there are very few that currently offer enough margin of safety.

For this reason, I have started doing more research into the PinkSheets market. It is a wild world, but amidst the development companies, scams, and terrible businesses, there are a gems with absolutely incredible potential.

However, many of these stocks are extremely illiquid so it will be very hard for me to write about them effectively.

Although I have no illusions about my ability to move the markets, picking up positions in some of these .PK names often takes week or even months, a dynamic that doesn’t lend itself to public tracking.

Conclusion

2010 was a great year and I’m looking forward to improving upon my results in 2011. I also enjoy hearing from my readers, so please use the Contact Form or follow me on twitter to share your ideas or questions.

I’d also welcome suggestions or feedback on improving the site, whether its article suggestions, layout/feel, or additional tools that you might find helpful.

Good luck in 2011!

Disclosure

See Holdings page for current positions.