China Agri-Business Inc (CHBU.OB) reported another outstanding quarter, driven by the rapid expansion of the company’s direct store sales program.

While the new distribution strategy seems to be working, the stock has appreciated significantly and now trades well above NNWC and book value – CHBU has now transitioned from a pure value stock into a growth story.

Financial Highlights

CHBU’s third quarter revenues were $3.5m, a 471% increase from the same period last year. This follows the 391% increase in second quarter revenues, as the company continues to add new direct stores at a blistering pace.

As of September 30, 2010, CHBU owned 400 direct sales stores, up from 346 direct sales stores in July. Management has set a goal of 500 stores by the end of October so growth should continue into the fourth quarter numbers.

While much of the sales revenue is due to direct store expansion, the company’s traditional network also saw a 120% increase in quarterly revenues, and are now up 22% on the year.

The company’s increased visibility and exposure seems to be helping across all business segments.

This growth is not without cost, as gross margins fell from 70.11% to 42.57% – the direct sales method has much lower margins than the company’s traditional sales network.

Operating margins took a hit as well, falling to 25.3% compared to 40% in the prior year period.

Since sales are increasing at a much higher rate, both operating and net incomes were up despite lower margins. Overall, net income increased 260% to $895k, or $0.07 per share, up from $0.02 per share in the third quarter last year.

Through the first nine months of 2010, CHBU has generated $2.1m in operating income and EPS of $0.15.

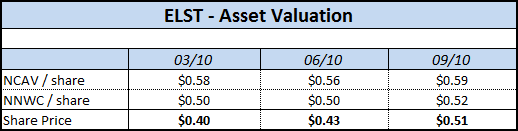

The company’s balance sheet remains strong, with almost $0.81 per share in net cash and a book value of $0.88.

Management has also taken steps to improve the stock’s capital structure. During the quarter, the company paid back a $500k convertible note, reducing the risk of share dilution for common shareholders.

The company still has 1.3m warrants outstanding as of September 30 at $1.00, $1.50, and $2.00 per share. However, 758k warrants expired in October.

The last significant chunk (500k) expires in Sept 2011, with a current exercise price of $1.50 per share.

Other Events

As I mentioned in my previous posts on CHBU, management had received approval from the local government for 66-acre land-use purchase costing $4.4m. If completed, this would take a significant chunk out of the company’s cash reserves and the original margin of safety for the investment.

Likely due to these delays, CHBU announced on November 12 that it would be leasing a ~4 acre parcel of land to construct a warehouse and distribution center.

The lease term is for 21 years at $53,800 per year (subject to a 12% increase every three years), with a prepayment of the first ten years in an initial lump sum of $540k.

While I’m not an expert in the going price for Chinese land, this lease agreement seems to come at a high price, especially when compared to the original purchase option.

Valuation

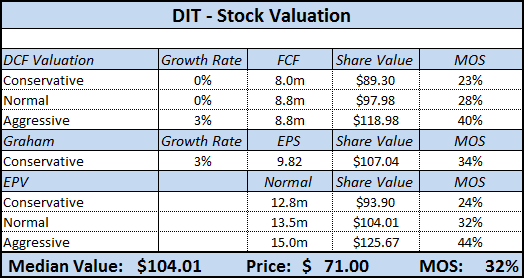

Due to its large cash balance, CHBU trades at very low multiples i.e. EV/EBITDA sits at only 1.73 using an enterprise value of 3.46m.

Looking at it another way, the stock has generated $1.7m in adjusted free cash flow for the year and should produce over $2m for the year – even using this conservative estimate, the stock has a ridiculous FCF yield of 57.8%!

The business should generate EPS of $0.06-$0.07 in the fourth quarter for an annualized EPS number of $0.22, translate into a P/E ratio of only 5.

Both DCF and EPV valuations suggest an intrinsic value of around $1.60.

Conclusion

While the stock has turned in an impressive year, my original thesis was predicated on a discount to tangible asset value.

Now that the stock is trading higher, it has ventured beyond value investing territory and has become even harder to predict. Also, I’ve become even more leery of Chinese small-cap stocks due to major accounting scandals that have recently surfaced.

While I think the stock could run up near $1.50 in the next few months (especially on the back of fourth quarter numbers with easy YoY comparables), I’m going to take the cautious approach.

I’m going to sell CHBU out of the Value Uncovered portfolio based on yesterday’s closing price of $0.99.

The investment gained 80% in 5 months for an annualized return of 314%.

Disclosure

No positions.