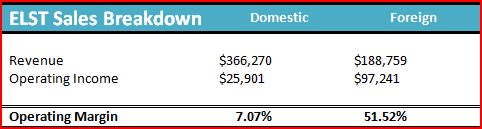

ELST filed its Q1 results on March 13th and reported a solid, if unspectacular, quarter. Total sales increased by 23% compared to the first quarter of 2009. Domestic sales were basically flat but foreign sales jumped almost 82%, due to higher demand for the company’s products from industrial automation projects in Chile, India, Colombia, and Peru. Operating margins are significantly higher on foreign sales – see chart below:

Foreign sales accounted for 34% of total sales in 2009, compared to 23% in the previous year. Hopefully management will continue to focus company sales efforts on this segment going forward.

Despite the improved results, management is still very cautious for the rest of 2010 –

“Management believes that the tenuous worldwide economic recovery makes sales revenues during 2010 difficult to predict and prone to potential fluctuation”

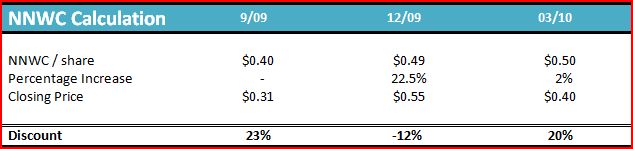

As a going concern, I think the business could be worth anywhere from $.75-$1 per share, substantially higher than the latest closing price. Barring a potential catalyst, it is very important to understand the downside risk as well:

Based on the company’s latest closing price of $0.45, the stock is trading for 10% less than the sum of its assets its liquidation value, providing a nice cushion to the downside.

Also, Paul Sonkin of Hummingbird Capital has increased his stake from to 16% to 21.1% of the company. Hummingbird Capital is a very successful hedge fund manager that focuses on nano-cap plays selling at a discount to their intrinsic value. Paul recently spoke at the Value Investing Congress (see a great writeup here: 2010 Value Investing Congress Notes by The Innoculated Investor)

It is always nice to have an expert on your side!

Disclosure

Long ELST

Adam – Great blog! Appreciate the link as well (I’ve added Value Uncovered to AAOI).

Thanks for the update Adam. Haven’t had time to look through many filings myself so I’m glad you started this blog.

AAOI – Thank you for the comment. I enjoy reading your blog, especially some of the presentations and other Scribd documents you have posted.

Jae,

Sure. I’ve been going through quite a few filings but honestly haven’t found very many stocks that look cheap. Been focusing more on special situations until I can find some bargains.