This is another update on recent news and results for some of my current stock holdings, following the theme from my post on first quarter results.

To be efficient, I’m once again going to combine several short blurbs into a single post.

Access Plans Inc (APNC)

APNC continues its amazing growth trajectory, recently reporting a 155% increase in fiscal second quarter earnings (which follows a 69% increase in Q1 earnings).

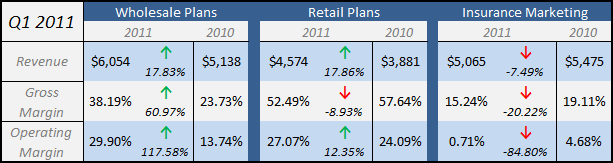

Quarterly revenue increased 5%, as solid gains in the Wholesale Plans (+12%) and Retail Plans (+4%) segments were partially offset by a decrease in the Insurance Marketing (-6%) segment.

The company benefited from a large decrease in direct costs, fueling the large jump in earnings.

Consider: In the first six months of the fiscal year, APNC has already earned more net profits than in all of 2010.

APNC is throwing off a ton of excess cash, with the net cash balance growing to $8.89m this quarter. Despite this rapid growth, the stock continues to trade at less than 5x TTM EV/EBIT and less than 8x EV/FCF.

As a continued vote of confidence, one of APNC’s largest shareholders, Russell Cleveland of Renn Capital Management, increased his stake by over 350k shares to 10.1%.

While there has been no news, the assumption is that the company is still exploring strategic options for unlocking shareholder value, including a going private transaction – I see this has a strong potential catalyst.

Iteris (ITI)

On a pure numbers basis, ITI is out of place when compared to the majority of my portfolio (which is focused on companies trading at a discount to assets, such as Fuji Oozx or IBAL).

ITI recently reported fiscal fourth quarter fiscals for 2011, with revenues up 4% as compared to the same quarter last year, primarily driven by the recent acquisition of Meridian Environmental Technology (MET).

The company continues to see strong growth in its product businesses, but revenues were held back by weakness in the Transportation Systems segment.

Operating income for the quarter was $0.67m, down from $1.19m last year, primarily due to increased sales and marketing expenses and costs associated with the MET acquisition.

For the fiscal year, the numbers are not great, with the company reporting an operating loss of $4.7m due a large impairment charge taken in the third quarter – backing out the impairment charge shows operating income roughly flat when compared YoY.

This impairment charge also has no effect on cash flow, as the company reported almost $5m in FCF. ITI’s cash balance now sits at $11.8m, offset by roughly $3m in debt.

Despite a history of losses, Iteris reported its fifth consecutive year of profitability, and has paid down over $11m in debt since 2007.

Iteris is probably considered more of a growth stock rather than a true value play, but it’s a name where I believe in the industry trends that back the company’s technology.

Consider these points from the latest conference call and recent investor presentation:

- Expect Global Intelligent Transportation System (ITS) Device Market to reach $65b by 2015, up from $24B in 2010, growing 22% CAGR

- Road and other infrastructure spending projects usually project $1.50 back as return for each $1.00 invested – comparatively, spending on management infrastructure (in ITI’s sweet spot) usually sees a 7x or more return for each $1 invested

- Next Federal Highway Bill will provide a ‘shot in the arm’ for growth – expected to pass this year

- EU mandate for LDW in commercial trucks will start boosting sales in 2013 ; by 2015, expect 10-20x increase in demand

ITI management sounded very bullish on the latest conference call, with the CEO saying that he expects Iteris to do $100m in sales within the next 18 months!

The stock has struggled, but it’s hard to come up with a valuation less than $2/shr based on current metrics – if the growth materializes, the stock could appreciate significantly from current levels.

New Frontier Media (NOOF)

As opposed to ITI, NOOF violates my rule to avoid investing in business facing industry headwinds. NOOF is not in a great industry, and is therefore ignored by many in the investing world.

But at some point, even unloved stocks in bad industries are just too cheap to ignore.

NOOF reported $48.7m in revenue for fiscal 2011, down 3.4% from 2010, continuing the string of slow but steady declines going back to 2007.

After taking a string of impairment charges over the past few years, operating and net income have both been ugly, but appear to be trending in the right direction – net losses have improved from $5.2m in 2009 to $1.7m in 2010 to only $0.8m in 2011.

The company will likely see continued pressure in the domestic Transactional TV business (the main source of profits). Growth is manifesting nicely however in international markets, where sales have increased 64% YoY to $5.9m.

Despite the GAAP losses, the company has enjoyed positive operating and free cash flow going all the way back to 2004.

The cash pile just keeps growing, and NOOF now sits on $18.8m in cash offset by no debt.

Management made a number of strong moves during 2011, including consolidating facilities and investing in new storage equipment.

These measures caused capex to jump to over $5m during the year.

In 2012, the capex figure should drop significantly, as the business only requires a normal ongoing capex of $0.3m per year.

While the business may be in decline, it’s hard to see a future where NOOF disappears overnight – the business should continue to throw off cash for the medium-term.

At these prices, the stock is selling at a 45% discount to book value and only 2x FCF, for a FCF yield of almost 50%.

That’s just too cheap in my book, and I expect to see management return some of the excess cash to shareholders once the business stabilizes.

Disclosure

Long APNC, ITI, & NOOF