International Baler Corp (IBAL.OB) is manufacturing company that has been in business since 1945 and currently qualifies as a net-net stock investment.

The company manufactures baling equipment, large complicated machinery that compresses a variety of materials (including scrap metal, boxes, cans, etc) into bales for easier shipping, storage, and recycling.

A leader in the field, especially for made-to-order and customized baling equipment, International Baler has over 40,000 units installed worldwide.

The stock suffered through a rough 2009 (along with many heavy equipment manufacturers) as customers put off cap-ex purchases – the company’s products cost between $4k and $500k.

A micro-cap stock with a market capitalization of only $3.5m, IBAL’s balance sheet remains rock solid, and the stock price has barely moved despite strong evidence that financials are strengthening in a big way.

Company Financials

After 6 years of steady growth in revenue from 2002-2008, IBAL saw a sharp sales decrease in 2009, with sales dropping 48.4%. The company suffered a small net loss, its first since 2003, as orders for every type of product were down across the board.

IBAL bounced back in 2010, with revenues up 16% and profits coming in at $254k.

Gross margins have remained steady over the past 5 years with a median just under 20%, while both operating and net margins hover around 5%.

For the year, these results translated into an EPS of $0.05 and owner earnings of $336k, for a CROIC and FCF Yield of 13.84% and 17.3% respectively.

2010 ROE was only 6.46%, as the company has consistently stockpiled cash to go along with an unused $1M credit line.

Overall, IBAL is a company that has gone about its business for over 50 years – although the recent recession affected the numbers in 2009, the company has proven it has the power to stay afloat during tough times.

Quarterly Analysis

Although it will probably take some time to match 2008 levels – a banner year – the latest quarterly reports show signs of improvement, not only in the actual numbers but in management’s language.

From the Q1 report last year:

“The decrease in revenue is the result of lower shipments in the first quarter of fiscal 2010, reflecting the deteriorated market conditions and lower commodity prices for recycled materials compared to the prior year first quarter”

And the latest quarter:

“This increase in revenue is the result of higher shipments in the first quarter of fiscal 2011 reflecting the improved market conditions and higher commodity prices for recycled materials compared to the first quarter 2010… The market for baling equipment has been moving toward larger, more productive and efficient equipment in recent years.”

This movement towards larger baler equipment is a good sign for the company, as there is much less competition on the high-end products (along with higher margins as well).

The recently released Q1 results show another sales increase, up 18% to $1.8m compared to the prior quarter last year.

Pre-tax income increased to $68k, compared to nearly zero last year, benefiting from higher product shipments and continuation of the company’s cost reduction efforts in 2009.

Even better, IBAL’s sales backlog more than doubled to $3.2m compared to $1.59m in 2010.

For comparison purposes, the backlog on Jan 31, 2008 was $2.8m – a year in which the company had sales and EBIT of more than $12m and $1.2m respectively!

While the company likely won’t approach those results, it has definitely gotten off to a good start in 2011.

Yet, despite the positive outlook, the stock has barely moved. In fact, it now trades at a discount to its working capital – compare the market cap $3.5m to net working capital of $3.68m.

Cash now sits at $3.08m, or $0.62 per share, unencumbered by any debt.

So IBAL is currently trading for less than working capital despite being solidly profitable, earning decent returns on capital, and announcing a record backlog!

Risks

Insider Ownership

Company insiders hold 58.8% of outstanding stock – I like to see management have a stake in the business but am cautious when the stock is so closely-held, as management can set compensation and make decisions at the expense of minority shareholders.

Digging into the latest proxy statement, the husband and wife team of LaRita & Leland Boren collectively own 51%, giving them tight control over the future of the company.

Outside of the Boren’s, little stock is owned by other company insiders or directors.

Recessionary Pressure

The company’s short-term results are heavily dependent on the economy. As commodity prices rise, it becomes more attractive and economical to purchase recycling equipment such as balers.

While the economy is showing signs of growth, a double-dip recession could reapply pressure to IBAL’s customers, potentially delaying purchases into the future.

Employee Lawsuit

On August 26, 2010, IBAL was served with a wrongful death lawsuit from a former employee for events that had occurred back in 2008. The lawsuit is asking for $2.5m, a huge potential liability for a company this small.

Lawsuits can be fickle and the company has liability insurance that should help cover any losses, but these sorts of cases can take a great deal of time and resources away from day-to-day responsibilities.

Positives

High-end Custom Baling Equipment

These special order products can cost up to $500k and offer much higher profit margins than traditional equipment.

These special orders remain a key growth segment for the company going forward – with such a wide array of configurations and over five decades of experience, the company is well positioned in the marketplace to capture the trend towards higher-end and custom equipment.

Undervalued Assets

The company owns its manufacturing facility in Jacksonville, FL, situated in a prime location next to a railroad and near a major highway. The facility is 62,000 square feet and sits on 8 acres.

With no mortgage, the company has depreciated the land, building, and all its contents down to $795k.

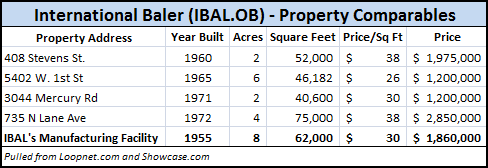

The land and buildings should be worth substantially more than the current carrying cost. Here are a few comparables:

Assigning a rough estimate at $30/sq ft to IBAL’s facility would yield a comparable value of almost $1m more than the current carrying cost (just for the building and land) – that’s almost $0.20 per share of additional value.

While it is unlikely that the company would sell the facility anytime soon (in fact, they had plans to expand the operation at one point), it is still a significant consideration for a company with a market cap of only $3.5m.

Insider Buying

John Martorana, a newly elected director, purchased almost 20k shares in the fall of 2010 at prices ranging from $0.45 – $0.52.

While the dollar value isn’t significant, insider buying is nearly-always a good sign for future prospects.

The CFO recently exercised his options and now holds 250k shares – it will be interesting to see what he chooses to do with this newly acquired stake in the business.

Valuation

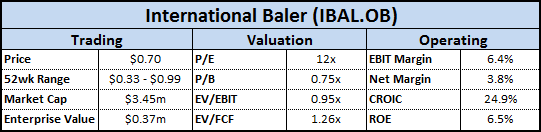

There is no doubt that the stock is cheap on an asset basis – book value sits at $0.927, so the stock is trading at a P/B ratio of 0.75x.

Using Graham’s definition, the stock is a net-net, trading below its NCAV of $0.74.

Typically, these figures provide a measure of protection by limiting risk on the downside in the case of a liquidation.

Using TTM figures and the recent $0.70 stock price, IBAL trades for .75x EV/EBIT and only 1x EV/FCF, making it one of the cheapest stocks I’ve ever seen.

Consider this:

If the current sales and cash flow trend continue, the company will generate more owner earnings in a single year than the entire enterprise value of the company.

Conclusion

I’ve been purchasing shares for the past several months under $0.60 – basically picking up a piece of a growing, profitable business for less than the cash on the balance sheet.

At that price, the company actually has a negative enterprise value, meaning the market thinks that the baling business is worth more dead than alive – and yet it is very much alive.

Book value has compounded at 22% per year since the Boren’s took over in 2005, and the large jump in backlog should forecast good things in the coming months.

With a solid balance sheet, competitive products, and undervalued assets, the company is ripe for an acquisition or merger.

Tragically, LaRita Boren passed away in February 2011, meaning her ownership stake passes to an Estate controlled by her husband, Leland Boren.

Leland Boren, now 87, not only controls IBAL, but is also in charge of Avis Industrial Corporation, a conglomerate of industrial companies including one of IBAL’s competitors, American Baler Corporation.

With the recent passing of Mrs. Boren, and the advancing age of Mr. Boren, estate planning is surely a consideration – I think the company is now poised to unlock shareholder value via a number of different catalysts – whether it is a merger with Avis Industrial or an outright sale.

Long term, the increase in fuel prices and other commodities, along with greater awareness and acceptance towards recycling, will only increase the need for the International Baler’s products.

At current prices, IBAL represents one of the most undervalued stocks I’ve ever seen.

Disclosure

Long IBAL

Other Articles on IBAL

Bailing out of the bailed out market and into International Baler (Ragnar)

I think this looks like an incredible find. They even have regular reporting going back to the ’90s. I wonder though, what has the market been like while buying shares? I see an incredibly large bid/ask spread, now looking at $1 to buy. Have you seen this fluctuate around enough that I could put a limit order in lower and possible catch it over a couple of days? I appreciate the write up.

mmel,

The bid/ask is quite large, and it has taken me several months to build up my full position. However, the stock does trade, on average a few thousand shares per day, so it is possible to build up a position if you are patient.

However, the stock is subject to wild swings. It briefly dropped down to $0.37 per share a few weeks back on a total order of only a few hundred shares – quite a shock to check the brokerage statement on that day! And no, I didn’t manage to pick up shares down there as it return to its normal trading range shortly, but if you panic at 50% swings, it might not be the stock for you.

On the same token, it briefly jump up to $0.99 per share a few days ago on a $99 order, so it works both ways.

But that’s the norm for these type of illiquid stocks – as long as you are patient, I haven’t found a large bid/ask to be very troublesome.

Hey Adam,

Funny you should mention IBAL as I was very close to establishing a position in this last month (I subscribe to the 10-K RSS, found it that way in case you were curious). I got spooked though, by two things: the changing of the auditor, and the move to the pink sheets. Do you have an opinion on these two things? I also noticed that over time, the more complex balers were becoming a smaller and smaller proportion of sales. Has this reversed?

On the positive side, there is an 11% owner who has no disclosed relationship to the Borens. I did some digging on him but was unable to turn up anything useful, other than that he has an enormous house, so he must be wealthy (probably a good sign). Did you see anything useful on this guy?

Thanks,

Tim

Tim,

I’m not familiar with the 10-K RSS feed. Is that something you setup through the SEC EDGAR website to keep track of every new 10-K filing?

Changing auditors is concerning, but I don’t see any reason why IBAL needs to be audited by a top 4 firm as a $3.5m market cap company. IBAL’s books are extremely simple, and I’m sure the company will save a decent amount of money compared to KPMG.

I used to sell accounting software to CPAs for several years, and am very familiar with the industry. The new auditor, The GriggsGroup, is one of the largest CPA firms in the area (and they are local, which I think makes it easier to do inventory checks, etc). Griggs is also part of the BDO Seidman, LLP Alliance, which is the 5th largest accounting firm and very well respected in the industry.

In the past month or two, it seems like the OTCBB changed its reporting/listing requirements for bulletin board stocks, as I noticed quite a few stocks that suddenly dropped to the pink sheets. From my recollection, it affected hundreds of stocks, and I read several letters by management teams explaining the changes (does anyone have a link to back this up?)

According to otcmarkets.com, IBAL trades on the OTCQB, the middle-tier when it comes to reporting, and above the pink sheets, which is confirmed by Yahoo Finance as well.

On the positive side, I’ve seen Toppan in a few different microcap stocks over the past several years (SODI is a good example). He seems to be a rich individual investor, and has been adding to his stake over the past several years. I don’t have any details on him though.

Yep, it’s just a feed that gives me every 10-K (and K/A) filed conveniently in Google Reader. This time of year it’s a bit overwhelming but most of the year you get maybe half a dozen a day.

I like what you had to say about the accounting firm. I too noticed that it was a local firm, which I considered to be a positive, but I have very little insight into the accounting industry other than the Big 4 (and some of the other large ones). I was also reassured by the letter from their former auditor. I would find it hard to believe that this letter would have been written in the event of a fraud.

I definitely was looking at IBAL during this transition you are talking about. Actually I noticed that a number of stocks I was watching suddenly went to the pink sheets. It’s good to know that it wasn’t permanent. I did, and still do, love how cheap this is. I may have to revisit.

Thanks

Tim

I came across this one a while ago, tried to get a position but failed. Ultimitely decided the volume wasn’t worth it considering it doesn’t make much in earnings, it’s just an asset play that sits there. I might revisit it some day.

Here’s a discussion on them

http://cornerofberkshireandfairfax.ca/forum/index.php?topic=3183.0

I would be careful with the litigation risk. There are probably a half dozen extremely cheap tiny companies with litigation hair. DFNS is another one, ADGI is a liquidation with huge upside and huge litigation hair. I think Frank Voisin has a few writeups on a net net with a lawsuit on them, but can’t find it. EPAX isn’t a net net but is extremely cheap, with a lawsuit on the management and company for insider trading.

Not sure what to think of these situations, the legal stuff is difficult to handicap.

Hester,

Although assets certainly play a big part in the downside protection of IBAL, the company is capable of earning a decent chunk of change as well i.e. they produced operating income of $1.3m in 2008. Obviously the earnings aren’t going to grow at 20% per year but the company is trading at a P/E level of only 10 even w/o accounting for all that excess cash.

The increase in backlog in the first quarter was a big jump, and since most of that backlog is sold down within 12 months, it should translate into a solid 2011.

Lawsuits are always a concern. For IBAL, I’m not as worried about the actual outcome, but of the time and expense that could occur if it drags on for a long time (attorney’s fees, etc). I think the treatment of lawsuits is much different depending on the type of litigation. In this case, IBAL has liability insurance to counteract such a scenario…in an insider trading scandal, there is no such protection.

Even if the company had to pay the full $2.5m, they would be trading at an EV/EBIT of 5.7x – not too shabby for a company earning double digit ROE and ROIC, and announcing a 100% increase in backlog.

Adam, good article. I have taken a relatively quick look at this one and it’s interesting. The assets certainly do seem to provide substantial safety. But here’s my question. As you note, as recently as 2008 they had operating income of $1.3 mil. However, other than 2008 and possibly 2007, based on a quick look at their past 10 years, the rest of the time their performance has been rather substandard. So the issue to me is are they more likely to perform like 2008 (or 2007)? Or will they keep performing the way they have most of the rest of the time. If they can get anywhere near 2008 levels again, this could do very well. Otherwise, unless the assets can be realized upon in some way it could be a long time coming.

Of course, I believe you mention Leland Boren’s advanced age, that his wife passed, etc. That, together with his ownership of the other baling company could possibly create an interesting situation. However, I’m sure people looking at this 10 years ago probably said Leland Boren is 77! He will have to do something soon. And here we are.

The litigation risk also gives me some pause. I am familiar with the risks, but there is no way to handicap the result. You have mentioned their insurance coverage, but do you have any way of knowing how much insurance coverage they have?

Again, good article and interesting situation. Thanks.

Kraven,

Thanks!

As far as I can tell, the Boren’s took over in 2005/2006, which seems to be the real turning point for the company if you look through the past ten years. 2008 was a banner year unlikely to be repeated – however, the recent jump in backlog puts IBAL on a pretty nice pace for 2011.

Most of their orders are pretty stable and realizable within the next 12 months, so I think it is a pretty good indication of what the upcoming year is going to look like. I’d be happy with $500k EBIT/$350k FCF as a stable earnings rate but think it could go much higher.

10 years ago, the Boren’s weren’t involved in IBAL 🙂 Unlike a family-founded and led company (such as my recent post on SVT), I’m guessing that Leland Boren doesn’t have as much attachment to IBAL, and believe that the recent death will change the dynamic – difficult to tell.

As for the litigation, I’ve emailed the company to see if I could get a sense on how much coverage they are covering, but would have to imagine it is a pretty high coverage amount – there would be little sense in getting accidental death coverage for only $500k, as it would never cover a successful suit.

However, even with a negative verdict against IBAL, the company would still appear pretty cheap, especially if sales & profits improve like I’m forecasting.

Adam, thanks for the response. I didn’t realize the Borens weren’t involved in the company before about 5 years ago. I just did a quick look and assumed (wrongly) that they were founders or something. I think that does change the equation a little bit. I agree he won’t have the attachment a founder or someone similar might.

In terms of the litigation risk, it is a good point that they are probably carrying enough coverage to make it worthwhile to do so. I guess it all depends on the facts of the situation and what led to the unfortunate victim’s death.

The backlog and current earnings are encouraging. When I looked at them it was a while ago, so they weren’t earning much, or were losing a little at the time, hence the reason for my thoughts on them just being assets that sit there without much profitability at the time.

I would be interested to hear how much coverage they have. I don’t remember seeing them disclose it in the Q’s or K’s when I looked at them, and they should, and would if they were bigger. Let me know if they email you back, I might bug them with a call or email if they don’t soon.

-Hester

Agreed. I’ve had the stock on my watchlist for more than a year, but finally pulled the trigger when the backlog saw a huge jump but the stock price didn’t move – the company was still selling below net cash. As I mentioned above, I think it would be very naive to take out a liability insurance policy for some nominal amount, as it just won’t cover any sort of negative verdict – even most personal insurance umbrella policies usually cover $1m or more (not an apples-to-apples comparison but similar I believe).

I searched around and couldn’t find an email address for their CFO – if someone finds it, let me know and I’ll send an email to him directly.

I am definitely interested to hear how much coverage they have. This is potentially very interesting. One thing we won’t know though is how their coverage works. For example, some policies might exclude negligence or gross negligence. Do you know the backstory behind the lawsuit? If the victim was dancing on top of the baler and fell in, that’s one thing. If he was just doing his job and the machine malfunctioned and pulled him or something because the company neglected to attach a specific safety mechanism, that’s another. Theoretically, the first could be covered and the second not. I have no idea as to their specifics. However, it seems as if they certainly have enough cash to cover it even if they had to pay in full. Although that would dissipate a large amount of their margin of safety.