Access Plans Inc (APNC) continues to chug along with solid results after reporting fiscal third quarter earnings this week. The stock remains substantially undervalued based on company financials despite worries about broader healthcare reform.

Sales Highlights

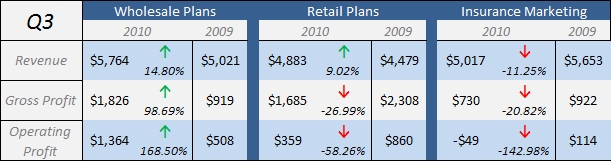

Company-wide revenue for the fiscal third quarter climbed 3% to $14.4m compared to the same quarter last year. Both the Wholesale Plans and Retail Plans divisions reported organic growth in revenue, increasing 15% and 9% respectively.

At the bottom line, net income in the period increased 10% to $0.95m compared to $0.86m a year earlier.

The company’s balance sheet has steadily improved as well. Current Ratio has increased from 0.9 to 1.4 over the past year. The company paid down all of its long-term debt and FCF for the year is the highest on record.

APNC also bought back approx. 8% of shares outstanding under the stock repurchase program, bringing the total number of shares down to 19.8m.

Business Segment Analysis

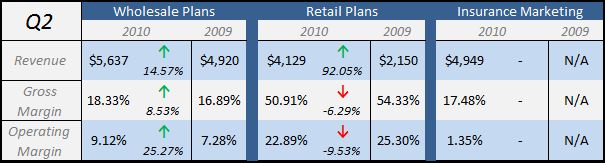

The revenue increase in Wholesale Plans was especially solid as margins also improved significantly, building upon the 14.5% revenue increase in APNC’s previous quarter.

Although profits declined in the other two divisions, the company has several new initiatives underway for achieving growth targets.

The Retail Plans segment is rolling out a new offering while phasing out legacy programs. Meanwhile, Insurance Marketing is focusing its strategy on combining supplemental and life products with major medical sales:

“We believe this new approach, which was prompted by certain aspects of the Healthcare Reform Act, should maintain commission income for agents, while improving the division’s operating margins. We are in the final stages of designing this new supplemental offering, and rollout is scheduled for the first quarter of Fiscal 2011.”

Uncertainly Around Health Care Reform

In the broader market, healthcare stocks are suffering after the passing of the ‘Health Care and Education Affordability Reconciliation Act of 2010’. According to Standard & Poors, Health Care is the second worst-performing sector YTD with a loss of 6.24%.

Although many of the new rules are yet to be implemented or even agreed upon, the market has shied away from companies whose business could be affected by the new reforms.

APNC – Health Insurance Company in Appearance Only?

Looking through the financials, company revenues are almost evenly split between Wholesale Plans, Retail Plans, and Insurance Marketing.

The Wholesale Plans division contributed 40% of total sales through the first nine months of 2010 and 51% of total operating profits – it is the most important division and wouldn’t be affected by the new law.

The Retail Plans segment offers ‘insurance-like’ services outside the scope of traditional healthcare insurance regulation. While there is some risk in this area – i.e. potential customers moving to a government-sponsored health insurance program instead of APNC’s products – I think there will always remain a market for alternative offerings.

On the other hand, the Insurance Marketing segment is the one area that will immediately be affected by the new law. According to the company’s filings,

“As a result of the minimum loss ratio requirement in the Health Care Reform Law, it is likely that commissions on the sale of individual major medical insurance policies will be reduced in January 2011 and, if that happens, it could result in a significant reduction in our revenue.”

However, it is important to note that the changes will only affect the commissions ultimately paid to agents – the company’s real risk is that fewer policies will be sold under the lower commission structure:

“Most of our commission revenue is ultimately paid to our agents so the potential reduction in revenue will not necessarily cause a reduction in our profitability in the same proportion. “

Conclusion

APNC continues to report solid performance, and has solid potential for growth in each division.

Although risk certainly remains (it is often hard to predict the outcome of governmental decisions on such a testy subject as healthcare), a good portion of the business seems to be insulated by its niche focus on wholesale plans and supplementary ‘insurance-like’ products.

As the debate rages on, there doesn’t appear to be any reason why APNC should be trading so low based on the financial numbers – substantial upside to the stock remains.

Disclosure

Long APNC