Electronic Systems Technology, Inc. (ELST) reported third quarter results last week, with significant improvements in revenue, operating income, and EPS.

2008 and 2009 were rough years for ELST, but recent trends show a return to former operating levels.

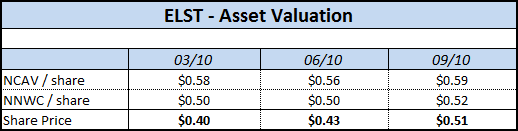

Truthfully, the stock is boring, but the company continues to trade at a discount to its net asset or liquidation value, providing a solid margin of safety.

Financial Information

Total revenues for the third quarter improved to $588k compared to $379k in the same quarter last year, an increase of 55%. Surprisingly, most of this growth was generated on the domestic sales side (in the first quarter, growth was seen mostly in the foreign markets).

Domestic sales made up 91% of quarterly revenues. While this sales growth is positive for ELST’s core markets, domestic sales have much lower margins than the international business.

Year-to-date sales of $1.6m are 20% higher than the same time last year, with growth increasing quarter over quarter.

The company reported positive quarterly net income, bringing YTD profits up to $102k or $0.02 per share.

A good portion of this yearly increase can be attributed to mobile data computer systems (MDCS) to public and government entities. For the first time, the company disclosed a material customer, ACL Computers & Software, which is a government subcontractor.

ELST’s products have long been used in patrol cars for police forces, and it appears the company is expanding into the federal space, a positive development.

The balance sheet remains strong, with a current ratio of 23.9. A significant portion of the company’s assets are in cash or short-term certificates of deposits.

Valuation Scenarios

At the latest closing price of $0.54, the stock is still selling at a small discount to NCAV and only slightly above NNWC.

Enterprise value is actually negative, as the company’s cash balance is more than the current market cap.

As a going concern, the company should report full year EPS of approx $0.03, with owner earnings of $200k.

Assuming no growth going forward, this still yields a DCF value of approx. $0.62 per share.

Conclusion

Now that sales are picking up, I’d like to see management return some of the excess cash to shareholders.

The company paid a consistent dividend from 2005-2008 when the business was in similar financial shape, and the resumption of this practice would be a good start.

Although government sales are notoriously unpredictable, another possible catalyst could arise through this new federal government reseller. Even a small federal contract could significantly help a company like ELST.

Overall, this is a pretty boring stock where future gains are limited but with solid downside protection. I’ll be keeping a close eye on an opportunity to sell if the price jumps significantly above the current asset value.

Disclosure

Long ELST