Company History

Founded in 1999, Tipp24 SE (TIM) was an early pioneer of online lotteries in Germany and other European countries. The original business model had Tipp24 serving as an online broker to the German state lottery, essentially funneling lottery ticket sales through an online interface and keeping a 10% markup fee.

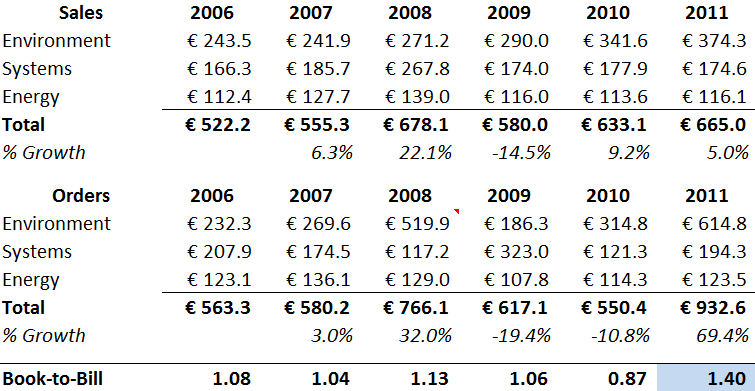

From 2002-2008, the number of subscribers grew from 0.4mil to 2.5mil (28% CAGR), as Tipp24’s market share rose to 60%.

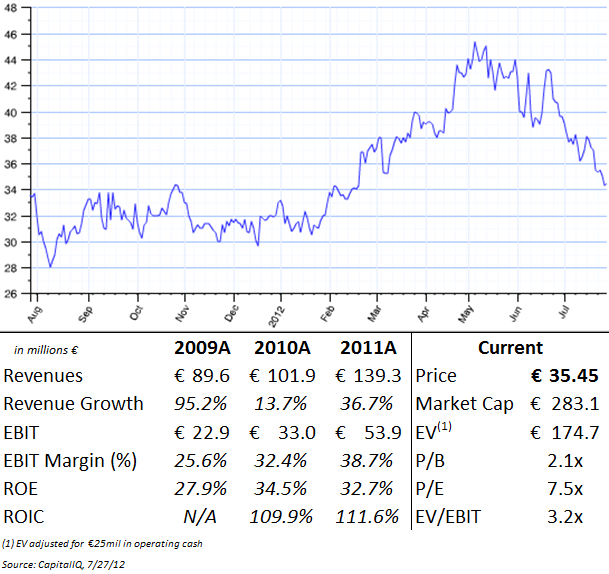

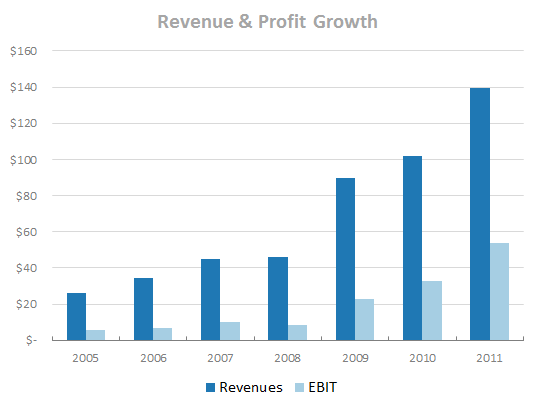

The stock went public in 2005, and has turned in a remarkable run since, with revenues and EBIT rising nearly every single year (a small EBIT dip in 2008 as the sole exception):

Legal Environment

But in 2008, the German government ratified the State Treaty on Gaming (GIStv), which banned all online lottery brokering and advertising. This basically eliminated Tipp24’s core business, and management had to scramble to come up with a new strategy. The company ended up applying for a gambling license to begin operating secondary lotteries via a UK subsidiary.

In September 2010, the European Union proclaimed that the GIStv violated European law, and that Germany would need to submit a revised treaty.

Then in 2011, one of the German states, Schleswig-Holstein, broke off from the others and ratified its own state treaty to allow online lotteries starting in 2012 – meanwhile, the new GIStv is still making its way through the court system for the rest of the country.

While the lottery ban seems unlikely to stand forever, it has cost Tipp24 millions of euros in legal fees and lost business.

The legal situation remains complicated in Germany, but fortunately Tipp24’s management team finally decided to spin-off the old brokerage segment into a new company, Lotto24 AG (ticker: LO24), which began trading on July 3, 2012.

This action separates the legal fight in Germany from the UK operation, and it’s the UK business which will be the focus of the investment thesis. Despite all of the controversy and legal battles in the home country, the UK operation has thrived.

(To try to avoid confusion, the use of “Tipp24” and “company” references the new standalone UK business)

UK Business Overview

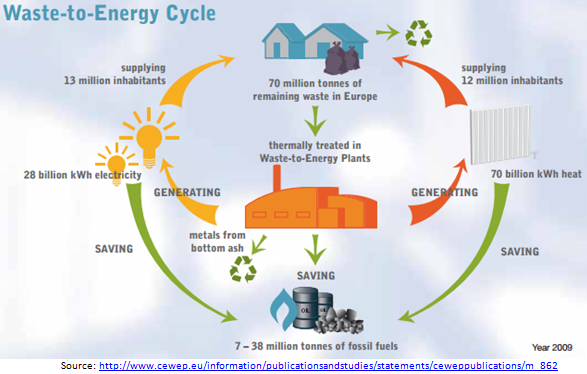

Tipp24’s UK subsidiary, MyLotto24 Ltd. (not to be confused with Lotto24, the new spin-off), operates a secondary or “virtual” lottery, allowing players to participate in lotteries such as the EuroMillions and German “6/49” lotteries.

Essentially, customers are “betting” on the traditional state lottery – keeping the same odds of winning the possible jackpot, but without having to physically go to the store and purchase a ticket. Tipp24 bears the risk if the jackpot is hit, but crucially, only pays if one of their customers is the winner.

The payout ratio is set at 50%, so Tipp24 keeps the difference between the price it charges for the lottery ticket and the expected payout, and then subtracts out a 15% UK gambling tax and any hedging costs to produce its overall profit.

Investment Thesis

#1) Attractive business model with high margins and free cash flow with little reinvestment requirements

Tipp24’s product offering is entirely online, and this asset-light business model is reflected in 2011 gross and net margins of 57.6% and 27.5% respectively.

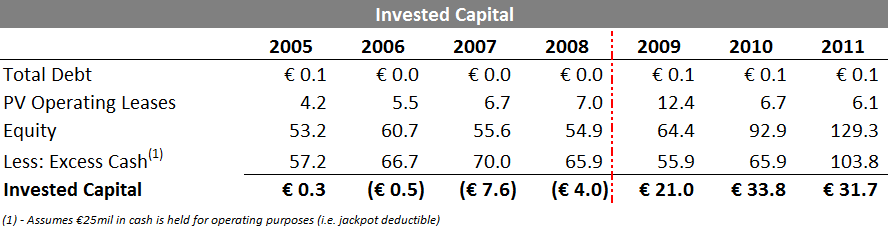

Historically, the old brokerage model operated with negative invested capital.

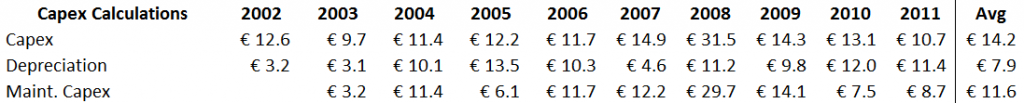

In order to start-up the UK operation from scratch, management invested ~€30mil over the last four years, mostly in software upgrades. Total capital expenditures, including software and PP&E, were €36.5mil or roughly €9mil per year.

Even with this start-up investment, Tipp24 generated €54.3mil of EBIT (€38m after-tax) with only €31.7mil in invested capital. ROIC is more than 100% – this is a phenomenally profitable business:

Management is forecasting total capex (including software) of only €3-5mil in both 2012 and 2013. Since software assets are amortized over four years and make up the majority of Tipp24’s non-cash invested capital, amortization will likely exceed reinvestment needs and ROIC should improve.

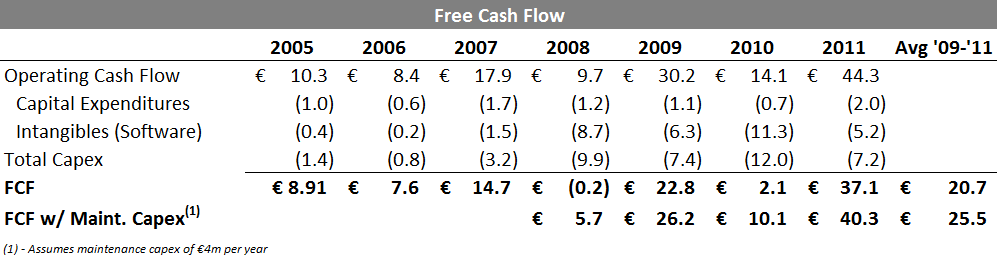

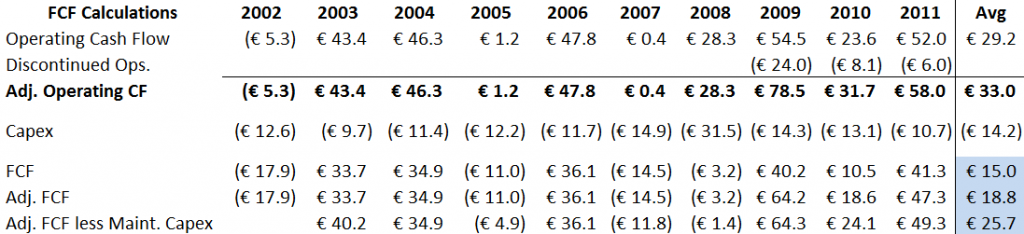

Limited capital requirements also mean that the company has significant free cash flow available for share repurchases or dividends:

Even with the start-up costs, FCF has averaged €20.7mil over the last three years for a FCF yield of 7.3%, or 11.8% using estimated maintenance capex.

#2) Spin-off of German operations eliminates most of legal headaches, creating a catalyst (likely a large special dividend) within the next 12-18 months

Due to the legal situation, Tipp24 was forced to transfer control over its UK subsidiary, MyLotto24 Ltd. In effect, the company was trying to segregate the UK operations – running successfully since 2007 without political pressure – from the legal situation in Germany.

To accomplish the split, 60% of the preference shares in MyLotto24 Ltd. were sold to a Swiss foundation, as a way to show independence to German regulators. Importantly, Tipp24 retained a call option to repurchase the shares of Mylotto24 Ltd. from the Swiss foundation for £30k, and therefore can regain full control over the UK subsidiary at any time.

Once the corporate structure is simplified, the parent company would then have access to the subsidiary’s cash balance of €133.5mil, 47% of the stock’s current market cap.

A substantial amount of that cash would be excess, even considering the requirement to keep cash on hand to pay the deductible, so a large special dividend is likely in the next 12-18 months.

The company did pay a €0.50 per share dividend back in 2008/2009, equivalent to roughly 65% of EPS – that same payout percentage would result in a dividend per share of around €3.00 (an 8.5% dividend yield).

#3) New hedging mechanism improves cost structure, leading to potential margin improvements

Historically, Tipp24 hedged its jackpot exposure in two different ways:

– Via an insurance contract for the German “6/49” lottery, which kicked in for any jackpot payouts over €10mil

– Via “native hedging” on the EuroMillions and other lotteries, which meant buying a ticket with the same numbers and earning a profit through markup and distribution fees

In September 2011, the company announced a new hedging mechanism with the issuance of a three year €70.5mil catastrophe bond (CAT bond). This bond transfers the payment obligation to a third party while having Tipp24 retain the first €22.5mil in jackpot payments (i.e. its annual ‘deductible’).

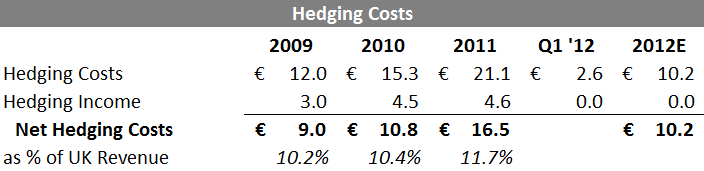

Essentially, the new bond allows Tipp24 to eliminate native hedging whenever the EuroMillions jackpot is less than €50mil – before, the company had to hedge every ticket sold regardless of the jackpot size. These hedging costs were significant, running around 10-11% of UK revenues:

Through Q1 2012, hedging costs have fallen 49%, from €5.0mil to €2.6mil – annualizing this figure results in a FY cost of €10.24mil, for a savings of €6.3mil.

This new strategy could boost EBIT by €5-6mil in 2012, without any growth in the number of players or popularity of the EuroMillions product, which seems conservative.

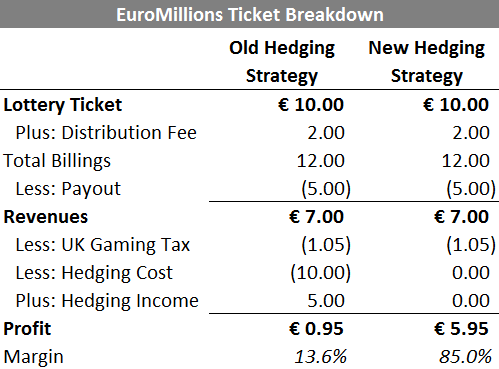

To make the benefits clear, here is an estimate of the economics of the EuroMillions lottery ticket, under the new strategy (i.e. no natural hedging required):

While not representative of true margins (there are other direct expenses, and the company will have to hedge tickets anytime the jackpot is over €50mil), it does showcase the benefits of this new strategy.

Valuation

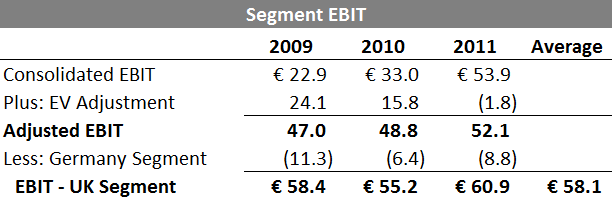

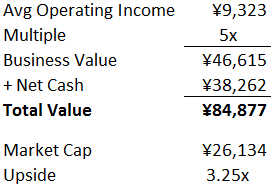

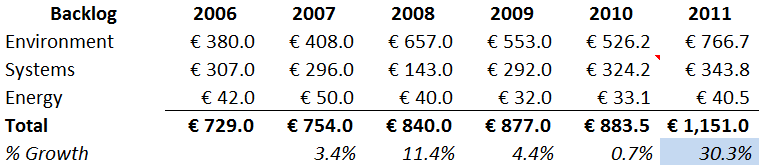

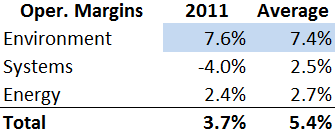

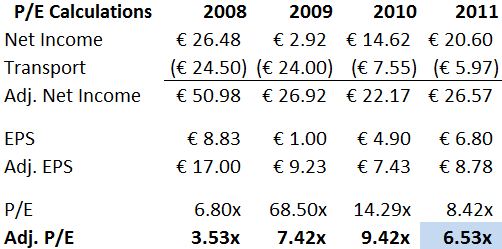

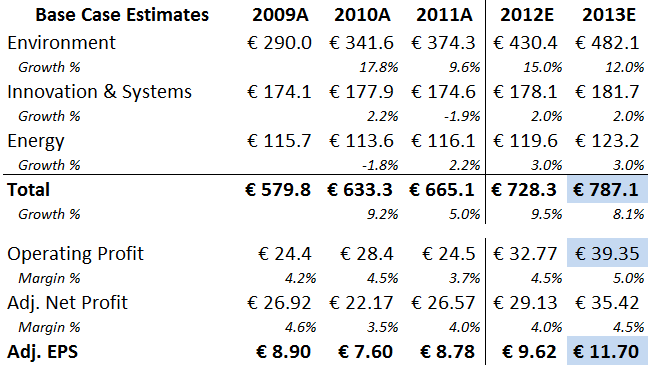

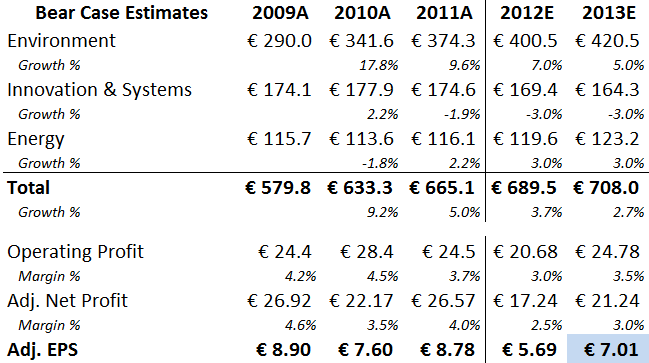

Due to the legal uncertainty, the Germany segment posted €26.5mil in operating losses over the past three years, which must be removed for the new standalone company.

In addition, statistical fluctuations should be excluded to get a better picture of the UK’s earnings power, assuming the “average or expected” result:

Management is forecasting revenues of at least €130mil and EBIT of €35mil for 2012.

However, this EBIT forecast builds in a €10mil buffer for statistical fluctuations, so the true EBIT forecast is €45mil. Even this number seems conservative considering:

a) the potential cost savings from the new hedging strategy

b) the spin-off of the costly Germany segment

c) any growth from re-focused operations and management attention

2011 earnings were skewed upwards by an insurance payment, counterbalanced by charges for the C-bond issuance, costs related to the spin-off, management changes, etc.

Let’s say that normalized earnings are €50mil per year – or €35mil after-tax.

With limited reinvestment needs, net operating profit after tax (NOPAT) matches up almost exactly with free cash flow.

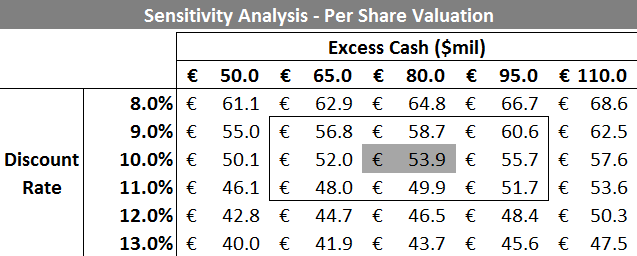

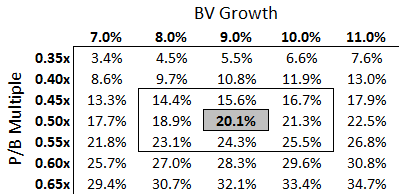

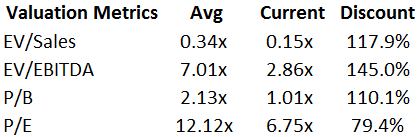

Capitalizing the €35mil number at a 10% discount rate yields a no-growth value for the operating business of €43.83/share, or 24% upside from the current stock price. This valuation is giving no credit for all of the excess cash on the balance sheet, plus any additional growth opportunities.

Here are the upside scenarios at varying discount rates and estimates of excess cash:

Put another way, the base valuation of €53.85/share (52% upside) is consistent with 9.5x P/E, plus the ~€85mil in excess cash – a rather conservative multiple for such a profitable business model.

Risks

Regulated operating environment – Gambling and lotteries are heavily scrutinized activities, and Tipp24 runs the risk of legal or political changes which could negatively affect the business model.

Negative statistical fluctuations – Even with the new hedging strategy, the company is still on the hook to pay jackpots up to €22.5mil, and lottery results could run below expectation for an extended period of time. Unlike other business models, poor results can occur purely by chance.

Management turnover – The size of both the executive and supervisory boards have been changed several times – for example, Marcus Geiss was added in April 2011, but left prematurely in April 2012. The current CEO and co-founder, Dr. Hans Cornehl, has been involved with the company since 2002, although the other co-founder left in 2009. Current management holds less than 1% of shares.

Conclusion

Essentially, Tipp24’s business model is rather simple:

In exchange for €25mil in invested capital (basically cash that is set aside in the case of a jackpot payout), Tipp24 takes a cut of potential payoffs (50% ‘rake’ on each ticket, less the cost of hedging), for running a secondary lottery – which just so happens to be more convenient to play than the real thing.

This €25mil in cash sits in the bank and generates €30-35mil in after-tax proceeds each year. Not a bad return, and better than a savings account.

To some degree, this is still a ‘wager’ on Tipp24’s part (essentially betting that two large jackpots won’t be hit back-to-back for example), but the jackpot odds are so small that the risk/reward is skewed heavily to the positive side.

No wonder lotteries have been around for hundreds of years…

Disclosure

Long TIM, LO24