Maruka Machinery is another net-net stock in Japan, but it’s a business capable of producing mid-teens return on capitals and consistent book value growth far above its typical Japanese peer.

With a net cash balance almost equal to the current market cap, investors are basically picking up the business for free – the epitome of downside protection – while enjoying a mid-teens expected future return.

Company Introduction

Despite its name, Maruka Machinery does not manufacture machinery. Instead, it primarily serves as a trading and distribution company for other machinery manufacturers.

The company is divided into two business segments:

Industrial Machines – includes machine tools, injection molding machinery (maybe CMT bought some from Maruka?), agricultural equipment, lathes, food processing equipment, etc.

Construction Machines – includes cranes, excavators, compressors, pile drivers, augers, etc.

The company has been in business for more than 60 years, and has built up a global distribution networking which includes 17 offices through the U.S. and Asia. This global reach helps local Japanese manufacturers reach international customers.

With a local presence in each geographic location, Maruka also offers “before-and-after service” for the equipment it distributions – for example, the company has 8 technical centers in the U.S. alone, a service that local Japanese manufactures are unable to offer their customers alone.

Financial Overview

Maruka has a long history of profitability, recording both an operating and net profit in every year going back to at least 1997. Cash flow has been consistently positive as well, with operating cash flows running approx. 140% of net income over the past ten years.

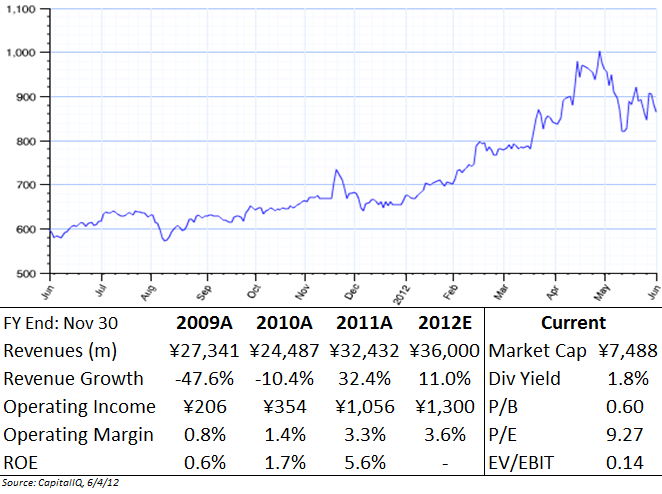

Revenues are cyclical in nature, touching a high of ¥52,167m in 2008 before falling more than 50% during the recession.

2009 and 2010 were especially difficult as ROE fell under 2%, well below the company’s long-term ROE of 8.3%.

However, revenues have shown a steady increase since the recession, and management is expecting double digit growth in both revenue (to ¥36,000m) and operating income (to ¥1,300m) for FY 2012.

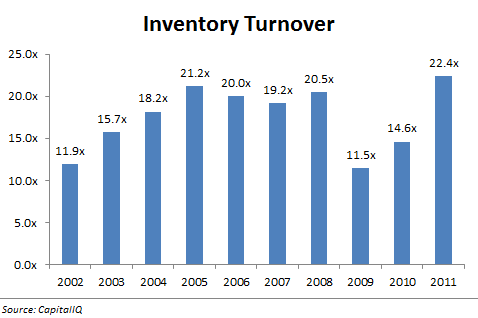

These improving business conditions are also reflected in how fast Maruka turns over its inventory, a key metric for distribution companies that are moving equipment for customers:

The latest turnover of 22.4xis the highest in the past ten years, showing that the company is quickly moving the product it gets from its suppliers.

Investment Thesis

Unlike many of my other write-ups, the investment case for Maruka is simple: it’s a good business at a very cheap price.

But before going into the valuation, here are some other investment positives:

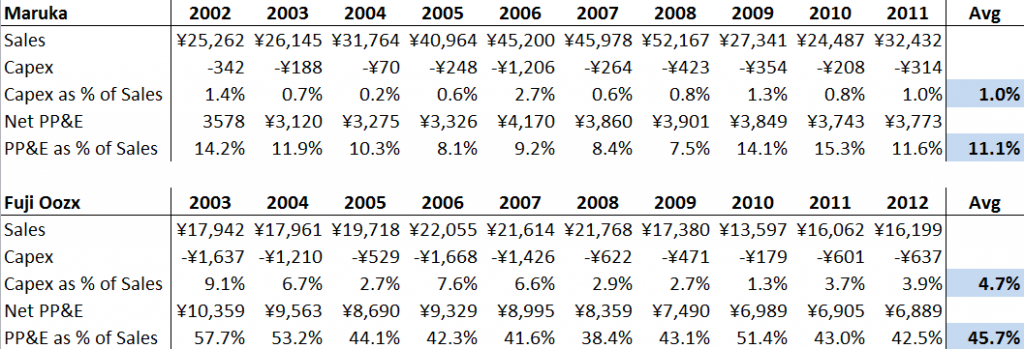

1. Asset-light business model – Unlike manufacturing companies, Maruka requires little in the way of PP&E, and therefore has to invest much less capital to operate the business.

By comparison, here are Maruka’s numbers against Fuji Oozx, another Japanese net-net which manufactures auto parts:

While the market caps for the two companies are similar, Maruka is producing twice the sales on only ¼ the PP&E. In addition, Fuji requires almost 5x the amount of capex investment each year for an equivalent amount of revenue.

2. Negative cash conversion cycle – Since in 2005, Maruka has enjoyed a negative cash conversion cycle, which describes the cash flows between accounts receivable, inventory, and accounts payable.

With a negative number, Maruka is effectively receiving an interest-free loan from its customers that can be reinvested in the business.

In the past 7 years, this negative cycle has averaged -28.1 days, meaning Maruka has been able to use its suppliers’ cash for almost a month, interest-free.

In Warren Buffett’s 1996 “Owner’s Manual” on investing in Berkshire stock, he describes these interest-free loans as having

“they are liabilities without covenants or due dates attached to them. In effect, they give us the benefit of debt – an ability to have more assets working for us – but saddle us with none of its drawbacks.”

He was talking about float and deferred tax liabilities, but the concept is similar, and this dynamic provides a competitive advantage for Maruka.

3. Export-heavy business – There has been many concerns about the strength of the yen, which has stayed strong despite concerns over the Japanese economy.

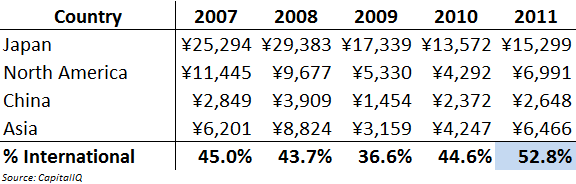

Here’s a table breaking down Maruka’s sales by country over the past 5 years:

Although exports have always been a significant portion of total sales, they passed 50% of the total in 2011 for the first time. While the Japanese market is still significantly below its all-time highs, the company has seen a large fall in its second largest market, North America – a decline due in part to the strong yen.

Many experts are predicting that the yen will weaken over the coming years, which will help boost international sales for Maruka and other Japanese exporters.

As a U.S. investor, improved performance by exporters in a declining yen scenario serves somewhat as a proxy for a yen ‘hedge’ on the underlying currency.

Valuation

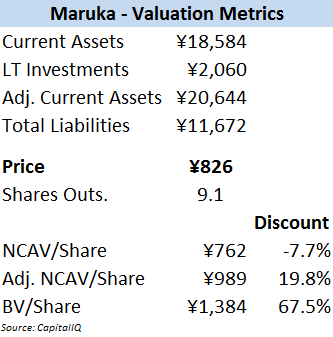

As with my other Japanese investments, Maruka is cheap on nearly every valuation metric:

While Maruka doesn’t fall into the strictest definition of net-net investing (Current Assets – Current Liabilities) the company also has ¥2,060 in LT investments (i.e. bonds) that are included in the adjusted NCAV calculation.

Regardless, the company is extremely undervalued, especially compared with its long history of profitability.

While Maruka isn’t quite as cheap as some other Japanese net-nets, I prefer it for several reasons:

– Despite being way overcapitalized, the company earnings a decent ROE (at least for Japan), with an average of 8.3% over the past ten years. At 0.7x of book value, the expected future return is almost 13% – if business results improve as expected, this should end up far higher.

– Maruka has exhibited growth in the past and has proven the ability to deliver revenue and profit figures 50% or more above current levels – basically, there is room to grow. Many other Japanese net-nets have not demonstrated this ability.

– Along with top-line growth potential, Maruka’s business model allows it to deliver above average ROIC – 16% on average over the past ten years. Although cyclical, this is a good business, capable of earning extremely high ROIC of 25%+ during upswings.

Conclusion

Some of my other recent investments in Japan are even cheaper than Maruka (both on a balance sheet and expected returns basis), but there are several aspects of Maruka’s business (export-heavy, asset-light model) that are attractive given the current economic and political situation in Japan.

In fact, there are other Japanese net-nets that are even cheaper than my holdings, but many of them are subpar businesses earning 1-2% ROE per year – those businesses are consistently profitable, but the income statement looks more or less like it always does, and there is no growth.

If it’s a choice between a quality business at $0.60 on the dollar vs. a below average but consistently profitable business at $0.40 on the dollar, I’m choosing the former.

Stay tuned for several other Japanese ideas.

Disclosure

Long Maruka Machinery

Nice work!

Did you learn about this stock from your screener before digging deep into the company filings? Just trying to see how you generate your ideas.

For Japanese stocks, what’s your primary source of info/data because most of the corps issue their reports and filings in Japanese?

Yes, I use CapitalIQ to run all of my screens. I rely heavily on the financial statements / info CapIQ provides, along with a heavy dose of Google Translate. However, I’m mostly using a quantitative approach over there, hence the net-net strategy – if a stock is trading for less than net cash and is consistently profitable, I don’t need to know much about the competitive position or strengths of the business model to know that its undervalued (in the vast majority of cases)

Not knowing the specifics, I also diversify my bets across 4-5 Japanese stocks, and hold smaller individual positions.