Buying companies at a discount to their net asset value is a strategy that has outperformed the markets for decades.

2008/2009 provided an amazing opportunity for net-net investing in the U.S., but most of the bargains have now disappeared, and the current qualifying stocks are unattractive, ugly businesses.

After making the switch to Interactive Brokers, I now have access to the world’s stock markets, and have actively been trying to diversify my holdings internationally.

Investing abroad provides a host of challenges – accounting variations, currency risk exposure, language barriers, etc. – so sticking with a proven, mechanical strategy such as net-net investing is the easiest pathway into new markets.

And there is no other place in the world with more quality net-nets than Japan.

Fuji Oozx (7299:TYO)

Fuji Oozx is a Japanese maker of engine valve components used in the auto industry. It has been in business for almost 60 years.

I came across the stock using a new screener, Screener.co, that is the best global stock screener on the marketplace (note: affiliate link)

Fuji has several operating subsidiaries and is partially owned by Daido Steel, one of the world’s largest manufacturers of specialty steel ($2b market cap).

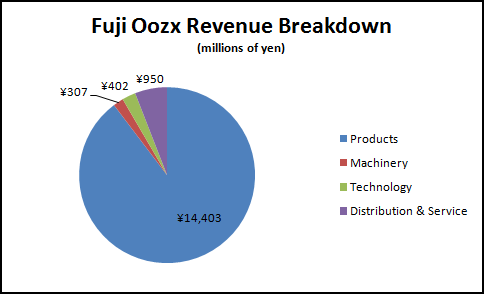

The company operates in four business segments:

“The Product segment manufactures and sells engine valves and others, as well as manufactures molds through one of its subsidiaries. The Merchandise (Machinery) segment sells mechanical equipment and jigs. The Technology segment is involved in the licensing of technology to its associated companies. The Distribution and Service and Others segment is involved in the transportation of its products, as well as the provision of employee welfare services. “

The Products segment makes up the majority of revenues and profits.

Financial Information

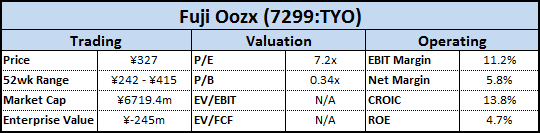

Results for the year ended March 31, 2011 were reported a few weeks ago. Revenues jumped 18%, to ¥16,062 million, as Fuji was one of the few net-net stocks showing significant revenue improvement.

These results were driven largely by a 17.2% sales increase in the Products segment, although all four operating units reported gains for the year.

Historically, the business is capable of producing revenue in the ¥20,000-22,000 million range (as evidenced by 2006-2008 results), leaving additional room for top-line growth.

Operating income jumped to ¥1,803 million, an increase of 141% from ¥746 million in the previous year.

Profits were down significantly in 2009 and 2010 as Fuji faced reduced demand from auto manufacturers during the worldwide recession.

The strong increase in operating profit led to operating margins around ~11%, a sharp increase from the 6% average margins from 2008-2010, but consistent with the company’s margins in the boom years of 2005-2007.

Operating cash flow is strong at ¥2,314 million, and the company has generated positive free cash flow for at least the past six years.

For fiscal year 2011, free cash flow (using owner earnings) was positive ¥998 million, for a FCF yield of almost 15%.

Balance Sheet

While the positive operating results are a great sign, the investment thesis relies heavily on the balance sheet.

At current prices, Fuji Oozx is trading for less than net cash, meaning the operating business is available for free.

The most recent year shows a cash balance of ¥6,964 million, compared to a market cap of roughly ¥6,719 million, meaning the market is assigning a negative value to the operating businesses.

This translates into an enterprise value of negative ¥245 million yen…for a business that has produced an average operating income of ¥1,728 million for the past ten years.

Net Current Asset Value (NCAV) is ¥11,254 million, so the stock is currently trading at only 60% of its NCAV value.

It just so happens that Ben Graham’s original rules on investing in net-nets called for at least a 33% discount to NCAV, so Fuji Oozx qualifies under even the strictest definition of net-net investing.

Book value is ¥965.75 per share, translating to a ridiculously low P/B of 0.34x.

Over the past 6 years, book value has grown at 4.15% while shares outstanding has remained constant at 20.5m.

Valuation

For a Japanese company, Fuji Oozx actually has decent operating ratios. TTM ROE is 4.7%, held back by the excess cash balance, but CROIC was 13.8%.

A traditional multiple-based valuation metric (such as EV/EBIT or EV/FCF) doesn’t provide much insight since the stock currently has a negative enterprise value.

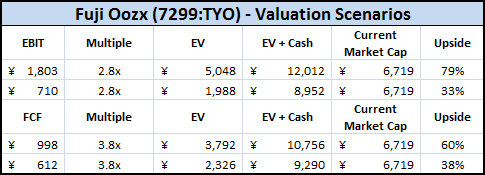

But looking at the past 6 years of financial results, Fuji Oozx’s EV/EBIT and EV/FCF multiple has averaged 2.8x and 3.8x respectively.

Here are several valuation scenarios, using both 2011 results and 2009 results (Fuji’s recession-low):

It doesn’t make sense to spend a great deal of time on valuation scenarios – at these prices, Fuji Oozx is ridiculously cheap.

Risks

Even so, there are certainly risks to investing in Fuji Oozx.

Earthquake

Obviously the Japanese earthquake has caused severe disruptions throughout the region, with an economic cost in the hundreds of billions of dollars.

It doesn’t appear that Fuji’s Oozx locations were damaged in the quake, but it has caused problems with some of the company’s major customers.

The full financial outcome of the quake probably won’t be known for several months, as it occurred too late in the quarter to impact the most recent results – there is a chance that Fuji’s results could be materially lower.

At this time, the company is not making any predictions, as results are still uncertain and difficult to predict.

Fuji USA Liquidation

The latest annual report also shows that the company decided to close down its USA subsidiary, which has been in operation since 1994.

I couldn’t get a good sense of why the decision was made, but the company already took a ¥130 million charge related to the liquidation.

Subsidiary Problems

Fuji also announced a ¥221 million charge related to bad loans in the company’s Shinhan Valve subsidiary. I was unable to determine whether this charge has already been taken or if it will apply to next period’s results.

While this revelation is a yellow flag around the company’s internal controls, Fuji has several subsidiary companies, the backing of a major steel corporation, and a long track record in Japan.

I view this revelation as an isolated incident which doesn’t materially affect the investment thesis – it hardly makes a dent in the company’s cash balance.

Currency

Finally, I invested directly in the stock on the Tokyo stock exchange, meaning I had to convert US dollars into Japanese yen. The exchange rate between the dollar and yen is roughly 1 USD = 82 yen.

The historical exchange rate is probably closer to 1 USD = 110 yen.

If the exchange rate moves closer to its historical average, it would cause a loss on the currency part of the transaction.

Conclusion

Even with an overvalued currency, Fuji Oozx and other Japanese stocks are substantially cheaper than their U.S. counterparts.

Fuji Oozx could likely see results suffer in the next period or two, as the auto manufactures and the rest of Japan suffer from power outages and lower output as a result of the earthquake.

Full productivity is unlikely to return until later this year.

But the company has been in business for 60 years and, despite the short-term setbacks, will likely remain in business going forward.

Some value should be assigned to a profitable operating business.

This is a great example of Mr. Market mispricing a public security – no rational seller would ever let go of a piece of a profitable operating business for free.

As for the currency, there are several options to hedging this risk, but I’ve decided to let mine ride for now.

All of my assets, as well as my retirement savings, job, car, household possessions, etc are all based in U.S. dollars and I’m not very bullish on the dollars prospect’s going forward.

Therefore, some currency diversification is prudent.

From a portfolio perspective, I’ve set aside 10-15% of my portfolio to invest in Japan, and will likely spread that money over 3-4 companies.

Investors have been losing money in Japan for 20+ years, but as a value investor, you just don’t get too many chances to pick up profitable businesses at these prices.

Disclosure

Long Fuji Oozx (7299:TYO)