Since starting this blog back in May, I’ve profiled a number of undervalued companies and have invested in quite a few.

However, several stocks remained on my watch list despite a detailed analysis and writeup, primary because I wasn’t able to purchase shares with enough margin of safety.

Here are updates on a few stocks that remain on my watchlist:

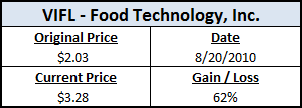

VIFL – Food Technology Inc.

I missed out on investing in VIFL back in August and the stock price has appreciated considerably despite no real news.

At the time, the stock wasn’t quite cheap enough to make an investment, especially since MDS Nordiron, the company’s largest shareholder, could continue liquidating its position at any time.

I didn’t see a near-term catalyst, but it looks like other investors jumped at the chance to pile into a unique business with a rock solid balance sheet.

The stock now trades higher than my estimate of intrinsic value, with third quarter earnings due out in the next week or so.

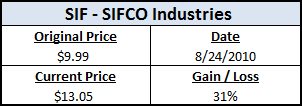

SIF – SIFCO Industries

I entitled the article on “SIFCO – A Contrarian Investment” as the business was struggling with depressed sales numbers due to weakness in its primary markets.

Barel Karsan, an investor and blogger that I admire, wrote a piece on SIFCO after my article was published entitled “Contraction Expansion.” Despite the current economic climate, management is spending almost $6m in capex (vs. a normal $2m) to expand the capabilities of the ACM group.

There is certainly risk to this strategy, as a prolonged recession could jeopardize the company if the business expansion doesn’t take off. However, if management is correct and the industry outlook is bright, SIFCO will be in an even better position to capture market share.

I think the company will probably suffer through another rough quarter of YoY comparables before it fully turns the corner, although the stock has been bid up significantly since my original article.

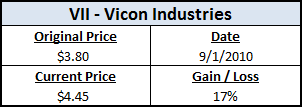

VII – Vicon Industries

VII’s stock has dropped almost 36% over the previous three years, as the industry is very cyclical. However, management compensation has fallen 54% in the same period, so management is not benefiting at the expense of shareholders.

Recently, Vicon announced the renewal of its employment agreement with the company’s CEO, Ken Darby, while also setting a performance based bonus plan.

The latest agreement sets Mr. Darby’s annual salary at $400k, the same as the last two years, with a bonus pool tied to hitting consolidated sales targets and performance metrics.

Aligning shareholder and management interests is definitely a positive sign for any micro cap stock.

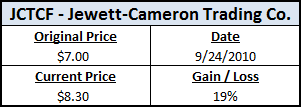

JCTCF – Jewett-Cameron Trading Company

JCTCF is a closely held company that has flown under most investors radar – management has largely went about its business and shareholder communication has been lacking.

In the last year, the policy has changed, starting with the implementation of a share buyback program in May. The program was further extended until Jan 2011.

More importantly, the company reported outstanding fourth quarter and annual numbers, with net income jumping almost 25% for the year.

I listed the management team as a possible risk in my original article (saying they control the majority of the company and have not necessarily been forthcoming with shareholders).

However, it’s hard to argue with results: management has grown book value by over 20% per year for the past 15 years.

Conclusion

This across-the-board price appreciation was certainly helped by overall gains in the market. The S&P is up about 11% in the past three months. As they say, “a rising tide lifts all boats.”

While I missed out on investing in these securities, I think most of them are financially sound businesses and I will continue to monitor a drop in stock price or new catalysts that could be the basis for pulling the trigger.

Disclosure

No positions.