Company Overview

Constructions Industrielles De La Mediterranee, or the CNIM Group (EPA:COM), is a French industrial conglomerate which traces its roots back to 1856 – see the full history here.

After a number of acquisitions and division realignments over the years, CNIM has rounded into its current form providing turnkey high-tech industrial solutions in three main areas:

Environment – includes the production and operation of waste-to-energy (WTE) plants, including component parts such as flue gas treatments

Innovation & Systems – includes government contract work (such as missile launch, sea landing, and bridging systems), nuclear parts manufacturing, and industrial research services

Energy – includes solar projects, rehabilitation of water treatment plants, and industrial boiler installation, cleaning, and maintenance

While the overall markets are large, the company goes after specific niches – according to the management team, the strategy is to “Become the leader in a certain number of selected niche markets” – a characteristic of many hidden champions.

This focus is demonstrated by the company’s description of several subsidiaries:

– “In the environmental sector, we are the European leader”

– “Babcock Wanson is European leader in construction of industrial boilers”

– “LAB is European leader in flue gas treatment for waste incineration”

Each business segment is characterized by complex projects requiring high-tech capabilities and engineering know-how.

CNIM is well-suited for the task of leading these niche technological markets, employing over 1200 engineers out of 3000 total workers – human talent is a real advantage when innovating and delivering on these complex projects.

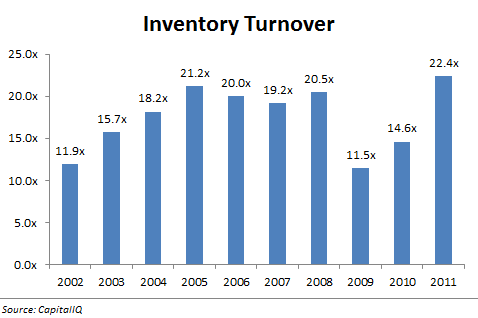

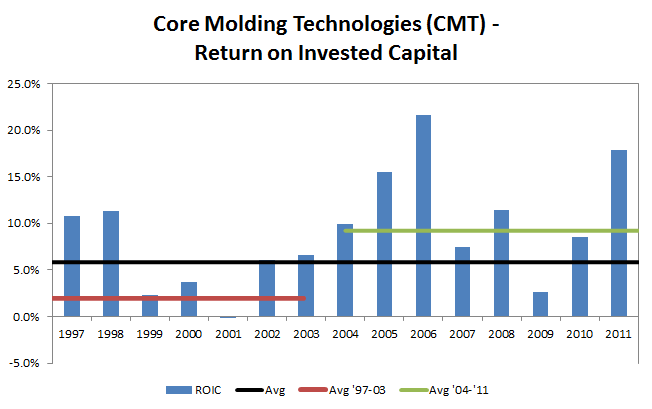

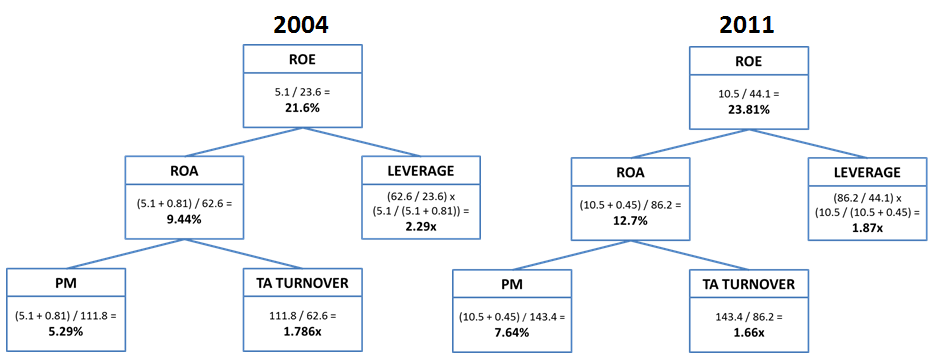

Another hallmark of a business with a competitive advantage is consistent and sustainable returns – over the past ten years, CNIM’s average ROE is nearly 20% despite maintaining a net cash position for the entire period.

Finally, while many projects are won through a one-time bidding process, CNIM also benefits from recurring revenue:

– After construction, many waste-to-energy plants are operated by CNIM for 20-30 years before the company turns the plant over to local governments.

– In the case of CNIM’s Babcock Wanson subsidiary (a key player in industrial boilers and part of the energy division), over 70% of revenues come from recurring service contracts.

The company’s long history and experience in France is reflected by the fact that former French president, Nicolas Sarkozy, gave his 2009 speech on economic recovery at one of CNIM’s sites.

WTE Industry Overview

Although all three business segments provide meaningful revenue, the Environment division provides the bulk of the profit and is what the company is typically known for – a big portion of this segment is focused on the waste-to-energy (WTE) market.

Active in more than 20 countries, CNIM has built over 140 waste treatment plants around the world in places such as Brussels, London, Paris, Turin, New Jersey USA, and Azerbaijan.

Although there is often public outcry from environmentalists and citizens regarding these plants, industry research and scientific studies have backed incineration as a valid method for dealing with municipal waste – it is also classified as a renewable energy source.

According to the company’s reports, waste incineration is

“…by a long way the cleanest, most efficient and most tightly-controlled industry in Europe, with extremely well monitored residual emissions whose effects on health and the environment in general are recognised as negligible”

Although recycling is still the preferred method for waste management, as much as 60% of municipal waste cannot be recycled or reused in a valid way.

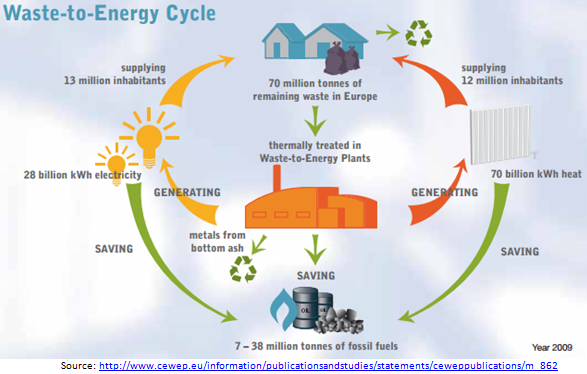

Here is an infographic that explains the waste-to-energy cycle:

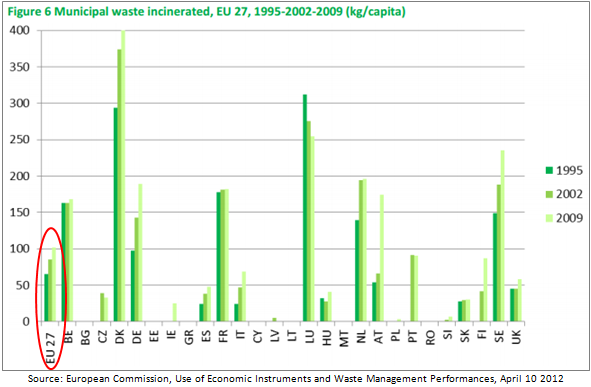

Across the EU27, over 400 such waste-to-energy plants are currently operating (implying a market share for CNIM of 30-35%) – these plants incinerate approximately 22% of total municipal waste and the volume of waste incineration is rising:

However, many countries within the EU27 still have little or no incineration plants, an untapped market for CNIM – one study has the WTE technologies market growing from $6.2B to $29.2B by 2022, or 17% per year.

CNIM’s leadership position in this market was validated in 2010, when the company was recognized as an official partner of the EU’s “Sustainable Energy Europe” campaign for its work in constructing six new energy-to-waste projects.

Investment Thesis

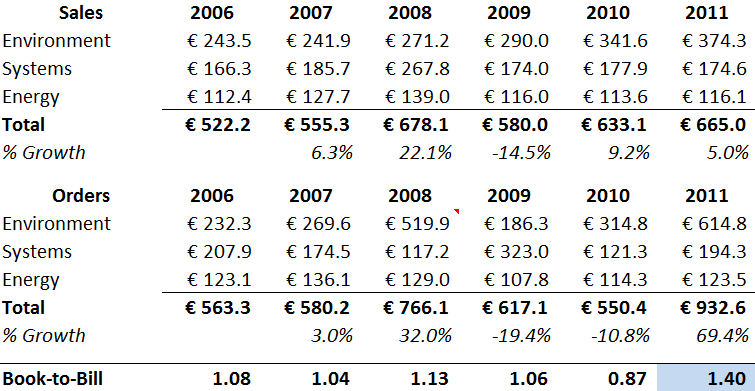

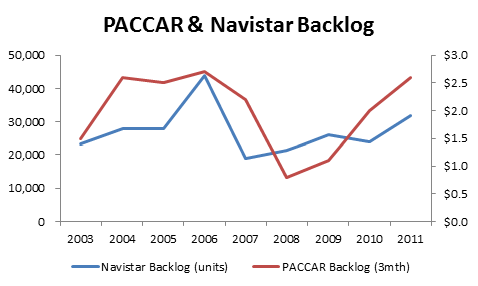

1) Record backlog and book-to-bill ratio points towards continued revenue growth in 2012, while shift in sales mix towards higher margin Environment business will boost profits

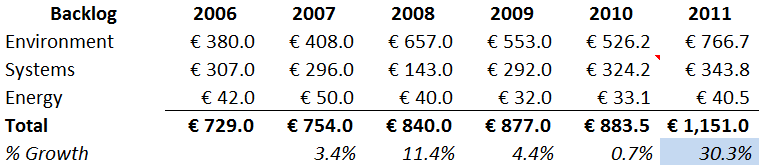

At the end of 2011, CNIM’s backlog stood at €1,151m, the highest end of year backlog in the company’s history and a 30% jump over 2010.

While backlog grew 30%, sales were up only 5%.

Assuming the company can successfully handle the additional business, this divergence in growth rates for sales vs. backlog represents significant revenue potential for CNIM through 2012 and 2013:

At the end of 2011, CNIM’s book-to-bill ratio was 1.4, 35% higher than the company’s long-term average of 1.04, once again signaling pent-up demand.

Based on Q1 2012 numbers released in May, the strong flow of orders has continued, with backlog rising to a new record of €1290m, 58% higher than the average backlog from 2006-2010.

Although the market is worried about CNIM’s exposure to Europe, these order numbers should lead to significant revenue growth over the coming year or two.

In addition, a closer examination of the backlog mix points towards a shift towards higher margin business lines.

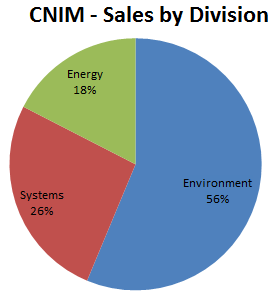

Here is a breakdown of the company’s sales in 2011:

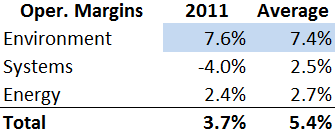

Although Environment business made up 56% of 2011 sales, it represented 71% of total backlog at the end of Q1 2012. Importantly, this division has margins that are almost 3x higher than the other two segments:

This percentage shift should push up the company’s overall margin, resulting in increased operational leverage and improved EPS as revenues rise in 2012-2013.

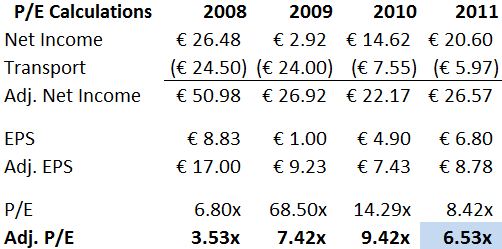

2) Discontinued operations have obscured the company’s true earnings power, causing the stock to be overlooked by casual investors

In 2009, the company went through a mini restructuring in response to a €7.8m operating loss.

The supervisory board fired the old management team and decided to divest the Transport business (a maker of heavy duty escalators), a segment which had lost money in the previous three years.

Since the decision to sell, the company has managed to liquidate, transfer, or sell a number of the units within the Transport division, but the process has dragged on (the segment had included 9-10 separate companies/subsidiaries, representing over €100m in sales).

While the Transport division was classified as discontinued operations going back to 2008, a quick glance at the bottom-line earnings number without adjusting for this fact shows a markedly different picture of the company’s valuation:

While some websites display the adjusted figure, others show a P/E in the 8-9x range, which could cause investors to overlook the stock while using basic screening methods.

3) CNIM’s contract-based and complicated business creates lumpy cash flow figures, despite an attractive double digit FCF yield based on normalized or average figures

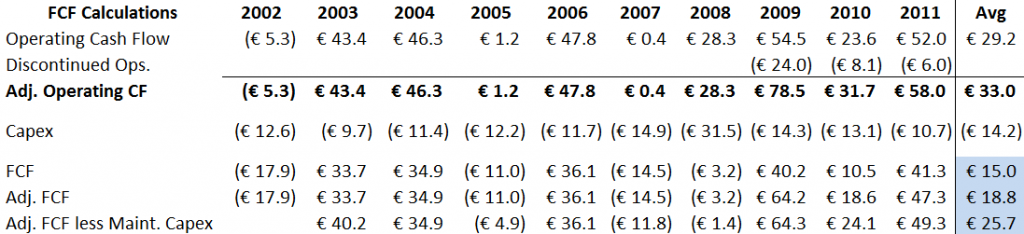

In 2011, CNIM reported €52m in operating cash flow offset by €10.7m in capital expenditures, which translated into €41.3m in FCF. With a market cap of €179m, that equates to a FCF yield of 23%.

However, CNIM’s working capital and operating cash flow can shift dramatically from one period to another, depending on the timing and collection of payment for its projects.

For example, a single large order (such as the €346m order to build a waste incineration plant in Azerbaijan in 2008) can cause dramatic swings in the company’s working capital.

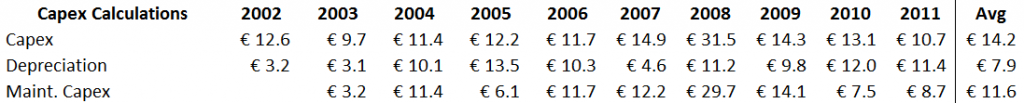

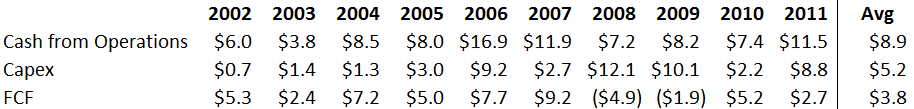

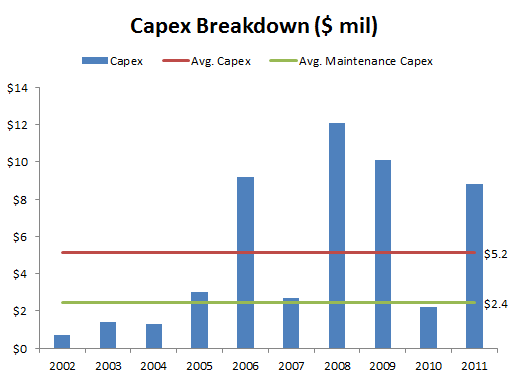

Therefore, it is helpful to look at the average cash flow generation of the business over a longer time period.

While CNIM is not a high growth company, capex has outstripped D&A over the past ten years, implying that management has invested back into growth opportunities – an estimate of maintenance capex results in an even lower figure:[1. Maintenance capex was calculated using the Greenwald method of estimating growth capex based on % of PP&E necessary to support revenue growth. See explanation here ]

The impact of the Transport division has also affected the company’s cash flow figures – over the past three years, the company has spent €38.1m in cash on discontinued operations:

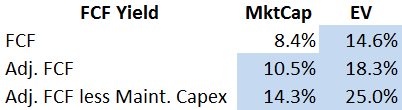

Average FCF yield ranges from 8.4% to 25% depending on whether a market cap or EV-based denominator is used – all but the most conservative combination clears a 10% hurdle rate:

Given the current rate environment, any of these FCF yield scenarios is attractive.

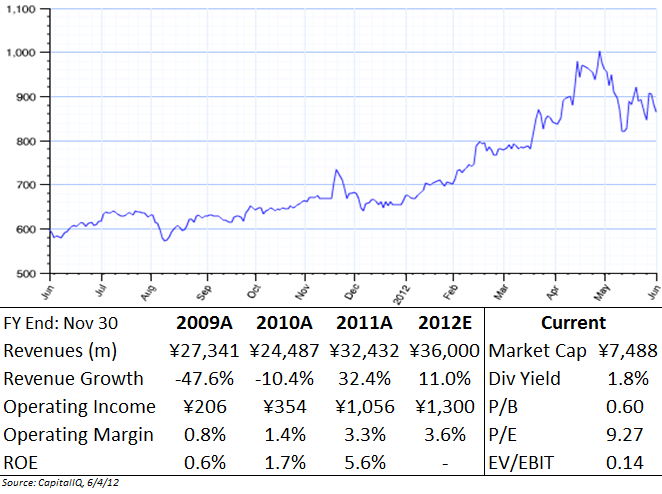

4) Business/management has impressive track record of creating value, while the depressed valuation due to Euro crisis presents a buying point far below long-term averages

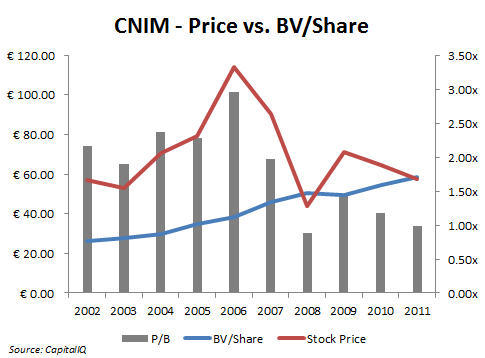

In the past ten years, CNIM’s management team has been able to growth BV/share from €26.30 to €58.50, for a CAGR of 9.3%.

While this number is good given the time period, it is even more impressive considering the company has paid a large dividend (averaging 40% of total earnings) for a dividend yield of 4-5%.

Looking at it another way: starting from a BV/share of €26.30 in 2002, CNIM paid out dividends/share of €26.00 over the next ten years.

Hypothetically, if an investor picked up shares at BV/share of €26.30, collected the interim dividend payments, and then sold out at the 2011 BV/share of €58.54, the resulting IRR would have been 17% over ten years.

While this exercise shows how management has created value, it is only hypothetical, as the stock price was actually flat from 2002-2011 due to a contraction in the stock’s P/B ratio.

Here is a chart showing the stock price, book value per share, and P/B ratio at the end of each of the past ten years:

Despite improving operating results and a steady growth in book value per share, the stock price has been volatile and has not recovered much from the recession lows – the P/B ratio continues to hover around 1x.

At near book value, an investor is picking up a business that has earned an average ROE of 20% over the past ten years, for an implied future return of almost 19%.

Valuation

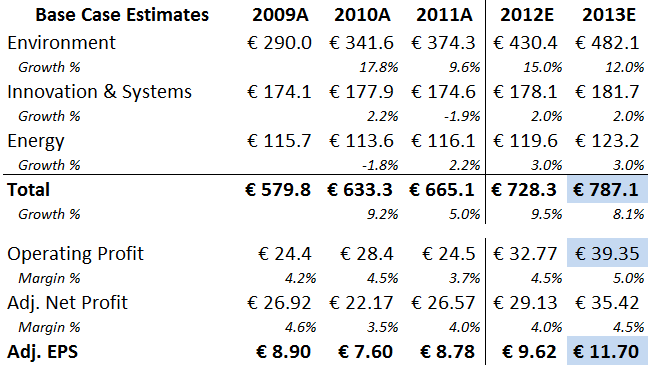

In the base case scenario, CNIM generates almost €800m in revenue, operating income of nearly €40m, and EPS of almost €12.00 by 2013.

Assigning a 10x multiple (below the LT P/E multiple of 12x) on this forecasted 2013 EPS would result in a per share price of €117, or 97% upside.

In addition, with the inclusion of expected dividends, the 2-year IRR would be 49% per year.[2. Assumes collection of FY2011, FY2012, & FY2013 dividends. Ex-dividend date for FY2011 is June 29, 2012]

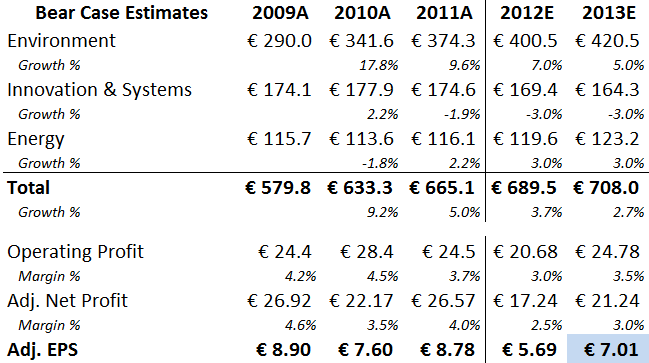

In a bear case, the backlog does not translate into the corresponding sales growth, margins compress further due to project cutbacks, competition, and discontinuation of defense programs, while the P/E multiple stays at its depressed level of 7x:

Even in this extreme example, the share price falls to €49.10, but with dividends included the two-year IRR is still 1.2%, or basically breakeven.

With the company reporting sustained growth in orders and backlog, the likelihood of this scenario seems remote.

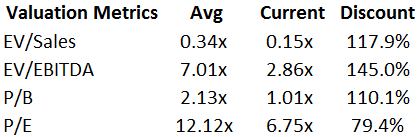

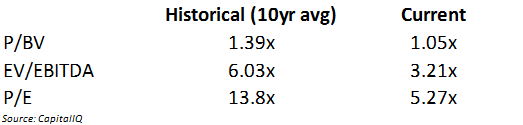

More simply, if the stock just returns to trading near its historical averages, the upside is substantial:

Risks

1) Growth via acquisition creates risk – CNIM has made a number of acquisitions over the years, and intangibles make up roughly 30% of total equity. Most of the recent acquisitions were small however, and goodwill impairments were negligible even during the depths of the recession.

In 2008, CNIM purchased the Bertin Group for €17.2m (€7.1m in goodwill) – the next year, Bertin had sales of €47m and net income of €5.9m, implying a transaction value of only 3x NTM earnings, a good deal.

2) Uncertainty over new French president – Reform policies by the new president of France, François Hollande, could affect CNIM’s businesses, especially in the Innovation & Systems division, which is tied to government spending and defense contracts.

Hollande has pledged to reduce the budget deficit to zero by 2017, which could entail defense cuts. On the other side, he has also pledged to reduce French dependence on nuclear power in favor of renewable resources, which would boost CNIM’s waste-to-energy business.

3) Family-owned stock with small float – CNIM is a closely-held company with only 29% of shares available to the public. Therefore, liquidity and common shareholder representation could be a concern.

37% of shares are held by the Herlicq and Dmitrieff families, who have family members represented throughout the management team and supervisory board, and have long histories with the company.

Conclusion

Barring a complete and catastrophic meltdown in Europe, the markets are providing an opportunity to pick up a well-run business well below its valuation averages – and near lows not seen since the depths of the 2008/2009 recession.

Not only are investors receiving a double digit FCF yield and a healthy dividend payout, but if the growing backlog translates to the anticipated sales/earnings growth, CNIM should provide an attractive IRR over the next several years.

Disclosure

Long CNIM