Pinnacle Gas Resources (PINN) is a micro-cap stock that holds natural gas properties in the Powder River Basin of Wyoming and Montana. The company leases approx. 406k gross acres of undeveloped land and 15 billion cubic feet (bcf) of proven natural gas reserves.

The company has reported large operating losses for the past three years, with 2009 being especially brutal. PINN reported a net loss of $68.75m as natural gas prices dropped significantly, from an average of $6.24/Mcf in 2008 to only $3.07/Mcf in 2009.

Strategic Going Private Transaction

On February 24, 2010, Pinnacle announced a going private transaction led by Scotia Waterous, the oil & gas M&A division of Scotia Capital. From the press release,

“The Special Committee considered a range of potential alternatives, including continuing to operate as an independent entity, possible sales of certain assets, the Company’s ability to issue additional equity in a public or private offering, and restructurings of the Company’s outstanding debt”

According to the board, this transaction was the best alternative for company shareholders.

Agreement Terms

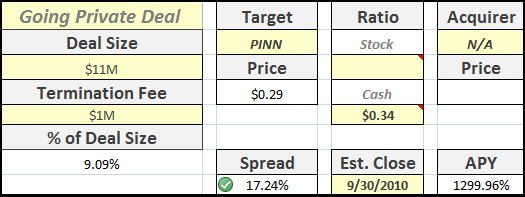

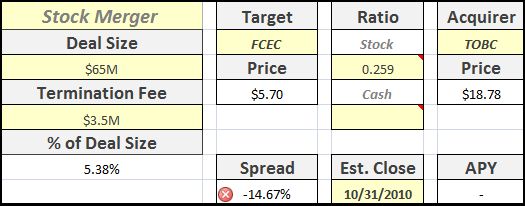

The going private deal is a $0.34/shr cash offer, valuing the company at $11m. The merger required shareholder approval and the waiver of certain lending conditions of Pinnacle’s credit facility.

Under the merger agreement, shareholder approval had two parts: 1) a majority vote of all shares & 2) a majority vote of all shares not owned by DLJ Merchant Banking Partners III (DLJ) and the company’s senior executives.

On August 11 2010, PINN’s shareholders voted to approve the merger, with 72.6% voting in favor.

Credit Agreement Default

The last condition for the completion of the transaction is a waiver by the company’s senior lender, the Royal Bank of Scotland.

Pinnacle borrowed heavily in 2007 – the drop in gas prices and the poor performance of the business forced severe restrictions on the company’s credit facility.

The credit agreement was modified a total of 7 times on the $5.1m balance.

According to the latest revision, the Final Maturity Date was set at

“(i) June 15, 2010 or (ii) the date that is thirty days following the earlier of (A) the date the merger is withdrawn or terminated in whole or in part or (B) the date that the lenders have been advised that the merger will not proceed.”

The company missed payments on both July 1 and Aug 1, effectively breaching the agreement not only with the lender, but with Scotia Waterous as well.

However,

“Scotia has indicated at this time that it will not waive the default; however, it has not terminated the Merger. Accordingly, the Company and Scotia are proceeding with the Merger”

There has been no further info since the August 16 quarterly filing.

Risks

This is a tiny transaction, and there were several lawsuits (since settled) surrounding the management team and their relationship to the acquirer both pre and post merger.

Typically, these types of transactions close very quickly after shareholder approval, but the deal has been languishing for almost a month.

If Pinnacle does not receive a waiver from its lender, the full $5.1M becomes immediately due – since most of the company’s assets are tied up in natural gas (under the ground!), this would most likely force the company into bankruptcy.

Valuation

The stock dropped over 10% towards the end of the day on no news and slightly above average volume – amazingly, $0.29 has been the lowest price since the merger was announced over 6 months ago.

Conclusion

The drop in price at the close today is a very suspicious indicator, possibly indicating that the market does not believe that the company’s lender will give the go ahead.

Although the spread is very attractive, the downside risk is basically bankruptcy.

So, is the deal worth the risks? Any reason why the RBS would refuse a final waiver after such a long road?

Disclosure

No positions.