AML Communications Inc. (AMLJ.OB) is small high-tech stock focused on the defense sector. AMLJ is the leading designer of Micro-Electric Amplifers and Subsystems used in military defense programs.

It is a highly specialized market, and the company ends up being the sole source supplier on almost 70% of their contracts. Most programs are long lasting (2-20 years), ensuring repeat revenue.

The stock has turned in 13 straight profitable quarters, and annual revenues have increased from $4.5m in 2003 to $16.3m in 2010, an impressive 20% CAGR.

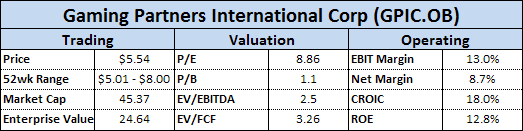

Despite strong competitive advantages and record setting financial performance, the stock is selling at extremely low multiples and a substantial discount to its peer group.

Company Overview

AMLJ is split in two operating segments, but the AML Communications group makes up 97% of revenue and is the main business driver.

AML produces solid state microwave power amplifiers across varying frequencies and output power ranges. In today’s world, many high-tech defense products are extremely complicated and require a large amount of customization.

AMLJ specializes in minor variations on their product lines to meet customer requirements while staying well within its core technological niche.

Company operations are vertically integrated, from inception -> program definition and design -> manufacturing and marketing.

For these large defense programs, the concept and design stage can take 1-5 years before an initial prototype is produced, so strong (long-term!) customer relationships are very important.

AMLJ has worked with many of the prime defense contractors including BAE Systems, Boeing, Lockheed Martin, Northrop Grumman, and others.

60% of revenues are generated from long-term defense programs. The other 40% is from the company’s catalog sales, a mail order business with a diverse range of small customers.

Existing Program Opportunities

AMLJ is already engaged in defense programs for aerial decoy drones, missle defense systems, UAV radar, aircraft electronic counter measures, and radar systems.

A few highlighted programs:

Northrop Grumman’s STARliteTM

“Small lightweight SAR/GMTI radar used for supporting tactical operations”

AMLJ is providing high quality amplifiers for the project that will be used by the U.S. Army for its Sky Warrior and Fire Scout programs.

Raytheon’s Miniature Air Launched Decoy (MALD)

“a low-cost, air-launched programmable craft that accurately duplicates the combat flight profiles and signatures of U.S. and allied aircraft.”

AMLJ has a five year contract for mission critical components related to the MALD program.

Financial Information

For the fiscal year ending in June 2010, the company reported overall revenue of $16.3m, a 23% increase from the prior year period.

Revenues were nicely split between the long term military programs and short term catalog sales. As these long-term contracts can be volatile from quarter to quarter, the small dollar / high volume catalog business helps smooth out earnings and cash flow.

Catalog customers are also a great source for new defense program opportunities, allowing the company to leverage existing relationships to go after the larger wins.

Gross margins made an impressive jump to 48% in 2010, up from 43% in the prior year, as the company benefited from initiatives to automate existing manufacturing processes.

Driven by increased revenue and higher margins, AMLJ reported net income of $1.5m or $0.14 per share, up from $959k or $0.09 per share in the prior period.

This momentum has continued into fiscal 2011 as the company prepares for a significant increase in production for the second half of the year.

Through the first two quarters of the year, sales were off 4% due to significant prepatory work for a ramp-up in production for a large contract. In addition, the company is also increasing its investments in engineering activity for a brand new $1m program.

Due to this preparation, gross margins fell to 45% during the latest quarter. However, on the conference call, management remains confident that margins will return to 50%+ for the remainder of the year.

The business continues to throw off cash, producing operating cash flow of $1.49m and 466k in owner earnings despite increased investments in property and equipment.

The company’s cash balance now sits at a healthy $3.3m, offset by only $3.0m in total liabilities, for a net cash balance of $300k.

Catalysts

Defense Program Growth

AMLJ received payment from Raytheon for a $2.2m and $3.7m order in 2009 and 2010 respectively.

As I mentioned above, management has been preparing for a significant increase in production going into 2011, with plans to reach annual revenues of $5.5m/yr for the next four years from the existing Raytheon agreement.

Management also announced a brand new program that will add another $1m starting next year.

Finally, AMLJ reported that they are in early stages of development on eight new defense contractor programs, worth up to $14m in incremental sales annually for 3-5 years.

At AMLJ’s size, even just one or two of these contracts per year will boost financial results significantly.

New Subsidiary

In September, management announced the creation of a new subsidiary company, Cal Mimix, focused on fabless development of RF and Microwave semiconductor products. While the semiconductor market has been hit hard lately, it makes good business sense for AMLJ as a logical extension of the core business.

One of the company’s suppliers discontinued a key component, so management decided to step in and leverage its existing technological know-how to source and manufacture the product on their own.

According Mr. Inbar, the company’s CEO, “There are clear opportunities for new products evolving from our long term relationships with our customers and for devices that replace products no longer available.”

While revenue projections have not yet been disclosed, initial devices will be launching before the end of the year.

Acquisitions

In July 2010, the company announced the hiring of C.K. Cooper and Company to identify strategic acquisition opportunities to expand the business horizontally.

On the latest conference call, the CEO announced that they had identified and signed two Letter of Intents (LOIs) with prospective acquisition targets, a basic framework on how a possible deal could be structured.

He also made it clear that he wants to fund the acquisition from the company’s existing cash balance, with common stock being a last resort – a solid indicator that management believes that the stock is undervalued.

Hopefully the team has identified highly accretive acquisitions that can be smartly integrated into existing operations.

Valuation

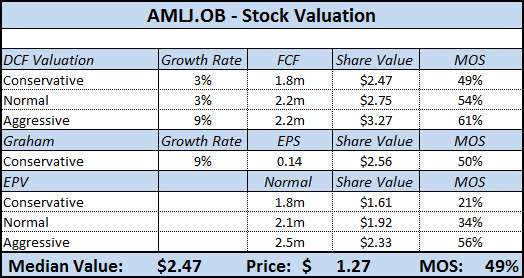

Despite achieving record levels of sales and profits, the stock is only 9% above its 52-wk low.

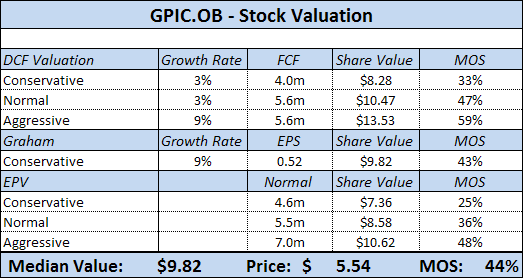

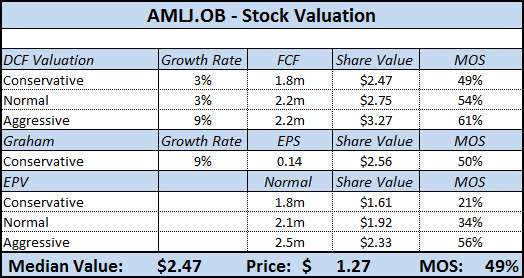

FCF for the year should come in significantly higher due to the second half ramp up in production – AMLJ had owner earnings of approx $2.2m last year so these numbers are conservative.

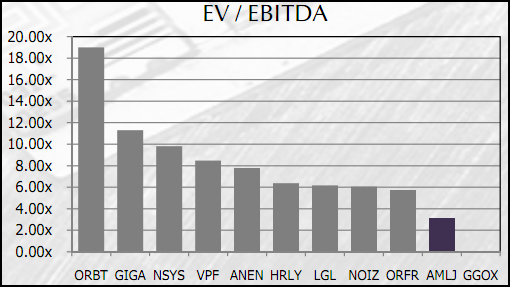

EV/EBITDA is only 3.39x and the company is selling for less than tangible book value. Despite having the highest gross margins among its peer group, the stock is near the bottom on a EV/EBITDA basis:

Applying a more reasonable EV/EBITDA ratio of 6x would almost double the current stock price.

Conclusion

An investment in AMLJ is not without risks.

Defense programs can be notoriously fickle and depend heavily on funding from the U.S. government.

A sharp cutback in defense spending could have a significant impact on AMLJ’s business (although I think high-tech electronic components for unmanned vehicles would be pretty far down the cut list).

In addition, one of the company’s directors has been steadily selling shares throughout the past year, although it has been confined to just this one insider.

All told, insiders hold approximately 34% of shares outstanding, solidly aligning their interests with common shareholders.

I’m adding AMLJ.OB to the Value Uncovered portfolio at the 12/01 closing price of $1.27.

Disclosure

Long AMLJ.OB