Techprecision Corp (TPCS.OB) reported fiscal 2011 second quarter results last week, continuing a trend of rising backlog and consistent profits.

The new CEO seems extremely confident in the future prospects for the company but the stock remains undervalued despite a recent run-up in price.

Financial Highlights

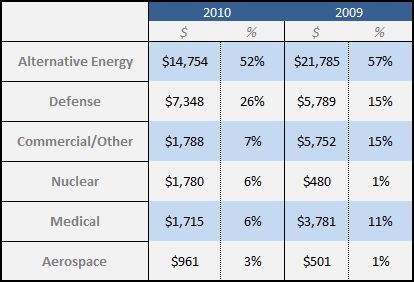

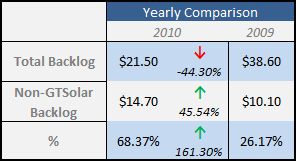

Second quarter revenues were $8.4m, compared to $15.1m in the prior year quarter. However, the 2009 quarter was affected by a non-recurring inventory transfer to the company’s largest customer, GT Solar.

I’ve written about TPCS’s dependence on GT Solar before – TPCS receives much lower margins on raw inventory transfers versus shipping finished goods.

Adjusting for this one-time cost, sales increased 25% over last year’s results, along with a sequential increase from the first quarter.

Although gross margins were around 30%, operating expenses increased $500k to 13% of total sales compared to only 4% of sales last year.

The increase is partially due to the hiring of new sales personnel to cover the mid-Atlantic market. The expense increase was also impacted by the CEO search (recently completed in July with the hiring of James Molinaro).

Net income was $855k or $0.04 per share fully diluted compared to $0.06 per share last year – YoY comparables are difficult due to the materials transfer last year.

Through the first six months of fiscal 2011, the company has generated a net profit of $1.6m, up 40% from the same time last year.

TPCS generated $1.1m in free cash flow despite a significant increase in capex costs associated with the purchase of a new gantry mill to upgrade and modernize the company’s manufacturing equipment. The mill’s total cost is $2.3m and will be spread out over the remaining quarters of 2011.

The balance sheet remains solid with a cash balance of $9.24m compared to total liabilities of $8.1m. The stock’s current ratio is 6.1.

Future Growth Opportunities

Total order backlog increased from $21.5m at March 31, 2010 to $26.4m as of the September 30, 2010 filing. It further increased to $31m as of November 1, 2010.

The sales efforts for the company have paid off with several large orders from existing customers:

- Sept 8 – $2.9 Purchase Order from Existing Tier-1 Clean Technology Customer

- Sept 29 – $3.9m Purchase Order from Solar Customer

- Oct 13 – $6.7m Purchase Order from Solar Customer

Even better, TPCS announced an exciting expansion opportunity in the fast growing Chinese market by creating a company subsidiary to meet the growing demand for local manufacturing and machining from its customers.

This new local arrangement resulted in a $2.9m purchase order, and the company expects a significant increase in business with multiple customers as a result of this arrangement.

According to Mr. Molinaro, TPCS’s CEO,

“Demand for solar, nuclear and industrial components is growing globally, but this demand is increasing most in Asia and especially China…Already, 80% of poly silicon panels and many nuclear reactors are scheduled to be built in China, and our customers indicated interest in expanding business with TechPrecision if we could support them locally in Asia”

Reverse Stock Split

The latest proxy statement shows a new amendment giving the Board of Directors the power to affect a 1-for-2 reverse stock split. According to the filing,

“The Board believes that the Reverse Stock Split is an effective means of increasing the per share market price of our Common Stock in order to achieve the minimum per share stock price necessary to qualify for listing on well-recognized stock exchanges, such as the American Stock Exchange or the Nasdaq Capital Market. “

Currently trading on the OTCBB, the uplift of TPCS to a major exchange will significantly increase its exposure to individual and institutional investors, likely resulting in a big boost to the stock price.

The shareholder meeting for this proposal was on November 22, and the amendment was subsequently approved.

Conference Call

Management held its second quarter conference call, and seemed extremely bullish on the company’s prospects going forward.

A few notes from the call:

- Management’s goal is 4 new Tier-1 customers before the end of fiscal 2011

- First Tier-1 gas generation client will have prototype done in mid-2011 with full production in 2012; expect a significant increase in business from this market

- Stillwater is finishing up the medical beam prototype and expects to complete clinical trials in mid-2011. The university has hired a prominent specialist to head up the new unit, showing a commitment to the proton beam therapy

- New China operation will provide slightly higher margins and some tax advantages. Will also better serve the solar market in China (GT Solar has more orders than capacity through at least 2012!)

- China operation will also give them access to the nuclear market. U.S. has 104 old reactors but China is building rapidly with 10 new nuclear plants planned

Valuation

Trailing TTM diluted EPS is $0.12, giving the stock a current P/E ratio of 10.42. Based on management’s bullish prospects and the increasing order backlog, 2011 fiscal results should come in higher.

Assigning a more reasonable multiple of 12 to conservatively estimated 2011 EPS of $0.16 would equal a share price of $1.92.

An even better valuation metric is EV/EBITDA. TPCS’s EV/EBITDA ratio is only 3.77, very cheap for a growing, profitable company riding the clean energy wave.

Risks

An investment in TPCS does have risks around customer concentration and common stockholder dilution.

Although the company has focused hard on expanding its operations outside of the solar market, 54% of quarterly revenues were from GT Solar. The loss of this customer, or even a pullback in demand similar to 2009, would have significant consequences.

In addition, the share count has been increasing each year through a combination of stock warrants, options, and convertible shares. The company has seen some turnover in its executive ranks, which leads to the corresponding options grants.

Hiring a new CEO is expensive for a small company from an ownership perspective. However, the new CEO has a great deal of experience in the solar space, and seemed extremely confident on the conference call on the future direction of TPCS.

Conclusion

Despite the solid report, a company insider has sold a significant chunk of stock in the past month, a possible warning sign.

I’ll be keeping a close eye on TPCS and evaluating my exposure, but I like the direction the company is headed.

The downside is limited due to the strong balance sheet so the investment thesis depends on management’s ability to capitalize on the company’s growth opportunities.

Disclosure

Long TPCS