Iteris, Inc (ITI) has been a Value Uncovered holding since March, and just announced results for its fiscal first quarter ending on June 30, 2010. .

Iteris sells traffic management technology and services to the trucking industry, a tough business to be in during 2008 and 2009. Encouragingly, the past two quarters continue to show positive signs of a turnaround.

Sales Highlights

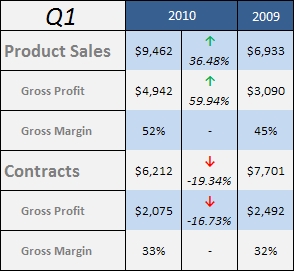

Sales increased 7.1% from the same quarter last year, driven by substantial increases in the company’s main product segments – a 30.9% increase in Roadway Sensors and 67.2% increase in Vehicle Sensors.

These increases followed double-digit revenue growth in the previous quarter, a very positive sign.

Transportation Systems (contract) revenue continued to decrease, but at a much slower pace than last quarter.

Overall, I believe product revenues are much more important indicators for the company’s future outlook.

Margins & Income

Overall, gross margins increased 6.7% to 44.8%, much closer to the company’s long-term average.

Net income increased over 450% for the quarter, jumping to $797k from $144k in the previous quarter.

I will be watching the cash flow numbers closely after the 10-Q is filed, but I estimate quarterly owner earnings to be around $0.8M, a substantial increase from the same time last year.

CEO Remarks

“I am encouraged with our financial performance for the quarter, and believe we are beginning to see the positive impact of the initiatives we put in place during the last year, such as expansion of our R&D efforts and an increase in sales and marketing activities…This quarter reinforces my confidence that we are on the right path.”

Business Outlook

Management seems very bullish on the business going forward. The company continues to invest in new product lines, expanding the scope and breadth of its offerings.

The balance sheet is solid with $11.7m in cash plus an untouched $12m line of credit.

ITI was not able to utilize its NOLs in 2010 due to deteriorating conditions and uncertainty over future profits. Since the business outlook seems to have improved substantially, some of these tax assets should be realized in fiscal 2011.

Valuation

I will revisit my valuation assumptions at the halfway mark of the year, but by most any measure, Iteris appears extremely cheap – ITI was recently profiled at Old School Value as well.

Even using the recession-depressed numbers from 2009, the company seems to be worth a little over $2. If conditions continue to improve, I think the stock could rise closer to $4.

Despite the seemingly positive report, ITI’s stock price has dipped, providing a nice buying opportunity.

Disclosure

Long ITI