NexCen Brands Inc (NEXC) is a brand management company holding 7 brands in two different operating segments: quick service restaurants and footwear & accessories.

Across the brand network, the company operates approx. 1,700 retail stores for brands like Great American Cookies, Marble Slab Creamery, and The Athlete’s Foot.

The current arrangement provides another special situations investment opportunity, with the company’s liquidation providing potential returns for the patient value investor.

History & Financial Situation

NexCen purchased the rights to the seven brands back in June 2006. Since then, the stock has plummeted, as the company has lost money every year since 2005 while book value per share has been negative since 2008.

NEXC took on a great deal of leverage as it expanded its brand portfolio, borrowing over $138m under its credit facility in 2008 in order fund the acquisition of Great American Cookies.

However, the investment did not pay off, and the company struggled under the debt burden, casting doubt over whether it could continue as a going concern.

From the most recent 10-K, NEXC’s

“Credit Facility obligates us to make a scheduled principal payment of $34.5 million on our Class B Franchise Note in July 2011. We currently do not hexpect that we will be able to meet this obligation.”

As a result of the debt load, the company began seeking strategic alternatives for its debt and capital structure with the goal of maximizing return for shareholders.

Strategic Asset Sale

On May 13, 2010, NEXC announced an agreement to sell its franchise businesses to an investment firm with significant franchise experience for $112.5m, subject to stockholder approval. The proceeds would be used to pay off the company’s credit facility.

The definitive proxies for the transaction were filed on June 11, 2010, with special shareholder meeting scheduled for July 29. The proxy described the asset sale of the majority of the company’s assets, followed by a dissolution and liquidation of the company.

On July 30, 2010 the shareholders voted to approve the sale and dissolution proposal, effectively ending the company’s status as a working business.

NEXC Plan of Dissolution & Liquidation

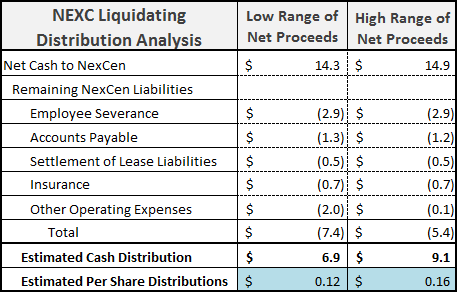

According to the proxy filings, the company expects liquidation distributions in the range of $0.12 to $0.16 per share.

The stock is trading only slightly above the low point of the estimated range, providing a downward floor from a risk perspective but with significant upside.

Potential Catalyst

Further increasing the chances that the company will end up distributing cash towards the high end of the range, NEXC announced the hiring of a strategic consulting firm who will handle the wind-down of the company, including the distribution.

The fee for this service is $100k, money that could potentially go to shareholders. However, I like this arrangement because the terms of the agreement provide an incentive fee in the event that at least $8m is distributed to company shareholders.

I’m a big believer that people will focus exclusively on what they are incentivized to do – in this case, it should influence the consulting firm to quickly wrap up the transaction in a timely fashion and for the lowest cost.

Since the biggest risk in these transactions is the final closing being bogged down in legal and logistical nightmares that take a great deal of time, I view this arrangement as a very positive development for shareholders.

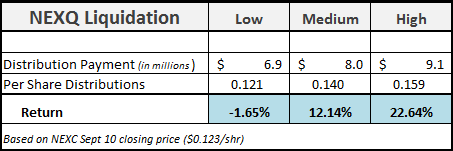

Return Scenarios

Major Risks

Although the company is estimating the low range of net proceeds to be $0.12, there remains the possibility that shareholders might not receive any compensation at all.

Also, despite the consulting arrangement, these type of liquidations can sometimes take years to wind-down, as the company pays down creditors and satisfies remaining obligations.

Conclusion

While there is definite risk in the deal, substantial upside remains if the consulting company can finalize arrangements in an orderly and efficient manner (right in line with their incentive arrangement).

I believe that the firm will do everything in its power to reach their success target of $8m, allowing for a potential return of 12.14%.

I’m adding NEXC to the Value Uncovered portfolio at Friday’s closing price of $0.123. The record date for the liquidation distribution is today, Sept 13.

Disclosure

Long NEXC