REMEC, Inc. (REMC) was a high flying stock back in the internet bubble days (trading over $36 in Mar. 2000), only to effectively close up shop only 4 years later.

After selling off the various business units, management and stockholders approved a Plan of Dissolution and Liquidation on July 21, 2005, but the stock has languished on the OTCBB ever since.

History

Immediately following the asset transfer, the company paid an initial cash distribution of $1.35 per share. Several other distributions followed over the next two years, adding up to total payment to date of $3.35 per share.

The last liquidation distribution was in June 2008.

Lawsuit Settlement

Back in 2004, several shareholder lawsuits were filed against the company alleging that former officers made “false and misleading statements and failed to disclose material information regarding the Company’s financial condition.”

After the case made its long and painful way through the court system, positive signs appeared in April 2010 when the court ordered a ruling for summary judgment.

Finally, on August 30, 2010, despite another appeal (and cross-appeal!), the parties finally entered into an agreement to dismiss the case.

After 6 long years, the markets reacted very favorably to the news, as the stock jumped over 6% with over 2M shares trading hands (a huge volume compared to prior months, where the stock often went several days with no trades at all).

With this news, all outstanding litigation against REMC was finally satisfied, and the company could now move towards wrapping up the liquidation process.

Liquidation Estimates

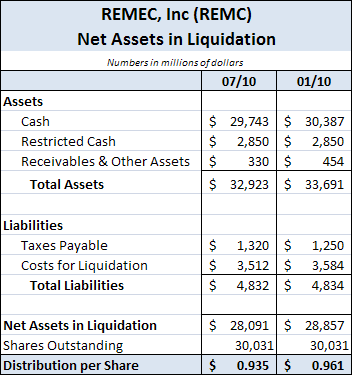

As of July 30, 2010, the company’s assets were as follows:

On September 17, REMC announced a cash distribution of between $0.81 and $0.87 per share payable to shareholders of record on November 24, 2010.

The company plans to hand over its remaining assets to a liquidating trust on December 31, 2010, for the final wind-up and liquidation.

The company expects to complete the liquidation of the trust by March 2011.

Catalysts for Higher Returns

As shown in the chart above, $1.32m of the company’s remaining liabilities are taxes payable. However, a line in the latest quarterly release is key:

“We believe that it is reasonably possible that $1.3 million of our current remaining unrecognized tax positions may be reversed by January 31, 2011 as a result of a lapse of the statute of limitations.”

Although tax laws and rulings can be complex, the company has already written down tax liabilities before (i.e. $6.7m in the 2010 fiscal third quarter).

If the statute of limitations passes on this liability as well, it should add approximately $0.05 per share to the final distributions.

In addition, one of the company’s major shareholders has been aggressively buying up shares at prices ranging from $0.85 to $0.95.

S. Muoio & Co. LLC, a value-oriented activist firm, has purchased over 5m shares in 2010, bringing its stake to over 28% of REMC.

The purchases have been recent as well, with the firm buying over 440k shares on 9/27 for $0.94.

This seems to be a strong indication that the company will pay out on the upper end of the liquidation range.

Valuation

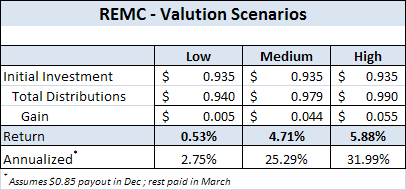

With the upcoming payout in December, a substantial portion of any upcoming stock purchase would be returned right away, leaving the rest on the table for potentially higher returns.

Conclusion

I think there is a strong possibility that the $1.3m tax liability will ultimately be returned to investors.

Combining this assumption with the strong insider buying, and I think the chances of a negative outcome are remote.

With some careful planning and a few positive developments (buying near the record date, tax payable is dissolved, distributions are at the high end of range), this investment offers potential for outstanding annualized returns.

Disclosure

No positions.