Similar to the FCEC/TOBC merger from a few months back, small community bank mergers can provide a tremendous source for arbitrage profits.

Jacksonville Bancorp Inc (JAXB) and Atlantic BancGroup Inc (ATBC) are two tiny micro-cap banks that agreed to merge back in May.

Due to their small size – a market cap of $13m and $2.6m for JAXB and ATBC respectively – the transaction seems to have flown under most investors’ radar and offers attractive returns for patient individual investors who are able to pull off the trade – at least in theory.

Merger Background

On May 10, 2010, JAXB and ATBC signed a definitive merger agreement where ATBC, along with its subsidiary Oceanside Bank, would be acquired by JAXB.

Both banks operate locations in the greater Jacksonville, FL area. According to ATBC’s CEO,

“We believe that a well-capitalized local bank run by local people will offer our customers and our shareholders the most benefit in the long run. This is truly a unique opportunity. “

To help finance the transaction, JAXB also announced a stock purchase agreement with a group of four investors, led by CapGen Capital Group, to provide $30m in new capital through the sale of newly issued shares of JAXB common stock.

Deal Terms

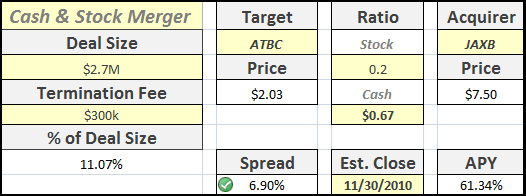

Under the original merger agreement, ATBC shareholders would receive 0.2 shares of JAXB common stock plus cash consideration of up to approx. $0.65 subject to the sale of certain assets.

These assets were eventually sold on June 30 for $700k in cash, or approx. $0.56/shr.

JAXB would also plan on issuing 3m new shares at $10.00 to the new investor group to finance the transaction.

Subsequently, the merger agreement was modified on September 17 to increase the amount of capital raised from the JAXB stock sale, to a total of $35m at a per share price of $9.00.

This modification also served to set the cash consideration of the merger agreement at $0.67.

Final Stock Exchange Ratio: 0.20 JAXB common stock for each share of ATBC common stock

Cash Consideration: $0.67 per share of ATBC common stock

Regulatory Approvals

Like most banking transactions, the merger requires approval from a number of different governing bodies, including the Federal Reserve Board, the Florida Office of Financial Regulation, and the FDIC.

After Federal Reserve Board approval, the companies must wait 15 days before officially completing the transaction. The OFR approved the transaction on September 22, with the Federal Reserve following on October 14.

Shareholder Approval

To complete the transaction, at least 70% of ATBC’s shareholders must vote to approve the transaction.

Executive officers and management of ATBC hold 15.46% of outstanding stock, with the only other large shareholder being Apex Investment Management, with 9.91%.

ATBC’s shareholder meeting was scheduled for October 28, but the company hasn’t yet posted any news regarding the results of voting.

JAXB’s special meeting of shareholders is scheduled for November 9 in order to vote on the sale of stock to accredited investors in order to guarantee the financing for the transaction.

Returns

To lock in the arbitrage spread, investors would purchase shares of ATBC and short shares of JAXB according to the merger ratio.

While the timeline is still uncertain, management believes that the transaction will be closed in the fourth quarter of 2010.

Risks

Financing – The merger relies on investors committing $35m in fresh capital to JAXB in order to pursue this transaction. If these investors walk away – due to economic conditions, further deterioration in ATBC’s business, etc – the transaction could fall apart.

Approvals – ATBC’s management team only controls 15.46% of outstanding stock, leaving some risk for shareholder approval.

However, ATBC’s board determined that the bank would need to pursue a strategic transaction or merger in order to survive. While the bank recently reported a quarterly profit, it remains on shaky ground – the failure of the merger would have severe consequences for existing shareholders.

Conclusion

The biggest factor in this transaction is that both banks are very thinly traded.

JAXB hasn’t traded for the past several days, although there was a decent amount of activity the week of Oct 14-22, with several thousand shares changing hands.

Low trading volume makes it difficult to find JAXB shares to short in order to complete the other side of the merger arb.

The bid-ask spread could also be a factor that cuts into expected returns.

With these factors, the implementation of this arbitrage opportunity could be difficult for most investors – although attractive on the surface, this merger shows the importance of checking ‘paper theory’ with actual trade execution.

Disclosure

No positions