After reviewing the rationale behind closing my investment in SYK, this is the second part of my series on recent stock sales.

iParty (IPT)

While the investment in SYK turned out well, iParty (IPT) is an example of how several errors can compound to change the attractiveness of a position.

Through the first two quarters of this past year, IPT had turned in better than expected results.

In the initial writeup on IPT, I thought that the company was poised for a big year. Same-store comps were up 1.3% and 1.4% on a quarterly basis, putting the company on a strong path going into its busiest time of year – the Halloween season and fourth quarter.

Third quarter results showed a boost in the number of temporary Halloween stores – from 4 to 11 – that caused a $1.9m loss in the 3rd quarter compared to $1.4m in the same quarter in the prior year, setting back the company’s progress.

Then, fourth quarter results did not show the expected jump. While the balance sheet improved, the company reported full year earnings of only $254k compared to $1.1m in 2009.

I try to avoid putting too much attention on quarterly results, but do keep a close eye on investments and evaluate them when appropriate.

Investment Review

With IPT, I made a mistake in this analysis on two fronts:

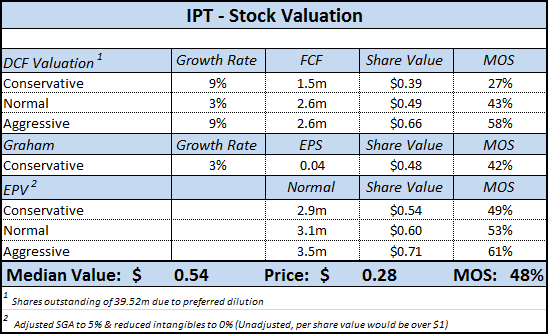

1) In the DCF valuation, I placed a much heavier weight on 2009 results – a high water mark for the company – vs. using the long-term averages. My upper estimates were predicated on a growth rate that was not supported by the historically lumpy results (as opposed to a company like SYK, where the trend line has continued upwards more or less in a straight line)

2) I did not include the significant number of preferred shares in my original EV calculations. Not my finest moment, but one of the consequences of learning on the job.

With this new calculation using the preferred shares, total EV comes out to $27.5m. This translates into an EV/EBIT multiple of 30x (!) using 5 year averages.

EV/FCF is slightly better due to the large depreciation expenses, but still high at 21x.

While the company has the backing of top tier investors, continues to expand its retail footprint and clean up its balance sheet, it probably doesn’t qualify as a value investment at these levels.

Conclusion

Warren Buffett said,

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

Retailing is a tough business, and IPT is in an especially tough part of the retail market. 5 year average ROE of 4.06%, CROIC of 9.25%, and ROIC of 2.54% reflect this challenge.

My investment methodology has gotten more conservative, with a heavier focus on long-term averages, which therefore changes the viewpoint of IPT as a viable value investment.

With this in mind, I closed out my position at $0.30 per share on Feb 24 – I’ll take the gain and move on.

Final Thoughts

To be clear, my preference for long-term investments hasn’t changed (despite the whirlwind of sales in recent months).

It is important to grow as an investor, and I feel like my approach has changed significantly from some of the early analysis on this blog. As my philosophy matures, I’ll continue to make adjustments to the portfolio.

Learning from mistakes is a big part of that process.

Disclosure

I still own a small remaining position in IPT (1%) in my personal account.