It’s a busy time of year from an earnings perspective, and the real world has gotten in the way of my normal posting schedule.

However, I’m pretty happy with the earnings results so far, as most of my current positions have performed well – some more so than others.

While one quarter’s (or even a year or longer in many cases) performance doesn’t make or break the merits of a selection, I continue to monitor my investment thesis closely for any signs of deterioration, whether from competition, changing market conditions, or other catalysts.

To be more efficient, I’m going to combine several earnings reports into a series of summary posts.

AMCON Distributing Co. (DIT)

Despite a challenging distributing environment and significantly higher energy costs, AMCON turned in a solid quarter.

Second quarter revenues came in at $206m, down 6% from $230m during the same quarter in 2010. The majority of this decrease was a lower volume of cigarette sales (down $18.7m) that was not offset by a corresponding increase in cigarette prices (up $5.9m).

Net income was $1.5m, down 12%, translating to quarterly EPS of $2.56.

While the income statement showed some pressure, management continues to strengthen the balance sheet.

Due to the nature of the DIT’s business model (i.e. extremely low margins, decent operating leverage), it was good to see the company pay off $5.8m in debt during the quarter.

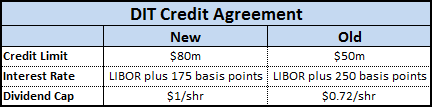

More importantly, the company renewed its credit agreement with Bank of America – an absolutely vital lifeline for the distributing side of the business – for another 3 years on significantly better terms:

Management continues to take a long-term perspective, not only in expansion but in potential acquisition targets as well:

“We are delighted to have an enhanced credit facility that we believe will give us additional flexibility to take advantage of potential acquisitions and merchant opportunities …We are taking a long range view as we continue to make investments in foodservice, technology and related value added propositions designed to increase our customers’ bottom line… We are carefully evaluating new store locations in both of the regions we operate in. Our recent store opening in Tulsa, Oklahoma has met our expectations. Our niche in the retail market is well defined and we believe there is room to prudently expand…”

Sparton Corp (SPA)

After reporting tough second quarter results back in February, Sparton’s stock sold off sharply over the next few days, dropping almost 20%, despite reasonable explanations for the mixed results and several positive developments.

The confidence was vindicated with the third quarter results this week, as quarterly revenues shot up more than 30% to $50.3m, compared to $38.6m in the third quarter last year.

The new acquisition of Byers Peak is providing immediate gains – with further margin improvements possible due to the planned plant consolidation – and the EMS segment finally showed a big jump in margins as management focuses on profitable contracts.

This margin improvement led to the largest quarterly gross profit in over five years, with quarterly net income more than tripling to $2.5m, or $0.25 per share.

The turnaround is continuing nicely, setting up SPA for its stated (and very bold) goal of reaching $500m in sales by 2015.

Advant-E Corp (ADVC)

The company continues to chug along with steadily improving results. First quarter revenue was up 5% to $2.3m, compared to $2.2m in the same period the previous year.

Edict Systems, the amazingly-consistent SaaS growth machine, turned out another 2% revenue increase, but the big surprise was the Merkur Group with a 22% jump in sales.

Merkur was hit hard during the recession – even posting small losses – but the acquisition is looking better as the economy recovers.

Net income was up to $385k, equal to $0.006 per share, up 45% over the first quarter last year.

More importantly, the company announced another special dividend of $0.02 per share, payable in two installments during the remainder of 2011. The last special dividend was a big part of the original investment thesis.

By the end of 2012, the company will have returned $0.05 per share in dividends in less than two years – almost 20% of the current market cap – once again showing a commitment to rewarding “shareholders, many of whom are long-term investors in the Company.”

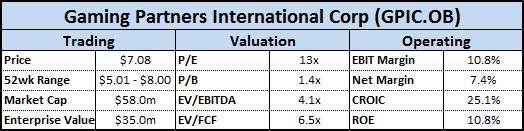

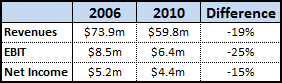

Gaming Partners International (GPIC)

I was very late in posting my viewpoint on GPIC’s 2010 financial results, as the company quickly followed up my post by announcing stellar first quarter earnings.

According to the press release,

“For the first quarter of 2011, the Company posted revenues of $17.8 million and net income of $1.7 million, or $0.21 per basic and diluted share. These results compare to revenues of $10.9 million and net income of $37,000, or $0.00 per basic and diluted share, for the first quarter of 2010.”

And backing up my thesis:

“The primary reason for the significant increase in first quarter 2011 net income was comparably higher sales of chips to casinos in Macau.”

As far as the company’s prospects for the rest of 2011, consider this:

GPIC’s first quarter EPS of $0.21 is roughly 40% of the company’s earnings for all of 2010, the 2nd best year in the company’s history, AND the first quarter is usually the slowest of the year.

While the company warned that the rest of the year will unlikely match these results, I think it bodes well for the annual outlook (and hopefully the stock price!).

Concluding Thoughts

I continue to look for ways to raise additional cash in the portfolio, as I remain skeptical on the overall market.

However, there are quite a few stocks, including a few international ones, that I am tracking closely. I’ve had 6-7 bids outstanding for many weeks, as I continue to remain patient about picking up shares in some of these illiquid issues.

I hope to showcase some fresh analysis over the coming months.

Make sure to stay tuned for Part II as more holdings report their results.

Disclosure

Long DIT, SPA, ADVC, & GPIC