Acme United (ACU) reported fiscal fourth quarter and annual results for 2010.

Revenues increased after the sharp drop-off in 2009, but the company’s margins remained depressed.

Financial Results

For the year, the company reported a revenue increase of $4m, or 7%, to $63m. Sales increased in all of the company’s geographic regions, led by Europe at 14%.

The European division continues to operate in the red, reporting a loss of 487k, although that loss has narrowed slightly from 2009 and 2008.

The U.S. market continues to dominate the company’s business, with 75% of total sales, so the 5% YoY increase in this segment is good news.

Despite the increase in sales, operating income was flat, coming in at $2.98m.

The decrease in margin was mostly affected by higher air freight expense of approx. $500k, as labor shortages in the company’s Chinese manufacturing facility required expedited shipments to meet customer demand.

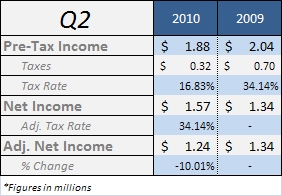

Net income was 2.52m, or $0.82 per share, compared to $0.86 per share in 2009. However, 2009 results were positively impacted by a benefit associated with the remediation of the disposed Bridgeport facility.

Adjusting for this benefit, net income was up 3.6%.

For the year, the company negative operating cash flow of $1.1m, due largely to a significant increase in inventory going into 2011. According to management, this is a very deliberate strategy to prevent delays going into the company’s busiest time of year.

Owner earnings came in at $2.5m.

New Acquisition

On March 1, the company announced an acquisition of Pac-Kit Safety Equipment Company, a leading manufacturer of first aid kits. This is another long-standing and storied brand, having been around since 1890.

ACU is paying $3.4m for the company, with annual revenue in 2010 was $5.4m. This revenue stream is stable, falling between $4.8m and $5.4m for each of the last three years.

The company expects the acquisition to be accretive in 2010, with operating earnings of $100-150k before operational synergies.

It is a nice tuck-in acquisition for the firm, but probably won’t move the needle significantly.

However, I view these types of combinations as much more shareholder friendly than a larger alternative (with its associated headache).

Risks

The mishaps at the Chinese manufacturing facility are a blow to management’s credibility, but mistakes happen.

Inventory management is extremely important for this type of business – it remains to be seen if the current inventory stockpile is a smart move for 2011.

According to the CEO, ACU remains firmly committed to its Chinese manufacturing strategy, so the company must prove that it can correct these mistakes going forward.

At the same time, margins have shrunk considerably from the 2005-2007 time period (where operating margin averaged almost 11%).

The good news is that this fact leaves room for improvement from the current numbers – however, a sustained downtrend is concerning.

Management also sounded confident on the conference call that they have taken significant action to shoring up the European division. A reduction in non-sales headcount and other operating expenses is expected to save the company 400-600k in euros in the upcoming year.

Even breakeven for this division would provide a nice boost.

Conclusion

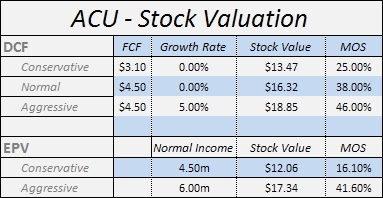

While 2010 was not the greatest year, ACU is still trading with a FCF yield of 8.69%, with return on equity a decent, but not spectacular, 10.13%.

EV/EBIT of 12x and EV/FCF of 14x show that the company is fairly valued, but on are calculated on depressed earnings – 5 yr averages for the two ratios come in at 7x and 10x respectively.

Until proven otherwise, I believe that management will not repeat the same mistakes in 2010. They are incentivized to do that – management did not receive any bonuses for 2010, nor any increase in base pay.

Hopefully the bonus situation will improve in 2011 (on the back of a strong year for shareholders of course).

While I’m not adding to my position at current prices, I continue to hold.

Disclosure

Long ACU