Analysis

Background

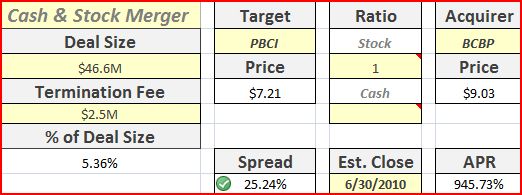

On June 30th, 2009, BCB Bancorp Inc (BCBP), a small community bank with three branches in NJ, offered to purchase Pamrapo Bancorp (PBCI) in a transaction valued at $46.6m. It was a friendly transaction with both company’s board of directors voting for the merger.

Mark Hogan, Chairman of BCBP –

“We believe the partnership will solidify the combined entity’s Hudson County franchise and presents the opportunity to generate earnings and attractive returns to both groups of shareholders. The combination will greatly assist us in developing a more responsive and efficient institution while holding true to our tenet of customer service.”

Kenneth Walter, CEO of PBCI –

“We believe that this transaction is a great opportunity for our shareholders and will benefit our customers, employees and our community. We can continue with our philosophy of providing a high level of customer service and local decision making in our market area but will now have the added benefits of being part of a larger organization with much greater resources, lending limits and convenience for our customers.”

Terms

PBCI shareholders will receive 1.0 share of BCBP.

Shareholder Complaints

Despite friendly management terms, it has been a rough road since the merger announcement. On Dec 2, 2009, PBCI’s former president and largest shareholder, William J. Campbell, filed a complaint that the bank did not fully disclose the cross-ownership between the two entities by members of the board of directors. This joined another shareholder complaint filed by Keith Kube, who argued that the board of PBCI breached its fiduciary duties to shareholders.

Shareholder complaints seem to be common occurrences in many corporate mergers, but they rarely end up changing the outcome. On Feburary 17, 2010, the court of NJ voted to dissolve its injunction that was blocking the merger, opening the door for the shareholder vote.

Shareholder Approval

BCBP Shareholders voted to approve the merger on Dec 17, 2009. PBCI’s shareholders followed suit and voted to approve the merger on February 17, 2010, with 77% of shareholders voting to approve the transaction.

Investigations

To complicate matters even further, it seems that PBCI has been under investigation for quite some time for various issues. The bank received a Cease and Desist Order from the Office of Thrift Supervision back in September of 2008, and received another on Jan 22, 2010 relating to unresolved deficiencies in management and succession plans. The bank had to submit a 3yr business plan and hire 3 outside independent directors to satisfy OTS’s requirements

To make matters worse, the DOJ had been investigating the bank for several years for lax controls around anti-money laundering laws. On March 29, 2010, the bank pled guilty to the DoJ’s charges and was ordered to pay a $5m civil penalty.

Despite the setbacks, PBCI’s 10-Q on May 17, 2010, reports that the merger has received all necessary regulatory approval.

Discussion

It doesn’t appear like anything is stopping the merger from completing in the near future. Although all of the investigations look terrible for PBCI, BCBP has not given any indication that it will back away from the merger. I’ve read through most of the press releases, and it seems like PBCI’s management a) is incompetent or b) disregarded numerous compliance and regulatory rules that come with owning a financial institution.

Another concern with this arbitrage opportunity is the illiquidity of both stocks. PBCI trades roughly 3000 shares a day, while BCBP trades only 1000. It would be difficult to short BCBP, and the large bid/ask spread could eat into profits when exiting the trade after the completion of the merger.

It seems like many investors have been caught up in the bad press surrounding the merger, while the companies have slowly crept closer to completion by satisfying all of the necessary requirements one-by-one. The spread is very attractive, but only if investors can successfully pull off the trade. Thoughts on this opportunity?

Supporting Documents:

[table id=1 /]

Disclosure

No position in either PBCI or BCBP at the time of this writing.