Overview

New Frontier Media (NOOF) reported 4Q and 2010 fiscal year results last week. The Company continues to struggle with a decline in domestic revenue and the impairment of intangible assets. There is no doubt that the economic downturn is negatively affecting the company, but the Company remains in solid financial shape, especially from a cash flow and balance sheet perspective.

Sales Results

Net sales decreased to $50.4m, a 4.4% drop from the prior fiscal year. In the Transactional TV segment, sales decreased by 12%, partially offset by a 40% increase in the Film Production segment. Profit margins in the TV segment average around 70%, compared to margins around 50% for the other business segments – if the trend continues, the Company will need to closely monitor costs, or bottom line profitability could erode further.

However, several bright spots remain from a top-line analysis:

The 4.4% sales decreased was moderate compared to the 11.7% drop in revenue from 2008 to 2009, the (hopeful) start of a positive trend. Q4 revenues of $15.1m were the highest quarterly revenue since Dec 2007. Although domestic business has stagnated, international sales increased 61.7% and now makeup 14% of total sales.

Owner Earnings

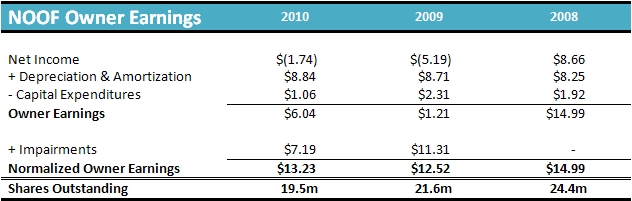

In the past two years, the Company has been forced to write down a significant portion of their intangible assets (writedowns of $11.31m in 2009 and $7.19m in 2010). Overall, goodwill and other intangible assets have dropped from approx $22m in 2008 to approx $4.3m in 2010.

As an investor, this shows the danger of investing in companies with a substantial balance of intangible assets – the value of those assets can be fleeting when compared to hard assets like cash or PP&E.

The good news is that the Company has written off all of the goodwill from the Film Production business, so further writedowns are unlikely.

Despite the non-cash charges, NOOF continues to generate healthy Owner Earnings (OE), with $6.04m in 2010:

Add back the non-cash impairment charges, and a clear uptrend in ‘normal’ owner earnings over the past two years can be identified, despite the net losses. In most cases, cash flow is usually a better indicator of the financial health of the business.

Balance Sheet

Although the company’s topline performance will probably continue to struggle, the balance sheet is solid – especially since the majority of the intangible assets have been eliminated.

The Company’s quick and current ratio is 3.2 and 3.5 respectively, the highest numbers since 2005. Total liabilities dropped almost $5m, as the Company reduced accounts payable by 29% and paid off $3m off their outstanding credit line.

Valuation

Even with no growth, the company looks extraordinary cheap. At current levels, NOOF is trading at 5.5x OE. With conservative topline estimates going forward (and no writedowns), the business should generate roughly $12m in owner earnings in 2011, or 2.6x OE at current price levels.

Conservative Valuation: $2.5-$3.5

Aggressive Valuation: $5-6

Disclosure

Long NOOF

[…] NOOF – 2010 Year End – Very Cheap on Cash Flow Basis | Value Uncovered […]

[…] NOOF reported first quarter earnings this past week, and turned in a solidly profitable quarter, after suffering through two write-down plagued years. […]

[…] is a stock is a current holding at Value Uncovered (see my posts on NOOF here and here). Insiders have started to aggressively buyback shares over the past week after the stock […]

[…] Analysis http://shadowstock.blogspot.com/2010/06/tails-i-win-heads-i-dont-lose-too-much.html http://www.valueuncovered.com/noof-2010-year-end-very-cheap-on-cash-flow-basis This entry was posted in Uncategorized. Bookmark the permalink. ← TechTarget, Inc. […]