Spin-off Details

Lotto24 AG (LO24) began trading on July 3, 2012, as a spin-off of Tipp24.

According to Tipp24’s CEO,

“we believe that a complete legal separation is the best option to provide Lotto24 AG with a starting position in the German market which is not burdened by legal disputes.”

Two board members from Tipp24, Petra von Strombeck and Magnus von Zitzewitz would join the new executive board of Lotto24 AG, with von Strombeck as CEO.

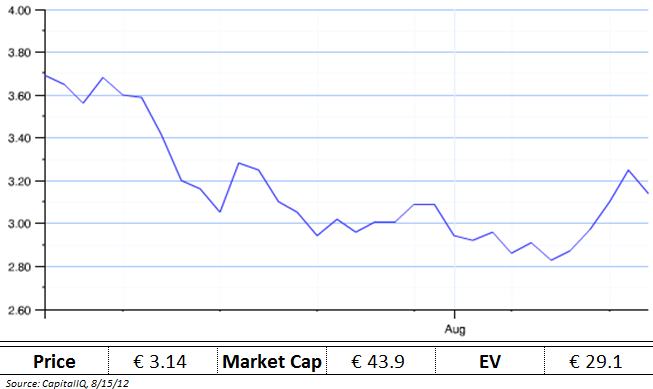

Priced at €2.50 per share, the spin-off jumped to the mid to high 3’s on the first day of trading before falling to a low of €2.78 only a month later.

Specific details of the spin-off included:

- Treated as a dividend in kind from Tipp24’s capital reserves

- Offered an additional 5,988,816 ordinary shares via a rights offering

- Total proceeds of approx. €13.87 million after-fees

Lotto24’s goal is to re-establish lottery brokerage services within Germany as soon as possible, essentially resuming Tipp24’s domestic business which was halted by the 2008 German State Treaty on Games of Chance (“GlüStV 2008”).

Q2 Financial Report

Lotto24 just released its first quarterly report as a public company, and it provided some detail about the company’s current state and future plans. Another quick history lesson on the German legal situation:

- Jan 1 2009: The GlüStV 2008 is passed, banning online gambling including lottery advertising and ticket brokerage over the internet

- Sept 2010: European Court of Justice (ECJ) declares that key elements of the GlüStV 2008 contravene EU law

- Dec 2011: Based on the ECJ’s opinion, the German States draft a new treaty

- Jan 2012: Schleswig-Holstein, one of the 16 German States, moves forward with its own law making online gaming legal and allowing LO24 to restart operations for SH residents

- March 2012: A revised treaty, the First State Treaty to Revise the State Treaty on Games of Chance (“GlüÄndStV”), is given to the ECJ for positive approval, but the ECJ does not approve or comment on it, casting doubt on whether it complies with EU law either

- July 1 2012: The GlüÄndStV treaty is ratified by the German States anyway

- July 2012: Schleswig-Holstein reverses its original course and now plans to join the other states in ratifying the GlüÄndStV this fall

So what does this all mean for online lottery brokerage in Germany? The short answer is that it’s still unclear.

The longer answer is that

“although the approval process [for nationwide rollout of online lottery brokerage] has been initiated, the permit criteria, Internet requirements, and advertising guidelines have not been finally decided yet.”

In addition, Lotto24 still believes that the new treaty’s validity as it relates to the ECJ ruling is still questionable:

“All in all, it is uncertain under such circumstances whether or not the GlüÄndStV can be legally applied.”

What the company does know is that the internet and TV advertising permits are handled by the German State of North-Rhine Westphalia, and will not be finalized until after their state elections – sometime in November 2012.

Although the GlüÄndStV might need to be revised even further to pass the ECJ (ultimately ending up in an even better situation for LO24 in all likelihood), the state of online gambling seems to be moving forward (albeit slowly and with a ton of uncertainty), and the company expects to be operating its lottery brokerage nationwide within the next twelve months.

On the financial side, LO24 has total equity of €32.6million, with the vast majority made up of cash (€14.7mil) and goodwill (€18.9mil). The goodwill is a result of the contribution in kind from Tipp24 for the “business opportunity for the resumption of online lottery brokerage in Germany.”

Unlike other start-ups, Lotto24 does not have to re-invest much back into operations or R&D – the software is developed already and can sit on the shelf without incurring holding costs, and the majority of expenses (like marketing) are discretionary and can be ramped up when the internet ban is lifted.

Operating expenses through the first six months of the year were €1.6 million. However, €960 thousand of that expense was due to one-time IPO costs.

After removing these non-recurring items and annualizing this figure for the entire year, LO24’s has a steady-state cash burn rate of €1.25 million per year.

With almost €15 million in cash, that’s a long runway…

Lotto24 Positives

Brand recognition:

With more than 2.5 million customers prior to the internet ban, German lottery players are familiar with the Lotto24 brand – it seems reasonable to assume that they will return to a familiar and trustworthy service. Lotto24 should benefit from a sharp initial jump in customers when the online lottery market resumes.

Negative working capital:

Lotto24 benefits from advanced customer payments and a slight lag in payouts, leading to “steadily increasing negative working capital” balance. With limited reinvestment requirements, FCF will be higher than net income[1. For reference, from 2003-2007, Tipp24 had cumulative FCF that was 2x of total earnings.]. This is very similar to insurance float, and allows LO24 to grow basically for free.

Stable investor base:

Gunther Holdings, a large shareholder in Tipp24, increased its stake even further (to 33%) via the rights offering, signaling confidence in the stock’s prospects. Gunther has been involved in the Germany gambling industry for decades, and will likely be a stabilizing shareholder through any delays in starting up operations.

Broadband penetration:

More internet users = a greater number of people who can gamble online. Over the past five years, Germany’s broadband penetration rate grew by 76.8% to 32 users per 100 inhabitants. This is faster than any Western European country save Ireland, and Germany now ranks 5th overall in broadband penetration out of the entire European Union. Basically, the pool of potential customers has almost doubled since 2007.

Growing lottery market:

See below.

Lottery Market

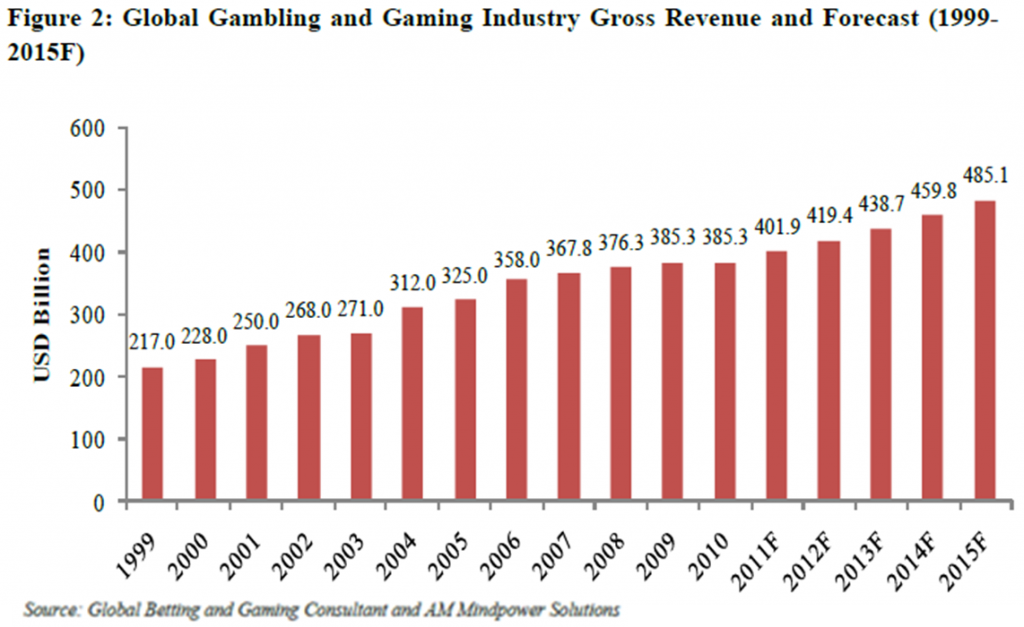

The gaming gambling, at least when looking at global numbers, is largely immune from economic downturns, growing at 4.9% per year from 1999-2011 without a single down year (2009 was flat):

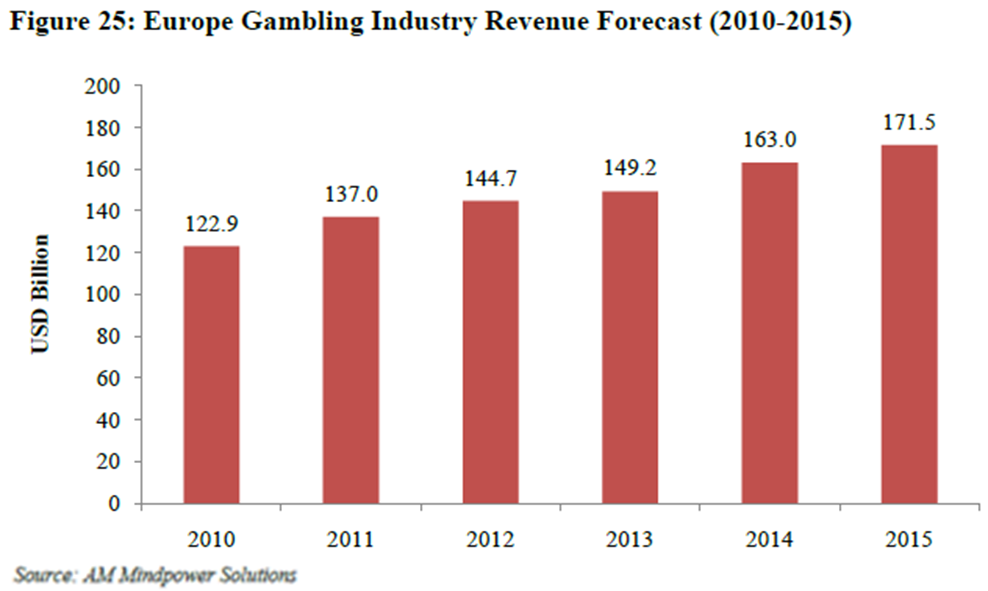

As the second largest market (only slightly behind North America), Europe is expected to grow from $122.9 billion in 2010 to $171.5 billion by 2015, or 5.7% CAGR, slightly faster than the global rate:

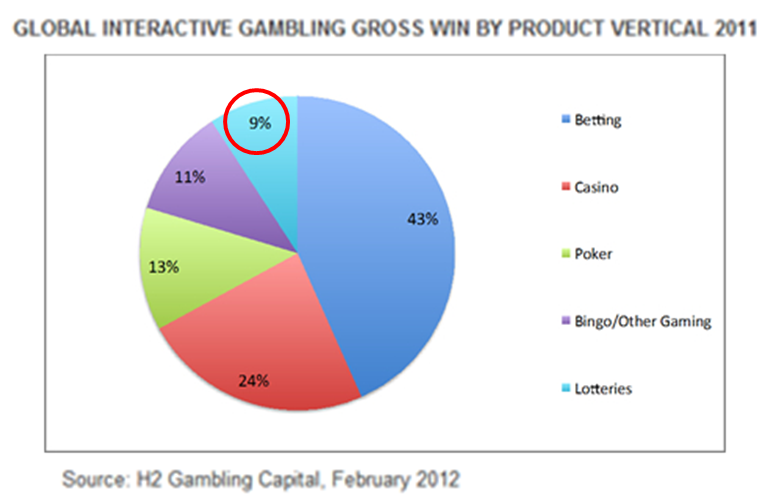

The largest gambling product worldwide?

Lotteries, with 29.1% market share.

German Lottery

While it has been four years since the GlüStV 2008 was passed, a relaxation of the law seemed inevitable.

First, as shown by the above charts, people love to gamble and have done so via lotteries for hundreds of years – moving that business online seems logical.

Second, the ECJ was strongly critical of the original treaty and will likely continue to apply pressure to the German states until a compliant law is passed.

Finally and most importantly, money from the state lotteries goes towards the sports, environment, youth projects, and state budgets.

To put this in perspective, the German lottery had total receipts of €6.66 billion in 2011. Due in part to the treaty, this number is down more than €3 billion from the average levels from 2004-2007 – a pretty staggering drop – and no doubt forcing some unpopular budget cuts.

With a restart of online lottery brokerage, Lotto24 is planning for an immediate jump in lottery receipts to €8 billion, with the overall lottery market in Germany growing to €12 billion by 2020.

The company is also projecting a rapid increase in online ticket sales, growing to €6 billion by 2020, or 50% of total lottery sales.

While this growth rate seems optimistic, it is not crazy outlandish. Two thoughts:

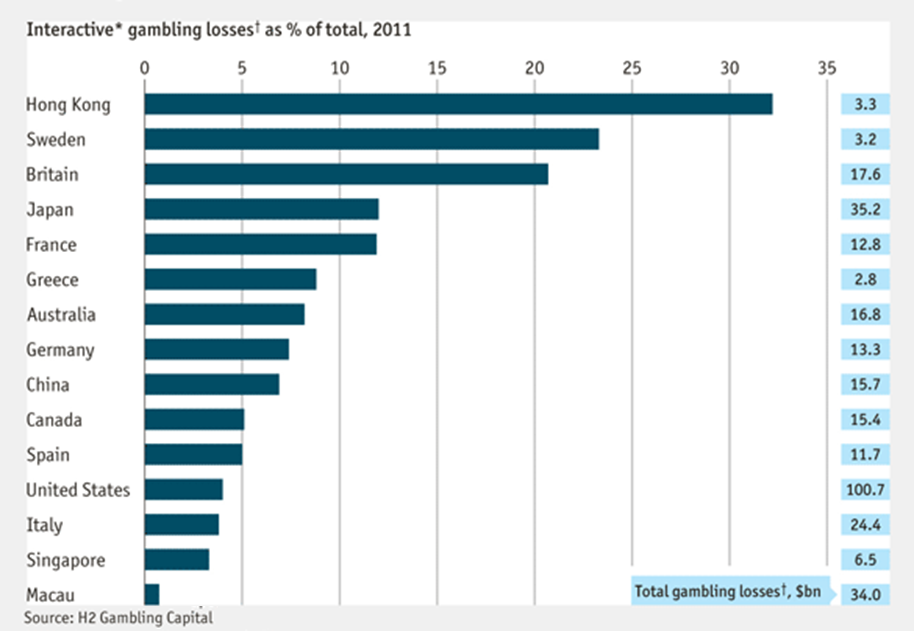

1. Already, some countries (such as the UK) have more than 20% of gambling done via online/mobile channels – 50% in the next eight years seems within the realm of possibility:

2. While lotteries are still the most popular form of gambling, they lag other products in online sales, so there is even a larger runway for internet growth:

In summary, there is a ton of potential for LO24 once the company’s marketing machine can crank up again.

Historical Business Model

Lotto24’s plan is to sell tickets online for the State Lottery and take a small percentage commission. This is the same model that Tipp24 employed from 2003-2007, before the German gambling ban forced the management team to focus on secondary lotteries abroad.

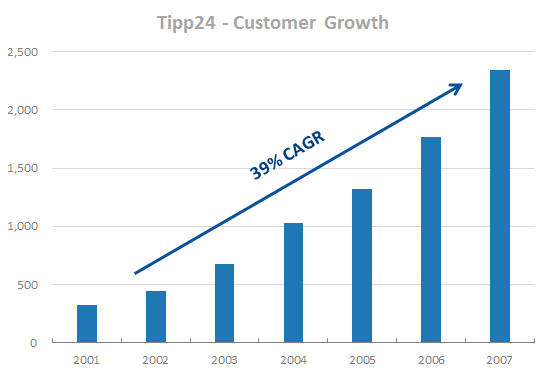

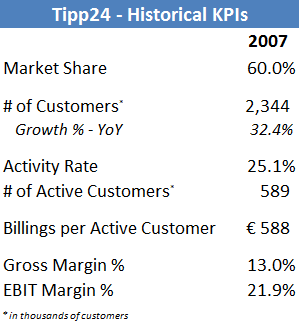

Tipp24 was the dominant player in German lottery brokerage, reaching 60% market share of online ticket sales by 2007.

Check out this growth rate:

Roughly 25-30% customers were ‘active’ (completing at least one transaction per month), but Tipp24 earned almost €600 in billings per active customer[2. Active customers play a lot, and show almost no churn after the first year].

In the brokerage model, Tipp24 generated revenue from three sources:

- 10% distribution fee on traditional lottery ticket sales

- 20-30% markup fees for premium lottery products like scratch cards

- 15-20% margins on ‘white label’ business services (Tipp24’s technology powered the back-end on other lottery broker websites)

Therefore, blended gross margins – revenues / gross lottery receipts – were historically around 13%.

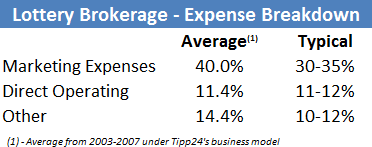

Here are the biggest operating expenses as a percentage of revenue:

Both marketing and other expenses were skewed higher in 2006-2007, as the company spent money on legal/consulting fees while also dealing with slowing customer growth due to the uncertainty surrounding the impending internet ban – Tipp24’s management was targeting marketing expenses at 30% of revenue.

As shown by the cost breakdown, the key part of the brokerage business model is marketing, as money spent to attract new customers is the largest expense by a wide margin. Customer acquisition costs averaged roughly €20 per new registered customer.

As the business matures however, these costs should fall as the rate of sign-ups slows and the company moves towards maintenance marketing.

This is a highly scalable business model, in that ‘other’ expenses (such as personnel, rent, etc.) will fall dramatically as a percentage of revenues as the number of customers grows.

Once the infrastructure is in place, the marginal cost of selling another lottery ticket is basically zero.

This should lead to future margin expansion, with a steady-state ceiling well above the 20% EBIT margins shown by Tipp24 historically, assuming the growth materializes and management executes successfully.

Lotto24 Forecasts / Valuation

So what is LO24 worth?

LO24 is essentially a start-up right now – with only a few thousand existing customers and negligible revenue – facing a still uncertain legal situation.

There are a ton of variables to consider:

- what year (and if) the ban is reversed

- legal restrictions in the new permitting process

- growth rate of the lottery market overall

- % of lottery market share taken by online tickets

- growth trajectory of LO24’s market share

- new customer acquisition cost curve

- and the list goes on…

However, with five years of Tipp24 financial history, there are some historical benchmarks to guide the exercise.

Here are key metrics for Tipp24 from 2007, the last year before its business was disrupted by the GlüStV 2008:

These metrics can be used as a baseline to forecast possible growth scenarios, in order to value Lotto24 based on its expected future cash flows through 2020, discounted back to the present.

First, some core assumptions which apply across each scenario:

- Activity rate starts out at 30% but falls as the market matures

- Billings per active customer gets an initial boost when the ban is lifted (i.e. the most die-hard lottery players sign up first) but stabilizes around €580 per active customer

- Gross margins start out at 8% and rise to 12% as premium lottery products and business services are phased in

- The company burns cash until the ban is lifted, but once legalized, operating margins rise steadily due to the scalability in the business model (i.e. falling marketing expenditures & other operating costs as a percentage of revenue)

- Capex and depreciation cancel each other out (reinvestment is negligible)

- Business model benefits from negative working capital, and FCF outpaces net income (consistent with Tipp24’s track record of cash flow generation)

Finding a precise value is not the goal[3. Whew!], but the exercise can demonstrate a range of scenarios.

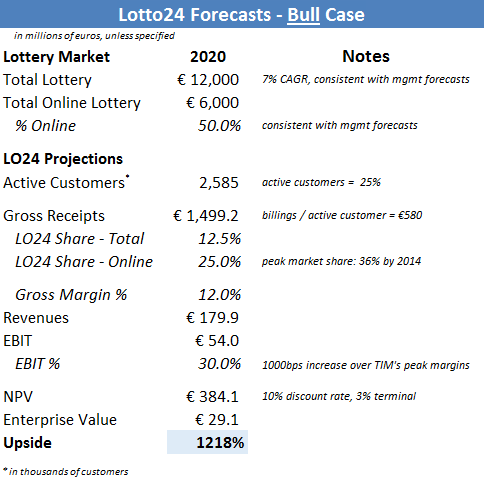

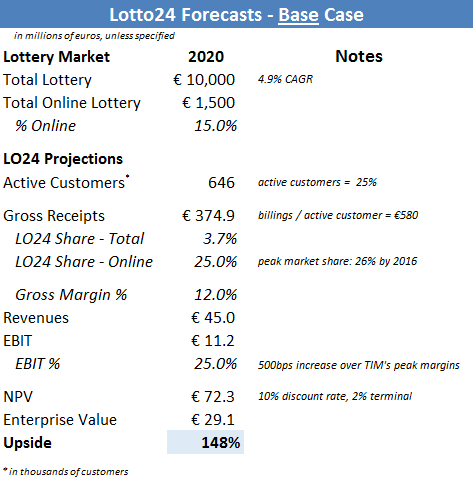

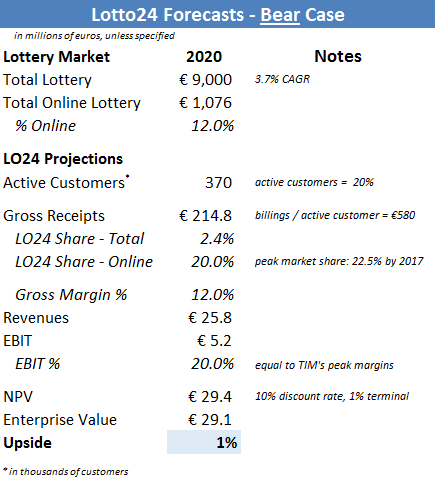

Here is how Lotto24 might look in 2020:

Bull Case

This assumes that the online market is fully legalized by 2013, and grows – both overall and online – to meet management’s forecasts of €12 billion and €6 billion respectively. It also models sustainable EBIT margins of 30%[4. Analysts were predicting 5-year margins closer to 40% for Tipp24 back in 2005-2006, so 30% seems achievable].

Even with a peak market share well below the company’s past history, if this plays out, LO24 would be an absolute home-run investment.

Base Case

This projects a more realistic growth trajectory for lottery sales (5% CAGR), with online transactions making up 15% of the total (still a €1.5 billion market).

It also assumes that the internet ban isn’t lifted until 2014, even though LO24’s management is predicting full resumption of activities within 12 months.

Even so, this scenario still results in over 100% upside.

Bear Case

In the bear case, Lotto24 burns money for three years before finally winning the legal argument and starting up in 2015.

The total lottery market does get an ‘internet spike’ in 2015 (20% growth, back to pre-internet levels), but barely grows above the rate of inflation overall, with online sales reaching only 10% of the total.

Active customers fall to 20%, as LO24’s customers get bored and move to new forms of gambling , and economies of scale never kick in to boost EBIT margins north of 20%.

The market thinks the bear case is likely (i.e. Lotto24 is fairly valued).

Ultra-Bear Case

The stock goes to zero, a possibility for any start-up.

In this world view, the German government never allows internet brokering of lottery tickets and/or centralizes that function within the state lottery itself.

LO24 burns through its cash fighting legal battles and eventually goes bankrupt.

While this seems unlikely, there are still lots of uncertainties, and management will have to prove that they can navigate the legal and regulatory situation while executing on the company’s growth potential once the opportunity arises.

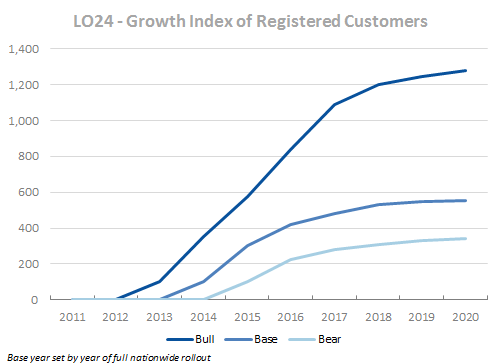

Growth Comparison

Here is a simple chart that shows the growth in registered customers under the various scenarios:

Conclusion

Putting it all together, LO24 is more of a special situations investment, where investors are weighing the probabilities of several scenarios and not necessarily coming up with a specific intrinsic value.

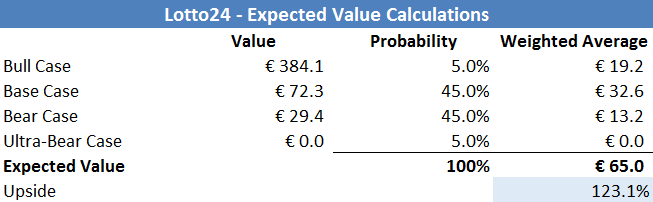

Using this range of outcomes, here is the expected value of making the investment:

This assumes a reasonable chance that Lotto24 is a success, while giving some weight to the extreme outliers on both the positive and negative side. With these probabilities, investing in the stock seems to be a very +EV decision.

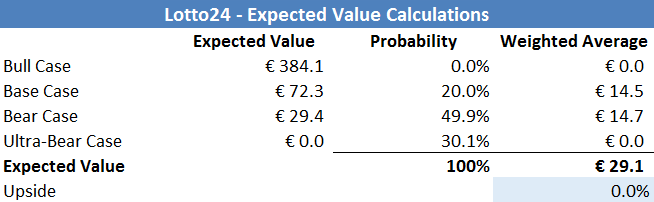

Inverting the argument, here is what the market is currently forecasting:

In order for the stock to be fairly valued, the market is assigning zero probability for the bull case, and a 30% chance of the stock going bankrupt (even though a full bankruptcy is unlikely, given that LO24’s cash pile is almost 12x the current cash burn rate).

In fact, because the bullish outcome has such a high reward, the chances of the bull case playing out only needs to be 7.6% for an +EV outcome, even if the rest of the probability (92.4%) is assigned to a the stock going bankrupt.

In poker, maximizing positive expected value decisions is one of the keys to making money over the long term. Unlike poker – where hands can be analyzed – the exact probability weightings are unknown in Lotto24’s circumstances, but it appears that the odds are heavily in favor of some sort of positive outcome.

With a poker background, passing up +EV situations is against my nature – with the odds on Lotto24, I’ll stay in the hand and see how the river plays out…

Disclosure

Long LO24, TIM

P.S. – If anyone has updated lottery statistics from LaFluer’s 2012 World Lottery Almanac, please contact me.

Great analysis thanks.

I like the probability tables, it just shows that the zero case must be quire high for your return to be 0%.

Thank you. A bankruptcy is unlikely given the current cash burn profile, so if you are comfortable giving any reasonable % weighting to the bull case, it seems to be a positive +EV investment, with the potential for a huge payoff if things go right.

[…] ValueUncovered – Lotto24 AG (ETR:LO24) Spinoff – Winning the Lottery Twice in a Row? […]