Jewett-Cameron Trading Company Ltd. (JCTCF) is another micro-cap industrial stock that has flown under most investors’ radars. The holding company can be broken out into 4 different segments:

- Greenwood Products: Industrial wood products, major product category is selling treated plywood to boat manufacturers.

- Jewett-Cameron Lumber Corporation (JCLC): Lawn, garden, pet and other, Sold primarily to home centers and other retailers.

- Jewett-Cameron Seed Company (JCSC): Seed processing and sales

- MSI-PRO: Industrial tools and clamps, sells pneumonic air tools, industrial clamps, and saw blades.

Business Segments

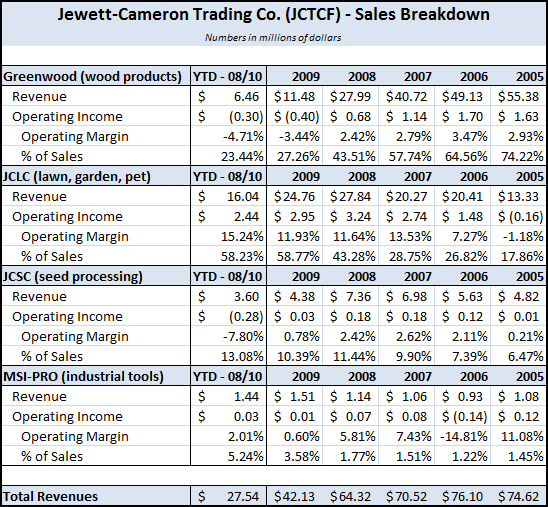

2009 was an extremely difficult year for JCTCF, as sales dropped 35% to $42.1M. This reduction in revenue led to a sharp decrease in net income – $0.66/shr compared to $1.09/shr in 2008.

Although sales were down basically across the board, the largest drops occurred in the wood products (-59%), and seed processing segments (-41%).

The wood products business has struggled mightily since 2005, falling almost 80% from peak sales of $55.38M. Boat manufacturers have been hit really hard by the recession, as dealers work through inventory backlog and consumers delay purchases.

Management does not believe that the boat manufacturing business will return in the near future:

“We continue to develop a readiness to participate when the market rebounds. In the meantime, we have been searching for alternative uses for our industrial wood products and developing new customer relationship”

Looking at the operating segments, JCTCF operates in a tough business environment with low single digit margins in 3 out of 4 business segments (similar to a current holding, APNC.OB, with its insurance marketing division).

The product mix has shifted towards the higher margin JCLC business, which now makes up almost 60% of sales. The company is transforming (maybe involuntarily?) into a business that relies on the lawn, garden & pet segment to drive profits.

Despite the revenue declines, the overall business remained solidly profitable in all four quarters in 2009, a trend that has continued into the first three quarters of 2010.

Company Financials

JCTCF has aggressively paid down debt, reducing its debt to equity ratio from 137.2% in 2003 to 9.6% last year – the company has no long-term debt outstanding, but has an unused $5M credit line available.

Overall, gross margins have improved as the company makes the transition into the higher margin lawn & garden business – TTM gross margin of 22.3% is the highest on record.

The balance sheet is extremely strong with a current ratio and quick ratio of 4.9 and 3.2 respectively. The company is sitting on a huge cash pile ($8.4M) or $2.71 per share in net cash after subtracting out liabilities.

CROIC & ROE have plateaued in the past five years at 10.3% and 15.3% respectively.

Risks

Management Team

The company’s CEO, Donald Boone, and Corporate Secretary, Michael Nasser, collectively control over 35% of outstanding shares.

Both executives have been with the company since 1987 and have seemed content to sit back and watch the cash position grow without any urgent concern for minority shareholders (although a recent stock buyback could be a step in the right direction).

Decline in Revenues

Sales have declined every year since 2006, and are currently almost half of the high water mark. The company’s language in the quarterly report continues to have a negative outlook on the boating sector, which used to be the major source of revenue.

If management cannot effectively guide the company into growing business segments, JCTCF’s long-term prospects could be suspect.

Positives

Share Repurchase Program

After announcing in July 2009 that the company began exploring options to increase shareholder value, management finally announced a stock repurchase program in May of this year for up to 425,000 shares, or 17.8% of the total shares outstanding.

Unusually, the company designated specified in the press release that it would only buy shares for up to a maximum of $7.00.

As of July 6, 2010, the company had purchased almost 80k shares with a month left to go in the original program. Assuming the company maintains this pace, the company would retire approx 7% of shares, making the company appear even cheaper.

Hidden Undervalued Assets

Property, plant and equipment is currently being carried at approx $1.9M, net of depreciation. However, the company owns several pieces of extremely valuable property:

“The Company’s executive offices are located at 32775 NW Hillcrest Street, North Plains, OR 97133. The 5.6 acre facility, which is owned, consists of 40,000 square feet of covered space (6,000 office, 10,000 manufacturing, and 24,000 warehouse), a little over three acres of paved yard space, and was completed in October 1995”

The property associated with JCSC, which is owned, consists of a little over 13 acres of land, 105,000 square feet of buildings, rolling stock, and equipment. It is currently used for seed processing and storage. It is located at 31345 NW Beach Road, Hillsboro, OR 97124, which is adjacent to North Plains, OR”

In all, the company owns almost 150,000 square feet of building space and almost 19 acres of in a prime location in Oregon right near a small airport and a major highway.

A quick search in Loopnet shows comparable buildings selling for approx. $17-$20/sq. ft. Undeveloped land is going for approx. $200k-$300k per acre.

At those prices, the land alone is worth over $3m and yet is sitting on the balance sheet at $635k.

Rebound in Boat Manufacturing

Although the company’s reports have been very negative on the status of boating manufacturers, other industry statistics show a glimmer of hope on the horizon.

As of July 2010, boat sales remain down 15% YoY but have been rising steadily since April 09.

As sales rebound, dealers will continue to work through their inventory backlog – an increase in manufacturing will follow, leading to increased sales for JCTCF.

While the Greenwood Products division will probably not see 2005 levels for quite some time, a resumption in sales growth and return to profitability in this segment will certainly help the stock.

Valuation

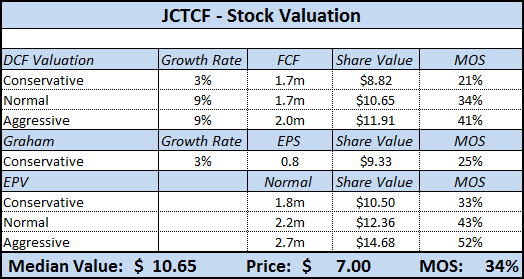

Using an estimated 2010 EPS of $0.80, JCTCF’s P/E ratio is 8.75, slightly below its long-term average.

After adjusting the P/E ratio to include the net cash balance ($2.71/shr), the modified P/E ratio is only 5.3.

JTCF is also selling at discount to book value as well as NCAV.

Conclusion

Over the past few years, the JCTCF managed to stay profitable, on both an earnings and cash flow basis, during an extremely difficult period and despite revenues cratering in the main business segment.

The stock is trading at a discount to its intrinsic value, and management now has the responsibility of guiding the business back to growth.

Although the share buyback is a nice gesture, management could do more – a special dividend or possible sale of one of the underperforming business segments would be a nice catalyst for future price appreciation.

Disclosure

No positions in my personal portfolio at the time of this writing.

[…] on TSX) was originally analyzed by Adam over at ValueUncovered here. JCT has also been extremely hard hit by the recession. The company usually carries some cash on […]