Last week, Access Plans (APNC) reported a 69% increase in first quarter 2011 earnings, with the market reacting very favorably to the news.

The company continues to show impressive growth in its core Wholesale Plans division, while investments in the Retail Plans division are finally starting the pay off, unlocking additional shareholder value.

Despite the rapid price increase, the stock remains undervalued as long as the company can sustain the new earnings power.

Financial Overview

Overall, net revenues were up 7% to $14.3m in the first quarter of 2011 compared to $13.3m in the same quarter last year.

Operating income jumped 53% to $2.5m, while net income surged to $1.5m, an increase of 69% compared to the first quarter of FY2010.

Diluted EPS came in at $0.08, an increase of 100% compared to the first quarter last year, and up 300% over the previous quarter’s results.

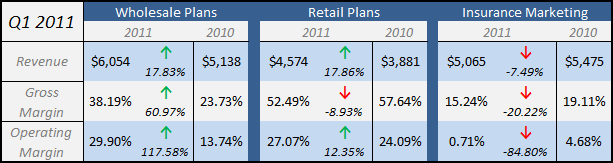

From a business segment perspective, the Wholesale Plans and Retail Plans division continue to turn in impressive results.

Wholesale Plans

Revenues within the Wholesale division increased 20% to $6.1m versus $5.1m in the prior period. The company added 49 new Rent-a-Center locations in Puerto Rico, which turned in better than expected results.

More importantly, gross margins improved significantly, which flowed down to help boost operating income by 156% to $1.8m for the quarter.

The margin improvement was partially explained by a reduction in the company’s involuntary unemployment waiver expense, which

“Assists members with their rental payments in the event that they are laid off, fired or lose their job due to a company strike or labor dispute.”

As the U.S. economy stabilizes and job cuts decline, margins in this segment should continue to be positively impacted.

Retail Plans

APNC has aggressively rolled out new programs in the Retail Plans division, with revenues increasing 18% to $4.6m versus $3.9m in the first quarter of FY2010.

In the third and fourth quarter of 2010, the company made significant investments in an inbound call center program for the Retail Plans – temporarily depressing earnings – a decision which is showing dividends going into the new fiscal year.

These positive results do not include the impact of APNC’s new Smart Solution Plus product, a roll-out on which management is very bullish.

The new product is approved in 22 states already, and could provide a nice boost towards operating profits throughout the rest of the year.

Insurance Marketing

The Insurance Marketing division remains profitable, but revenues have continued to decline due to negative effects of the Healthcare Reform Act.

Revenues decreased 7% to $5.1m versus $5.5m in the first quarter of FY2010, while operating profits dropped to $0.04m.

In the first quarter of 2010, two major carriers pulled out of the business, so this should be the last YoY comparison impacted by this change.

The company appears to be working hard to reposition the insurance division towards a mix of supplemental benefit offerings (more closely resembling the Retail Plans division).

Balance Sheet

APNC continues to stockpile cash, growing the cash balance to $8.5m, or $0.42/shr, offset by no debt.

Risks

With the recent price increase, the company is selling significantly above its current book value of $0.79 per share. APNC must keep up the current earnings level in order to justify such a premium.

In addition, the company is still embroiled in a lawsuit, Zermeno v Precis, Inc.

Under the case, the plaintiffs are arguing that APNC’s Care Entrée discount health program violates California law as it pertains to referring people to people to a physician, hospital, health-related facility, or dispensary for any form of medical care or treatment as part of a discount program.

On January 21, 2011, the Court ruled that the defendants must stop the program in California six months after the effective date. APNC has until March 25, 2011 to appeal.

According to the company,

“An adverse outcome in this case would have a material affect our financial condition and would limit our ability (and that of other healthcare discount programs) to do business in California.”

Lawsuits are notoriously unpredictable but it is certainly something to monitor.

Conclusion

The first calendar quarter is traditionally the slowest for the company, but results should be bolstered by a full quarter of sales for the Smart Solutions Plus program.

In addition, management still sees potential growth opportunities in the wholesale plans division, and continues to evaluate strategic alternatives (both a share buyback and possible dividend were mentioned on the conference call).

I trimmed some of my position in my personal portfolio, but will be holding on to the balance as I believe there remains significant upside in the stock, especially in a going private transaction or sale.

Management was bullish on the conference call, and it appears that a FY EPS of $0.30-$0.35 is not out of the question.

Despite the run-up, the stock still trades at 7.65 EV/EBIT and 10.26 EV/FCF.

A caller during the Q/A portion of the earnings call reiterated my thinking:

“You have a cheap stock here guys”

Management’s response:

“We think so as well.”

Disclosure

Long APNC.OB