This is part two of my series on abnormal stock market anomalies. I originally wrote a post about the S&P 500 index effect.

The second part of the series will focus on deletions.

S&P Deletions

Each time a stock is added to an S&P index, a corresponding deletion occurs to keep constant the number of companies with the index.

S&P has the option of moving stocks down to a lower index such as the S&P MidCap 400 or S&P SmallCap 600, or deleting them from all indices.

Firms are deleted for a number of reasons: declining market cap, a merger with another company, or moving headquarters to a foreign country.

The key theory behind this strategy:

Index funds and other institutional investors must indiscriminately sell their holdings in stocks deleted from the index, without regard to current financials, future outlook, or intrinsic value.

Price Movements for Deletions

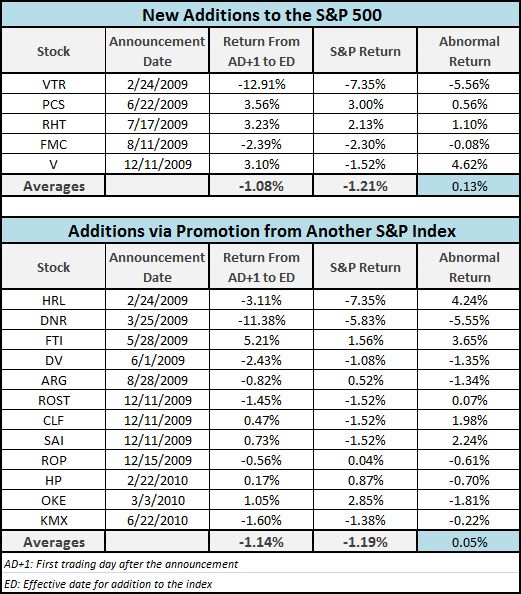

For deletions, the effect is the opposite of stocks added to the index. The price drops sharply after the Announcement Date (AD) until the Effective Date (ED) as institutional investors dump the stock.

Trading Strategy

In the book, the primary strategy for deletions is to purchase the stock after the effective date, with the goal of capturing a rebound in stock price caused by the indiscriminate selling during the announcement period.

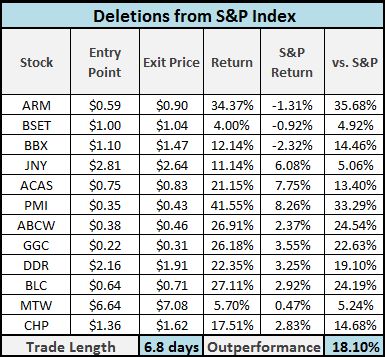

For these results, stocks were purchased on the close of the effective date. Price targets were set at 1.5x the abnormal drop in price during the announcement period, with positions closed after 20 business days if the target exit price is unmet.

Recent Results

There were 12 events that met the criteria for this trading strategy. Only 1 stock, BSET, failed to reach its target price within the 20 day window.

Average outperformance was 18.10%, with stocks reaching their target exit price after only 6.8 days on average.

Results through ED +20

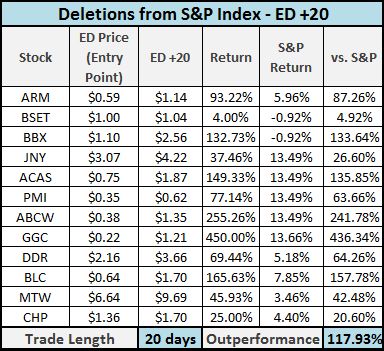

To further test the strategy, stocks were tracked for the full twenty day period after the effective date, with even better results:

Conclusions

Logically, some stocks removed from the index are on the verge of bankruptcy, having suffered significant loss in market cap over the previous weeks or months.

In this limited sample, this was not the case, as all stocks recovered their initial drop in price, before continuing to appreciate rapidly.

Recent results seem to show a large, abnormal price increase after a stock is deleted from the S&P indices.

Discussion

Why such a large outperformance? Could these stocks be candidates for value investors, a la the mindset around stock spinoffs in Joel Greenblatt’s book?

What are your theories?

Disclosure

No position in any of these stock at the time of this writing.